The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

It is right, where do you see the problem?

Al always says when probability is high RR is low for example RR=1 . Here probability is High , This is breakout so 70 percent is likely. 70 percent means RR=1 or RR>1 but you see RR>2 ! on side has good Probability and good RR , other side Nothing.

When I enter at this point , for example 4 days ago (GBPUSD chart) . I think al says we don't have good probability and good RR together. I entered early but I exited one times initial Risk. If I hold my position for 6 hours my RR becomes RR>10 !!! I can't gain big profit Even 2 times initial risk. Because Al repeatedly says When Probability is high ---> RR=1 so I think RR can not be bigger than one. I missed good trade.

Another Example : Bitcoin (2 days ago) I exited early because I think RR should be 1.

You say (where do you see the problem?) My system don't work . My losses is bigger than my Profits.

Your confusion is understandable. I reckon you have not yet watched video 30D. I think you will be a lot clearer after you're done with 'How to Trade Prerequisites' section.

The answer is, the high probability stays all through the breakout and therefore, the profit target keeps increasing with breakout. That is why, you need to be careful when the breakout phase ends and the market enters the channel phase.

Hope that helps. If you are still unclear after watching the videos, do come back and there are a lot of helpful people here who will definitely help you out.

The two trades that you are pointing out are both a swing and a scalp. Therefore you decide before taking the trade what will be your strategy and manage accordingly. Yes, sometimes the swing profit will be reached and you will think that you let a lot of money on the table, and this is completely right, but other times the MKT will turn at the scalp profit and go back to your entry or even to your stop-loss without reaching the swing target.

When a trade is both a swing and a scalp, one strategy is to exit half off at the scalp profit, move your stop to BE and leave the remaining to see if you are in one of the 40% of the time where the MKT will reach the swing profit.

Hey ludopuig, would you please comment on whether, what I understood regarding breakouts increasing the target was wrong or if my understanding was lacking at some point?

Thanks.

Yes, as long as the BO get new bars the target based on the BO height's increase and therefore the math improves. In the second chart, Nima used a measured move based on initial risk but she could have used also the height of the BO to create a MM or an even bigger MM based on the MM of the BO point and the start of the move, improving the math further because you would still have the same probability but now with a bigger reward compared to risk. The probability of reaching the second target at the moment of taking the trade was 40%, and 60% for the first target.

Anyway, even if your plan is scalping out at Nima's first target, when you see a BO coming from EMA with 4-5 bars closing on the high, the MKT is telling you that it will have, at least, another leg up, so you can manage your trade and increase your profit target and move it to the swing profit at twice the initial risk because once the BO happened, and not before, the likelyhood to reach the second target increased well above the initial 40%.

The probability of reaching the second target at the moment of taking the trade was 40%, and 60% for the first target.

Oh yeah. I see the concept more clearly now. I didn't consider the fact that even with MTR setups, the probability of reaching a target that is 1 times initial risk remains as high as 60%. If I understood it correctly, this actually makes a lot more sense. Thanks!

once the BO happened, and not before, the likelyhood to reach the second target increased well above the initial 40%.

Does it mean that, despite a BO, the probability of a 2 times RR ratio, does not reach 60%? Could you please elaborate more on that? I am not sure what I am asking here but this part got a bit fuzzy for me.

I didn't consider the fact that even with MTR setups

MTRs are 40-50% setups, but once a succesful BO happens, the prob is 60% for a MM.

Does it mean that, despite a BO, the probability of a 2 times RR ratio, does not reach 60%?

Yes, a BO is a 60% trade for a profit equal to the risk, not twice the risk. For twice the risk the probability goes down to 40% at the moment the BO is happening. Then, depending on how it develops, the probability to reach the target of twice the risk (or more, as Nima noted) can go higher, as it happened here with the new BO.

Yes, a BO is a 60% trade for a profit equal to the risk, not twice the risk.

Yes, yes, obviously. Al keeps saying this over and over in the course. I got a bit puzzled for some reason. Although, I did not know about the 40% probability when 2x risk. That's new information for me, so thanks.

MTRs are 40-50% setups, but once a succesful BO happens, the prob is 60% for a MM.

I am probably saying something silly again, but I guess MTRs are not the only swing setups right, despite being the most frequently(?) occurring one? I guess any kind of trend reversal setup is a swing setup?

To my understanding, trend continuation setups are higher probability trades(>50%), and since swing setups have 40-50% probability, it must be the reversal setups?

Thanks!

I am probably saying something silly again, but I guess MTRs are not the only swing setups right, despite being the most frequently(?) occurring one?

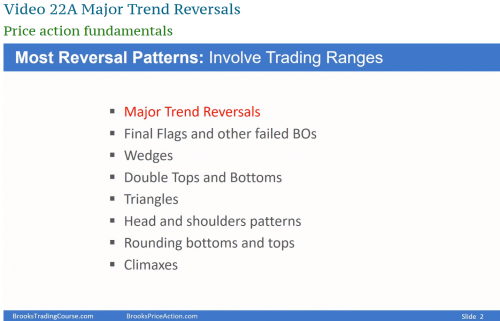

Nop, it is only the first one of the list below. I would say wedges are the most frequent ones tho most of the time several of them occur at the same point increasing the likelyhood of the reversal.

I guess any kind of trend reversal setup is a swing setup?

Yes, but not only: PBs at EMA like the one discussed above in Nima's chart are also good swing buys, but they are also good scalps.

To my understanding, trend continuation setups are higher probability trades(>50%)

Yes, you have to plug in 60% in the trader's equation for withtrend entries.

and since swing setups have 40-50% probability, it must be the reversal setups?

As I said above, all reversals are swings but not only: a PB at EMA can have 60% of reaching one time risk and at the same time 40% of reaching two times risk. Same thing with BOs, that can be the start of a trend. Therefore, when you suspect a swing is underway, you better don't take profits too early, instead you might exit half off at the scalp profit and let the runner to see what you get and, 50% of the time, the MKT will come back to your entry price, maybe other 30-40% of the time you will make twice the risk, and 10-20% you will make many times the initial risk, making this strategy very favorable.

Thanks a lot ludopuig, for taking the time to answer the questions but I have a few more and am nearing the end. Just a few clarifications.

Yes, you have to plug in 60% in the trader's equation for withtrend entries.

You're saying it's 60% for 1 times RR. However, Al says that when a PB has 20 or more bars, the probability drops to around 50%(>). Would I still be plugging in 60% in the traders equation in that case? For example, if I take a high 2 bull flag entry(or a high 3 entry, effectively wedge) of a bull breakout and then PB, would that be just above 50% probability or 60% in the trader's equation(when there have been 20 or more bars in the PB)?

a PB at EMA can have 60% of reaching one time risk and at the same time 40% of reaching two times risk.

Does this stay applicable when the PB at EMA stays above/around the EMA or it's not much of an issue if we get EMA gap bars(full bar below EMA in case of bull trend and vice-versa)?

Thanks again. It was very helpful learning from you. You also helped me realize that it's time for me to go back to the previous videos and review what I had learned.

The two trades that you are pointing out are both a swing and a scalp. Therefore you decide before taking the trade what will be your strategy and manage accordingly. Yes, sometimes the swing profit will be reached and you will think that you let a lot of money on the table, and this is completely right, but other times the MKT will turn at the scalp profit and go back to your entry or even to your stop-loss without reaching the swing target.

When a trade is both a swing and a scalp, one strategy is to exit half off at the scalp profit, move your stop to BE and leave the remaining to see if you are in one of the 40% of the time where the MKT will reach the swing profit.

I don't have the trades equation in this case. If it hits my stop in one trade, I will make a complete loss, but if I make a profit, it will be half a loss. Sometimes the second target, in which case the profit will be 1.5 times the loss. But I do not know what the profit and loss conditions will be after 100 trades.

If it hits my stop in one trade, I will make a complete loss, but if I make a profit, it will be half a loss. Sometimes the second target, in which case the profit will be 1.5 times the loss.

If I got this correct, you only employ this strategy when the setup is both swing and scalp(meaning 60% probability of 1 RR ratio). So, in 40% cases, your full stop will be triggered. In 40% cases, you will get 2 times your initial RR(you will effectively earn 1.5 times your initial risk) and in 20% cases, you will earn 0.5 times your initial risk. To me, that seems like a positive traders equation. This is actually a more favorable traders' equation than earning 60% of time 1 times RR and 40% of time losing 1 times initial risk(the standard scalp traders' equation).