The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Just finished series on stops and scaling. This question needs an intro. Sorry:

Al frequently says where the correct stop is, and if it's too far, "don't take it."

Let's say your risk is in dollars instead of points though, and I risk $100 dollars maximum a trade.

The stop happens to be 10 points away on /ES, or $50 per micro contract.

If I buy correctly with trend using the correct stop, I have a 60% chance of making profit, but my reweard is lower.

Al frequently says, "low probability high reward" or vice versa.

However, if I use the small high1 or high2 signal bar stop, I probabbly have a 50% chance of a profit. Let's say that stop is 2 points away instead of 5 points, or $10 risk per micro.

Suppose I buy 5 micros with the the 2 point stop instaed of 1 micro with a 10 point stop -

Wouldsnt I be risking "the same amount", ie

The probablity of being stopped out increases, but total points, or dollars risked, is $50 (the same). My probability drops by 10-20%, but my, my risk stays equal in dollar amount, but my dollar multiple could increase by 5 fold for the same move.

Is there a clear answer on which is "better," or is it just style and tolerance?

-Mo

Hi Mo,

"However, if I use [tight stop], I probably have a 50% chance of a profit."

This is a dangerous assumption to say maybe it will be 50%. What if it's 40%. Will the trader's equation still be positive? Guessing numbers versus using only the probabilities provided by Al Brooks moves away from the core knowledge of BPA and only backtesting will be able to answer if your strategy remains profitable.

"but my dollar multiple could increase by 5 fold for the same move."

Because of low probabilities you may get loss loss loss loss loss loss loss and then one big win. But will it be enough to erase all the losses? Everything depends on whether the trader's equation is positive for the trades you take. So try to reframe all ideas from the point of view of T.E. and it should help greatly in forming expectations.

Hope that helped,

CH

__________________

BPA Telegram Group

Thank you. But a still confused about a couple things.

Let's say you take a H2 setup, but the Major Low (correct stop) is 10 points a away. Signal bar below H2 is 2 points away. Does al have any percentages or expectancy based on the stop?

If you use the "correct stop", it appears if you read the market correctly, you have a 60%ish probability for a measured move.

Buf if you put the stop below the H2, I can't imagine that if you're correct on direction, you're much less than 40% (because if you went down to a 1 minute chart, you'd likely see a breakout big enough with a low below the H2)

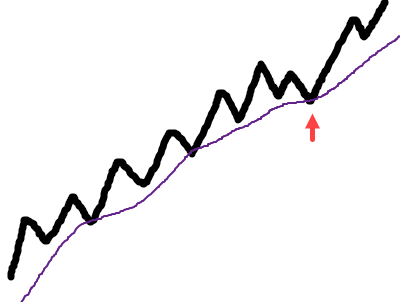

Sometimes H2 is itself the correct stop. Like a strong trend all day, H2 pullback to EMA, stop below is OK:

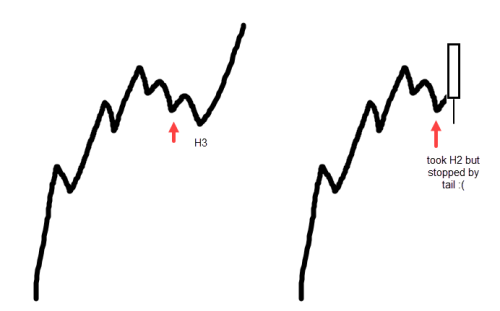

But a lot of times there will also be an H3, or a big tail and later goes your way so it's sad to get stopped out by such:

That's why Al recommends the correct stop below prior leg. Because if the trend is legit, pullbacks will come back to BOP (breakout points) but no deeper. And if deeper than low of prior leg then it's not trend so must exit. That's why we use The Correct Al Brooks Stop 🙂

That makes sense. Thank you! Will continue to learn.