The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

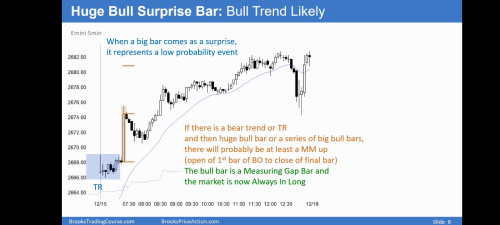

Why is a failed trend reversal expected

and why is a failed TR BO not expected with the Bull BO

This is the typical end of day trap, check the related videos and/or encyclopedia dedicated section for more details.

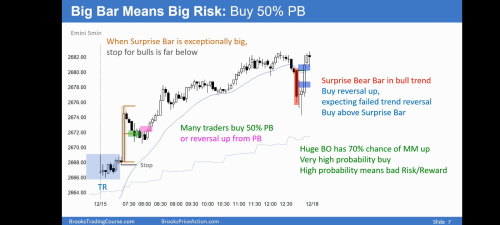

1. After the large Bear BO, there is a large doji bar, a large one bar TR. It's not good follow thru for the bears, but is it horrible follow thru? Better follow thru if a small doji?

2. If someone entered on the large Bear BO bar, what point should they realize a mistake and exit

3. If this same Bear BO happened early day, or mid day, would this be a high probability sell setup? (not counting follow thru bars)

1. After the large Bear BO, there is a large doji bar, a large one bar TR. It's not good follow thru for the bears, but is it horrible follow thru? Better follow thru if a small doji?

Bad FT after a BO in a small PB bull trend at the end of the day, bulls exit, see the videos.

2. If someone entered on the large Bear BO bar, what point should they realize a mistake and exit

It is shown in blue circles in the slide.

3. If this same Bear BO happened early day, or mid day, would this be a high probability sell setup? (not counting follow thru bars)

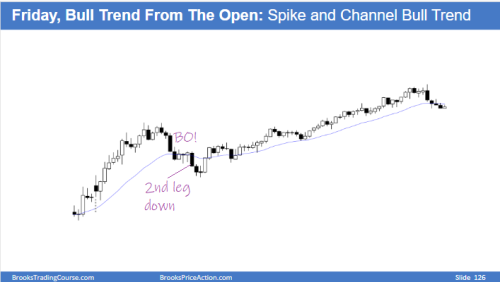

Yes, It would be different. Perfect example this last friday:

11B slide3

Similar setup.

No, it is completely different with two topping patterns that the first day didn't have.