The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

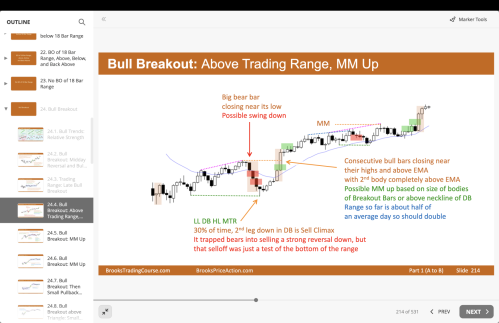

It is a LL DB with bar 12 on the chart.

It is an MTR with the day before as the market gapped down and had been going up in a channel. It is a HL MTR since the marked bar did not break the day's low.

Abir,

Thanks for clarifying this. How did you figure out that MTR was with the day before?

Usually when you are trading, you will look up at least few days back as a good practice before the trading session. So, if you look at the past few days' PA, you won't have trouble identifying an MTR if you are well familiar with the concept, I'm pretty sure that is what Al did in this case. Since, we can't see the previous days, you can count on Al.

I can't remember where, maybe on some EOD Emini review, he did use this concept of counting the MTR using previous days' PA. However, this might be a bit complicated to understand.

The easiest way is to think of a big gap down as one big bear bar(Al discusses this early on in the video course). So, anything after that becomes easy to understand. If the bulls can show enough buying pressure(which they did in this case), you can get a bull MTR. Something to keep in mind is, bigger the gap down - greater the buying pressure bulls need to show to get a successful MTR bottom.

Does that clarify your doubt?

Thanks Abir. Is there a way to get to get in touch with you privately? I apologize for the delay in response. It seems checking the subscription box is not enough, we have to confirm every single subscription email 🙁