The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

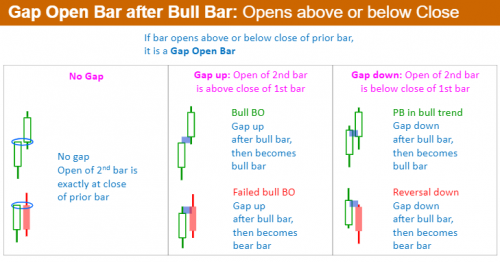

The new section about micro gaps is repetitive with the following section about Gaps Based On Open of Bar and close of prior bar.

Does this micro gaps is more important? But I cannot see. This just some concetps. How a trader use this concepts? What's the meanings?

E.g, Gap up, can be Bull BO, also can be failed Bull BO, gap down can be pullback or reversal, so how to trade this? Confused.

Hi Grego,

Yes, you are right, but checking with Al he wants same slides in both sections as they are relevant to both. Al does duplicate slides when it have relevance to other sections, just these so close together!

Ref trading these Micro Gaps I would take the full market context into account and only use such gaps as a minor indication of intent going forward. In my view a 1 tick gap is not significant unless supported by a suitable tail above or below the open of bar. If just a 1 tick gap and no tail, that can be due to random order placement with a single contract enough to flip the inner bid/offer to move (gap) up or down.

Other traders views on this might well differ. Just my 2 cents. 🙂

@richardhkbtc-com

thanks