The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

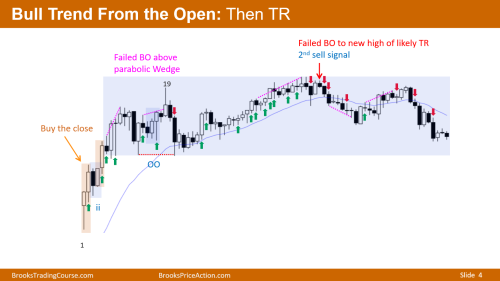

Did you buy anywhere between bar 1 and 19? Where did you buy? Where did you put your stop, how did you manage and where did you exit?

As a stop order trader, on days like these I find cases for buying and also cases for standing aside. If bought, I find managing such trades a nightmare.

For example, case for buying:

- Bars 1, 2 bullish, both closing near their highs, possible buy the close.

- Open gap above 2 high, body gap above 1 high.

Against buying:

- Bar 1 is a doji and bar 2 had a conspicuous tail above, telling me straightaway TR environment ahead.

- Far above the MA, on the day after a buy climax.

- Not a strong leg, rather a leg in a TR. Constant pauses: bear bar 3, 6. Bar 7 goes below bar 6 low. Big doji bar 8, and then scary pullbacks at 12 and 20-21. Yes, stop order bears didn't make money until bar 21, but do you really want to hold long through all this?

Thanks.

on the day after a buy climax

Isn't it the most common outcome after a buy climax day to get FT buying in the first hour(so 12 odd bars) and then a TR for 1-2 hours(12-24 bars)?

but do you really want to hold long through all this?

No, you enter above the ii and take your profits when the parabolic W appears. You look for longs once again after the market has seen 2 legs sideways so probably above 26 again.