The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi, This is slide 1

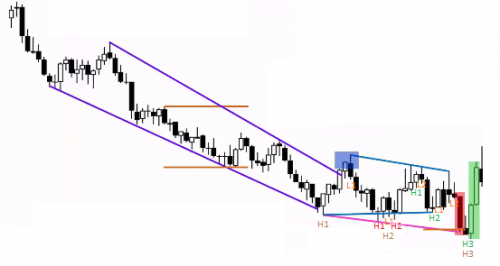

5 from Video. 44D: Trading Tight Bear Channels. at 32:32

Al talks about H1 H1 and then H2, but why didn't he consider that next bear doji as H2?

is it because the bear bar after 1st H1 entry bar went above the high of its previous bar (1st H1 entry bar)?

Yes, you doji is a H2 but it is also tight channel and it comes after a 40+ bars trend, so there is likely one more leg down before the bottom takes place. This is what Al H1s and H2 are marking.

In this chart area, there are a few other H1, H2, H3 and L1, L2 not marked neither (see the chart below), but the important thing is to notice that the MKT was trying to put a bottom and did two legs down before giving the BO where the MKT really did the reversal. Notice the move ended at H3 was about half of the bars of the bear trend, which is a long enough pattern to give a major reversal while the move ending at your H2 has not many bars, so this is another reason to expect more down before the bottom is in.

Take notice that the second H1 (in Al's chart) is really a H2, maybe there is a small mistake here, but the conclusion is the same.

Hello!

Id like to join this thread and ask something that I have been in doubt even after watching the course for the second time.

Why use the term H1/H2/H3 even though the bear trend has not yet ended, in fact we dont even know if a bull trend will actually develop or this is just the start of a Trading Range.

I mean, bar counting shouldn't only be used following the last clearly Trend? If it is a bear, you count as L1/L2/L3, and if it is a bull you count as H1/H2/H3?

To comment on the above mentioned situation, I would not bother about bar counting and simply consider it a wedge LL MTR.

Regards,

Danilo Melo

Bar counting is probably the biggest confusion of the entire course. Because of the time lag in the video, the exact locations of the H1/H2 etc signal bars was not clear (and not properly annotated).

Why use the term H1/H2/H3 even though the bear trend has not yet ended, in fact we dont even know if a bull trend will actually develop or this is just the start of a Trading Range.

I mean, bar counting shouldn't only be used following the last clearly Trend? If it is a bear, you count as L1/L2/L3, and if it is a bull you count as H1/H2/H3?

First off, you are right, H1... H4 is the way to count the pushes within either a PB in a bull trend or a TR. When counting for a bottom in a bear trend, even tho this is actually a TR, Al usually says instead first entry, second entry and wedge, or MTR, or whatever...

Yet, it is important to not let the naming fool you, a wedge is traded the same whether it is a continuation patter (wedge PB) or a reversal pattern (wedge bottom or LL MTR) so call them whatever better suits you but trade both the same.

Bar counting is probably the biggest confusion of the entire course. Because of the time lag in the video, the exact locations of the H1/H2 etc signal bars was not clear (and not properly annotated).

A lot of people having problems with that... for further clarification you can check the encyclopedia related section and also the books (Trading trading ranges, chapter 17).

If you have any question with a given chart, post it here and we can try to help...

You are definitely right.It is so confusing.