The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

When I watch videos to learn about trading, I often find myself thinking about different scenarios. This leads me to question whether I truly understand the concepts being discussed.

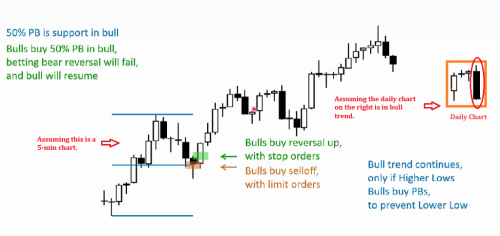

For instance, let's consider a general example using this chart. The video explains that in a bull trend, traders might buy a 50% pullback, expecting the bearish reversal to fail. If I imagine this as a daily chart, I'd consider buying because it's at a strong support level. However, if I look at it as a 5-minute chart, I also need to check if it's not close to the top of the daily resistance from previous days, as previous days highs on daily charts also acts as resistance and lows as support.

So, if the daily chart looks like the one highlighted on the provided image, I wouldn't buy the 50% pullback on the 5 min chart here unless I'm aiming for a quick profit since it may top out at the high of the day from the previous day which is acting as a resistance.

Assuming, even if the daily chart shows a bull trend, if the next day's bull trend price action is close to the previous day's resistance, I need to reconsider how I approach trading the 5-minute chart.

These are the thoughts that cross my mind while watching price action videos. I wonder if further progress in watching upcoming videos will make these concepts clearer. Perhaps there are specific videos on "How to trade" that explain these concepts. Any suggestions or thoughts on this would be greatly appreciated.

@ludopuig @Mr. Carpet

These are the thoughts that cross my mind while watching price action videos

Similarly,

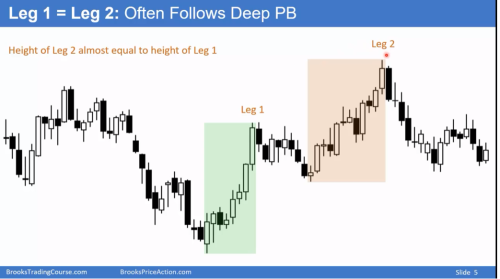

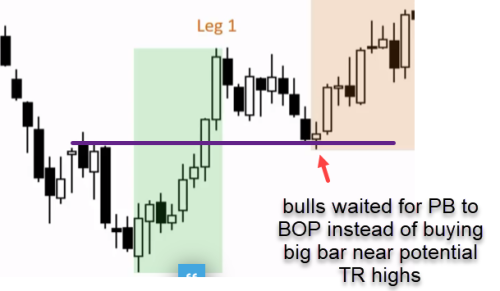

In this scenario, Al points out a bull breakout above the bear channel, marking the formation of leg 1. Examining the notable downward and upward movements on the left, traders interpret this as a trading range in price action. Leg 1 also establishes a lower high. The question arises: Why do traders anticipate a second leg up equal to leg 1? However, there's a potential scenario where a second leg (leg 2) may not occur. Instead, the reversal from leg 1 could test the bottom of leg 1, given the trading range price action and trader might be looking to sell instead?

same chart we have a second leg up here

Leg 1 is a 8 bar micro channel expect first reversal attempt to reverse to fail.

Hi Sudeep,

I thought those daily bars part looked suspicious... 😆

But yes, I agree that it's natural to expect resistance when getting close to prior day's high, but let's say this 5M chart was actually the daily chart, look at what happened when it got to that resistance level at (A), it shot right through... (DT failure). Possibly it was due to the fact that bears failed to reverse the market down twice. They had a great big signal bar and yet horrible FT so when the market came up to their stops there wasn't much to hope for (no strong cc bears ever appeared to make them care to scale in even) they just took the loss. So just because it looks like resistance on daily (or any timeframe) I think it's important to consider what did the other side was doing and did they fail at it or succeeded at it. How many times did bears try to reverse already? Were they strong at it to warrant a 2nd leg down at least? Or is the 2nd leg already over even. This may give you confidence to not be afraid of the daily resistance but actually take a buy on a 5M chart right into it (with a good signal bar) because formations like these often result in pops that go far (the reason why Al used to mark green buys into top of TRs on his daily review charts that beginner's couldn't believe).

Regarding your 2nd post - traders will anticipate a 2nd leg up due to market inertia. But you're right, the market is likely forming a big TR so yes it could instead drop all the way to the bottom first. But that's why Al Brooks teaches that inside TRs it's better to buy pullbacks instead of breakouts directly. So even though bulls are expecting a 2nd leg, they also don't want to buy too high in a potential TR so they'll probably wait for a PB to test some BOP (which it did) and look to buy a 2nd leg attempt. So this 2nd leg up wasn't unexpected, I think it was very much expected, especially since TRs usually have at least 2 legs up and down. So if the 1st leg up is very clear, traders are likely to wait for a 2nd leg up attempt after some PB. I also think it's important to rely on this word attempt. None of this is guaranteed, it's just an attempt, and it can very much fail and then go to bottom of TR like you said, so it's important to be vigilant and escape quickly if the attempt is failing. But an attempt is nevertheless a higher probability continuation in this scenario.

Hope that helped!

CH

P.S. I want to buy the book with the title of this thread 👍

___________________

BPA Telegram Group

Thank you, Mr. Carpet! More questions will follow through, with even more suspicious bars 😉.