The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi -

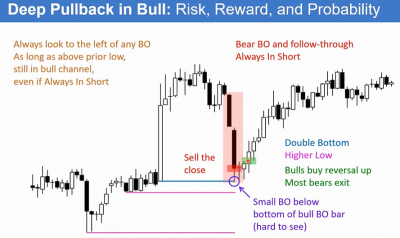

In the slide below Al talks about the Bull breakout possibly reversing due to the poor follow-through, which it does. He goes on to say that the BO could be part of the Bull Trend or could be a leg in a Trading Range.

I had a trade yesterday that caught me off guard in a big way and it relates to this slide in that the reversal was abrupt and immediate. The following slide is a 5-minute chart, you can see the Bull BO bar followed by a Bear BO bar. I would love to see comments about this situation and/or parts of the course I should review to help with handling this. I bought the green bar too far up, thinking another leg up or momentary sideways move, but the bear BO happened so fast I got caught holding. It looked to me like I was buying in a bull trend.

Risk happens fast. Probably i would've seen these 2 big bull bars as buy climax and/or possibly a 3rd push up in the wedge ( i need to see more bars to the left tho) or even 2nd leg trap in trading range (where second leg up in TR is often strong) rather than start of bull trend. After bear inside bar i would think about trapped bulls who bought the close of the last bull bar and you can see alot of them got out at the midpoint rather than close of the highest bull bar because we didnt get back to it. Bulls exited,bears sold correctly believing we will get 2nd leg dow... and we got second leg down.

If you bought the top, its reasonable to exit after bear inside bar, but its also reasonable to look to add lower and try to get out breakeven or even make little profit. Thats why its so important to trade small and look to scale in. As Al says in trading in almost any situation you can make money as a bull or as a bear but the key is trade management. In this situation many trades AND you bought the highest close as you can see, otherwise the price wouldnt be there, but they quickly realized that it might be a 2nd leg trap - some scaled in by buying 2nd bear bars close and got out at 50% pullback, some bought above the bull bar after 2nd leg down expecting to get out breakeven aswell.

When I see these 4 bull bars (i.e., a single bar on a higher time frame) I treat it as a spike, expecting at least a second leg. I typically set a limit order at 30% below this spike to go long. It it fills, great, but if it doesn't I learned not to chase the market. However, in light of the ensuing bear sentiment (notice the consecutive bear bars) I have to engineer an exit. My premise of a bull continuation is wrong, I have to get out, hopefully with a minimal loss.