The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello everyone!

I'm still confused about where the scalp stop should be placed, and how that relates to the Risk x Reward ratio for scalps.

I remember Al saying that you should not go for a trade if your risk is greater than your target. He also says that a 1:1 ratio should be used only for scalps.

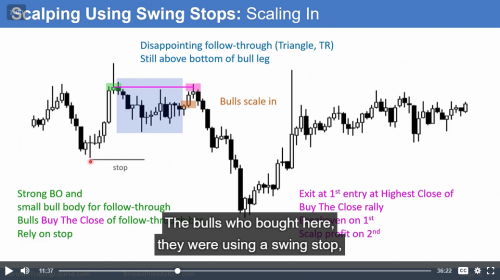

However, in this video, he says that a trader who bought the bull BO, should use the swing stop, regardless if the trader was planning to swing or to scalp:

In this case, if the trader was planning to scalp, he clearly is risking way more points that he intended to make. Am i right?

Al says that the minimum scalp on the E-mini should be 4-8 ticks. In these cases, should the stop also be 4-8 ticks away, or should it be a swing stop, far from the current price?

Thank you in advance!

Best,

I remember Al saying that you should not go for a trade if your risk is greater than your target. He also says that a 1:1 ratio should be used only for scalps.

This only applies if you wanna make money!

However, in this video, he says that a trader who bought the bull BO, should use the swing stop, regardless if the trader was planning to swing or to scalp:

Yes, but have in mind that you can only scalp with a swing stop if you scale-in lower, which modifies the math. If not, you have to exit quickly, which makes it difficult to do.

In this case, if the trader was planning to scalp, he clearly is risking way more points that he intended to make. Am i right?

Not really, if the MKT goes your way you just grab the scalp profit. Rather, if it goes against you, you add more lower improving the overall trader's equation but also increasing the risk (no free lunch). All this, of course, providing you scale-in at the right time within the MKT cycle. Rather, If you scale-in lower in a bear trend you kill your account. Is this what will happen to you? Of course not! 😉

Al says that the minimum scalp on the E-mini should be 4-8 ticks.

Yes, but it depends on the day's average bar's size.

In these cases, should the stop also be 4-8 ticks away, or should it be a swing stop, far from the current price?

If you don't scale-in, you have to be quick to exit. In this example, you bought just below the prior High and instead of a another big bull bar breaking above you got a big tail and a bear bar, so you should exit below (we don't see the scale, so if you were lucky you got your scalp within the next bar's tail).

Got it!

As always, thank you very much for all the knowledge you share here.

Wish you the best!