The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I have seen this rule mentioned in the encyclopaedia and in the daily setups, but not in the course (at least I don't remember seeing it).

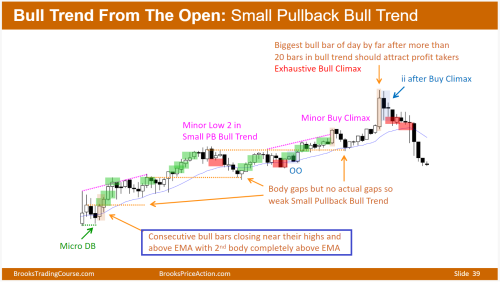

The rule is (bull version): Two consecutive bull bars closing near the high, both closing above the EMA, the second body completely above the EMA = Strong bull trend likely.

See for example this screenshot from the daily setup of the 17th:

My questions:

- Do they have to be consecutive?

- Should only the body of the second bar be completely above the EMA? Does that mean the wick can touch or go below?

- Is this rule elaborated anywhere apart from in the encyclopaedia and the daily setups?