The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

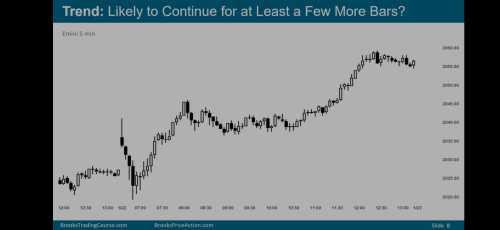

Faced something similar in the markets I trade in today so wanted to clarify. The above chart opened and then strongly sold off which reversed and strongly broke above. Al always mentions Big Up Big Down leads to big confusion and trading range. However, in this case it is leading to a bull trend. While, I concede that one should buy the moment market turns Always In Long, my doubt is, how to judge the exit, how to manage the trade correctly?

The second doubt is, after the upward rally, I presume the market also turned Always In Short. Given, how weak the pullback was I understand that it did not lead to a bear trend but only a trading range. My doubt is, Al mentions in the video how the upward rally was a BTC bull trend. If it was BTC bull trend and suppose I bought at the top bull bar COH, how am I supposed to manage the position? The obvious choice would be to scale in lower but after 20 bars or so, the chances of a BO would have faded quite a bit. So, not sure scaling in lower would be such a good idea.

Al always mentions Big Up Big Down leads to big confusion and trading range

In the opening range's context the sell off created an opening reversal that was followed by several consecutive bull bars for a swing up, so no TR.

However, in this case it is leading to a bull trend. While, I concede that one should buy the moment market turns Always In Long, my doubt is, how to judge the exit, how to manage the trade correctly?

Had the MKT gone up with prominent tails, no consecutive bull bars, bear bars, etc, bears would have tried to create a TR or a swing down, but the MKT was too strongly up so they just created a triangle PB before the MKT resumed. For you to study this, refer to the encyclopedia related section in which you can see many sell climax and opening reversals with different outcomes (strong trend up, trend up but deep PBs, TRs, openinig reversal failure, etc.).

The second doubt is, after the upward rally, I presume the market also turned Always In Short.

Maybe you mean AIL. If not, I don't know where you mean to be AIS because after the opening reversal at bar 6 ii the MKT remained long for the rest of the day.

If it was BTC bull trend and suppose I bought at the top bull bar COH, how am I supposed to manage the position?

Same than any other trend (swing) setup, stop before 6L until BO of triangle, when you can trail your stop. This is the correct stop, using a tighter one would reduce the probability as well.

The obvious choice would be to scale in lower but after 20 bars or so, the chances of a BO would have faded quite a bit. So, not sure scaling in lower would be such a good idea.

Doing scale-in seems good in theory but you need to be able to trade very very small, taking into account where the correct stop-loss is (really wide). Using a wide stop and scaling in is a sure way to kill the account, because one hit is huge. In this case, after such a strong move up braking above 1H and with the bears not able even to create a downwards PB, the probability of more up was high.

Had the MKT gone up with prominent tails, no consecutive bull bars, bear bars, etc, bears would have tried to create a TR or a swing down, but the MKT was too strongly up so they just created a triangle PB before the MKT resumed. For you to study this, refer to the encyclopedia related section in which you can see many sell climax and opening reversals with different outcomes (strong trend up, trend up but deep PBs, TRs, openinig reversal failure, etc.).

Okay, this was significantly helpful. I will do the necessary studies.

Maybe you mean AIL. If not, I don't know where you mean to be AIS because after the opening reversal at bar 6 ii the MKT remained long for the rest of the day.

No, I meant AIS but it appeared after your comment that I was not clear about Always In, so I studied up the videos once again and it was really very helpful.

Same than any other trend (swing) setup, stop before 6L until BO of triangle, when you can trail your stop. This is the correct stop, using a tighter one would reduce the probability as well.

Okay, I'm guessing stop below 12 L will not be feasible despite seeing a strong BO from there right?

Doing scale-in seems good in theory but you need to be able to trade very very small, taking into account where the correct stop-loss is (really wide). Using a wide stop and scaling in is a sure way to kill the account, because one hit is huge. In this case, after such a strong move up braking above 1H and with the bears not able even to create a downwards PB, the probability of more up was high.

Yes, I don't intend to use scale-in any time soon. I was curious about how to manage the position as even scale-in did not appear correct to a large extent. I wanted to understand what the theoretical answer might be. But, your answer was very helpful as always. Much thanks!

Hey ludopuig , Could you please take a look at this link here - Video 39D, am I missing something or is this buy a bit early? – 39 Trading MTR Bottoms – Brooks Trading Course Support Forum .

Al suggests an MTR buy after a significantly strong selloff. How does that not create a bear trend but the strong bull trend given in the above case(video 40D) does? Could you please point out the difference if any among the two? I understand a 2nd Leg Bear trap could be possible but is that really what makes the difference or is there something more to it?

Sorry, I am confused...

How does that not create a bear trend but the strong bull trend given in the above case(video 40D) does?

what bear trend are you referring to in video 40D?

In the link given above of video 39D(picture in the link given above), Al marks a LL MTR buy despite having some really consecutive strong bear bars that follow some strong bull bars. In this case it leads to a trading range which is enough for the MTR trade to be successful.

In the current case of video 40A(picture in this question), after a bear selloff, the consecutive bull bars create a AIL situation and not a trading range but a bull trend. While, I understand the premise of the bull case being so strong that the market did not create a TR but only a triangle pullback. I am however confused as to why in 39D the market creates a trading range and not a bear trend.

I was asking you about any points of distinction between the two if any. Please let me know if I still am not clear enough. I will try to frame a proper question in a separate post if necessary.

I am however confused as to why in 39D the market creates a trading range and not a bear trend.

Because with the previous bull strength the bear trend premise was seriously damaged. At that moment (5), bull day or TR day were likely. Then came the bear strength from 5 to the LL MTR, so the bull trend premise was also weakened, leaving as the most likely outcome a TR.

I was asking you about any points of distinction between the two if any.

Both trades are opening reversals with similar probability, the big difference is not in the setup but in the FT. Refer to the pictures below to see what I mean.

Okay, thanks ludopuig. You were helpful as always. Thanks! It's still not crystal clear to me but it's work that I need to do on my part.

As I understand, we need to look at PA on the left that's not shown in the slides. The LL MTR slide shows TR PA on the left where reversals are occurring at top and bottom making buying above a bull bar a reasonable, though low probability bet.

In the current case, I also see a bad follow through after the breakout of highs, but I also notice couple things. The bulls were strong going up with rarely any bear bars, so any reversal would be minor and at best a TR which they got. Second is that I notice bulls were strong enough to create higher lows in TR. Thanks!