The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello and good morning from Wiesbaden, Germany,

I`m new to this forum and english is not my native language, so I apologise for my errors.

I`ve studied Al's Videos now for months and I find good entrys now quite often. But what is hard for me is to exit "right".

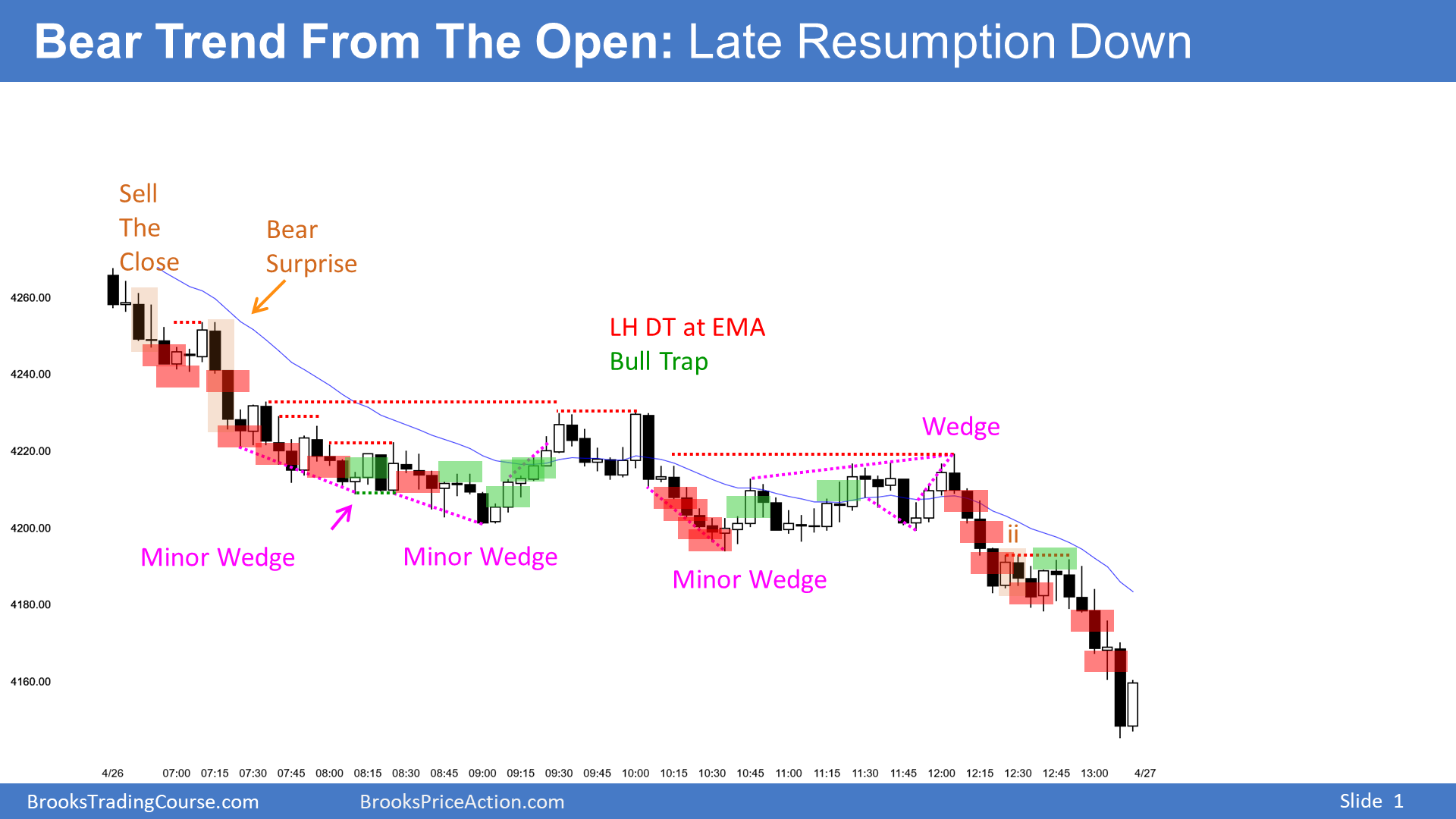

Take yesterday: I took the first short entry, added more at the third short entry, added more at the forth and fifth. And then came that bullbar, Bar 16, and I exited as Bar 17th High went above it, cause I thought it would be a buy setup. The idea was, to enter again short after a small pullback. I did not find an entry for me again and left the screen soon, cause I became too emotionally to go on trading well.

So if you identify a small pullback bear trend (which it was for me at that time), when do you exit if you want to swing? Where ist your SL when you are at Bar 16? Still way up at the opening?

Maybe someone nows a video about "exits", I'm not through all of Al's videos yet, cause a lot of them I had so watch 2 or three times to get the point 😉

And greetings to Al. I am so thankfull for his Videos.

Best regards,

Hardy

Hi Hartmut,

You are trading emotionally because of your wide stop loss, trade management comes next, the most important thing is what is your risk. If your stop loss is wide you can't trade freely. Because of your wide stop loss you always feel like exiting your position even when its going in your favor that's not good.

What is your usual stop loss?is it 10 points, 20 points?

Hi,

thank you so much for your answer. You are so right!

Since now, I used wide stop losses (Al Brooks ist telling to do so in a lot of his videos). In this case my initial SL was 20 Points.

So in this case it would have worked out to move stop loss 5 points above the last bear bar.

How do you move your stoploss? Especially when you have big bars going in your direction like yesterday after the FOMC?

20 points = $1000 per contract is too much risk, yes, al recommend to use a wide stop, but most beginners don't know where to exit if the trade goes against them, so my policy is to trade with tight stop that is not more than 16 to 20 ticks max.

Yesterday and the day before yesterday I took a couple of trades with less than 10 tick stop loss, profit was 20+ points and 45+ points each, that's more than 1:5 and 1:10 risk reward, you can check that in my YouTube channel.

I post my analysis there.

https://www.youtube.com/channel/UCJXI2lbTogstNi9q8ErfZWQ

I guarantee you that after 20 points Stop loss, you don't feel like trading again, emotionally its difficult to take 20+ point stop loss, and financially very difficult to recover in a single trade.

It's easy to recover 10 to 15 ticks than 20points.

You can master it if you give some time, screen time is very important.