The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

In the video Al Brooks showed a breakout on the 1 min. chart and showed how the breakout above the bull channel went on for 100s bars. He then showed a 30 min chart saying that the 5 bar rule applies to the highest time frame where the channel is visible.

I don't understand why he chose the 30 min chart. It looks to me that the pattern might have been there on the 60 min chart as well or higher. I'm not trying to pick on Al but rather understand myself what the highest time frame is. I have gone through various examples on other charts and it was not clear what the right higher time frame was. Sometimes it was visible on the 4h but it was still visible on the 8h. On the 4h the 5 bar rule was correct on the 8h it was obviously less. I will only know after the fact but not while it is happening. So how do I choose the right time frame for this?

I don't understand why he chose the 30 min chart. It looks to me that the pattern might have been there on the 60 min chart as well or higher.

He chooses the highest timeframe on which the channel is most prominently visible yet does not have bad shape. After a point on the higher timeframes, the pattern starts looking terrible and not what is originally was. That's where you draw the line. If you are still in doubt after going through this post, post a few charts, and I'm sure we can help you understand which is apt.

Bottom-line is PA is highly discretionary, so the essence of it will probably never be fully captured without the human interference. You build these senses, as you go along the course - it's a long way and you're just 2 weeks in 😉.

Sometimes it was visible on the 4h but it was still visible on the 8h. On the 4h the 5 bar rule was correct on the 8h it was obviously less. I will only know after the fact but not while it is happening. So how do I choose the right time frame for this?

Point is, you will never use this information in isolation to place your trades. You will need several factors to coincide for it to be prudent to place a trade(context), one of them being a strong signal bar which is not following several strong trend bars(don't confuse with climax). It is like a weather forecast warning you to carry an umbrella in case it rains(75% chance it will). So, you prepare yourself mentally and go along with the PA.

Does that ease your discomfort a little? It's best to discuss with examples if you're stuck.

Hi Jachym,

Could you clarify which video 16A-F and timestamp you're asking about? Thanks!

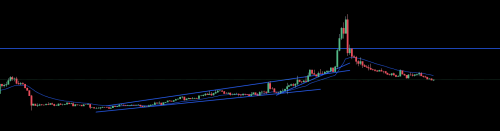

Yeah, let's look at a practical example of a trade that I totally screwed up. I shorted it way too early. Attached are two screen shots.

One is of 4h time frame the other is of the daily. It's a crypto called STORJ (STORJUSDT.P on bitget, if you want to find it on trading view). I was wanting to short it because it broke out of the bull channel and I was betting that it won't last and revert down (which it did but way later).

I was trading it on the hourly chart. But after watching the video I reviewed it again and started looking at the higher time frames to see if I can spot the 5 bar rule. That's when I started wondering how I would have chosen the right time frame to count the bars.

Imo the daily is probably where the previous bull channel isn't quite drawn well anymore. But all the other time frames (12h downwards) it looks fine to me.

In this specific example, how would I figure out the right time frame as the trade is going on?

I do understand that I would not only be looking at the 5 bars but also at other factors (which I have been learning in the course).

It's video 16A at 36:54.

I don't understand why he chose the 30 min chart. It looks to me that the pattern might have been there on the 60 min chart as well

Al must have looked at the HTF charts and decided that the 30M chart was the better option so we'll just have to trust him on that. To pick the HTF yourself you can incrementally increase periods. For example, check the 15M, then 30M, then 60M. I wouldn't go past 60M because, if you're a daytrader, a couple 60M bars and the day is over anyways. Also, don't worry too much about finding these HTFs. Al's main advice regarding timeframes is to just trade the chart in front you. That slide even had the title say "If BO lasts 10 bars", so it's an exception for unusually strong BOs.

The essence of utilizing these HTF concepts is two fold:

1) To not enter a reversal trade too soon since may still go far due to HTF reasons.

2) To not exit a trade too early since may still go far due to HTF reasons.

In this case, Al advises to check HTF bars because even though BOs of bull channels fail 70% of the time and a trader may consider selling, if the BO has gone for too many bars (>=10) then it's too strong to fade immediately.

In other examples in the course, Al mentions that if a trader sells short because expects a deep PB or reversal but this TBTL is also happening on some HTF then a trader should not take profits too soon and try to hold on as the HTF price action is playing out for massive profits.

Hope this helped,

CH

___________________

BPA Telegram Group

I was wanting to short it because it broke out of the bull channel and I was betting that it won't last and revert down (which it did but way later).

Betting against breakout of a tight bull channel early on is a high risk low reward proposition, and the probability that's on your side of the overshoot failing is not enough to compensate for it. After overshoot of a tight bull channel, the minimum target is just the bottom of the bull channel. So, unless the overshoot is significant, the most you can expect is a trading range and then trend resumption. This is what usually happens and that is what you got in this case as well. Al frequently says this, unusual behavior of the market can outlast you, so if you think you can outwait the market, you're gonna be paying heavily for it.

Imo the daily is probably where the previous bull channel isn't quite drawn well anymore. But all the other time frames (12h downwards) it looks fine to me.

You're absolutely correct. It does lose shape, so not the ideal choice.

But all the other time frames (12h downwards) it looks fine to me.

If it looks good on 12h timeframe(without losing the essence of the channel), then that is the timeframe you should pick(as per the highest timeframe rule).

In this specific example, how would I figure out the right time frame as the trade is going on?

You can do two things - understand that the market is overshooting a channel but if you think that the timeframe you are using is not the highest it can be(if you get too many bars in the pattern - again too many bars is subjective and you will get the hang of it with looking at enough charts) - then continue with the trend and ride the swing up as much as you can. Exit when it gets ways too climactic or if your stop is too big or if you get a reasonable reversal.

The other option would be - to toggle timeframes(not recommended by Al) and if feasible, trade on the timeframe which is appropriate to trade the pattern.

Feel free to ask more questions if still in doubt.

Nah that makes sense guys. Thanks for the replies. Has helped to further help with my understanding of the principle at play.