The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

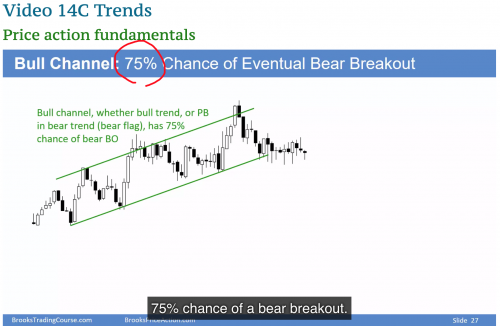

Each reversal attempt has a 40% prob. Yet, in 75% of bull channels will be a successful bear BO and only in 25% of cases there will be a bull BO.

So the 40% is per each reversal attempt but the 75% is for the whole move.

@ludopuig Can I understand that 75% of bull channel will be broken by bear breakout (causing reversals), but for the whole trend, the success rate of this reversal is low(40%),so this reversal probably be minor

I have similar issue with this statement from Al, based on above discussion ( ludopuig and Peter) what does this (75% figure) mean in trading terms? Do we look out for a bear BO (in a bull channel) and is there a 80% chance it will fail?

>Do we look out for a bear BO (in a bull channel) and is there a 80% chance it will fail?

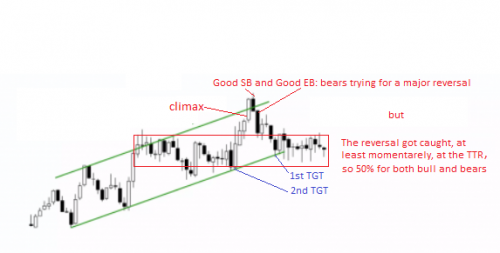

In general, you want to look at the bear breakout of the channel as one leg, with a good bear bar closing below the trendline, and a followthrough bar, in which case you have a good chance ( > 60?) of at least a 2nd leg outside the channel ( at least to the bottom of the 2nd leg up in the channel).

In this case, the breakout to the trendline was not in one leg (not good); there was no bear bar breaking below the trendline, and no follow-through...

The 75% figure refers to the idea that most of the time when the market breaks above a bull channel it will fail within several bars. The reasoning behind this is that a breakout above a channel is an acceleration of a trend since a channel is a weaker part of the trend. In some cases, both the bulls and bears agree that the prices are too low even in the channel and so the market will successfully breakout above the channel, restarting the market cycle (spike --> pullback --> channel --> trading range). Markets generally seek to facilitate two-way trade which is why breakouts generally don't last for more than 5-10% of the bars on the chart because once the market reaches prices that are perceived to be fairer by both sides the level of two-sided activity increases. The 75% idea also refers to the idea that many times the market will test down to the start of the channel in the trading range phase which is why there's a general expectation of a bear breakout (i.e. bull channels will often become bear flags). The percentages aren't exact, they're just used to convey that the probability of one event is more likely than some other event.

The 75% figure refers to the idea that most of the time when the market breaks above a bull channel it will fail within several bars. The reasoning behind this is that a breakout above a channel is an acceleration of a trend since a channel is a weaker part of the trend.

Very well said . This is the big picture . Percentages are just distraction .