The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello, friends. At time 9:17 of slide 13 (13C Market Cycle), Al says that, after 20 bars of trading range, "50% of the time the first breakout fails". But, according to the general rule, 80% of breakouts fail. How can these two statements be reconciled? Thanks in advance.

@leonardo Good question. My interpretation is that if in trading range, then you have already had failed breakouts at each turning point, so several potential 80% failures - meaning the probability of breakout is lowering significantly - as we must reenter a trend at some point. So after some time it makes sense to consider a breakout becoming random, ie 50%.

Thank you very much for your answer, Richard!

Leonardo, I'm trying to wrap this around my head as well. From my understanding, generally a Failed Breakout (be it out of a trend line, a Trading Range, or any support or resistance level, etc) is a Breakout without follow through, and (in most of the cases) then leading to a reversal (back into the Trading Range, or even leading to an opposite trend). For example a bull bar above a Trading Range, immediately followed by a doji, an (bear) inside bar or outright strong bear bar pulling the market back/below the breakout point. Reardless the probabilities, I think more important to learn is your ability to read the chart in real time properly and estimate whether a Breakout will succeed or fail.

As Al says, the market has inertia, so the forces that try to breakout of the consensus fail most of the time (usually in 1 to 5 bars, regardless of the time frame you use).

Al's books clarify this eloquently.

All best!

Just an observation, not a definitive solution. My understanding is that 50% of breakouts fail. Of those 50% of occasions, 50% of them reverse.

50% x 50% = 25% (success rate of breakouts)

That means a 75% failure rate, which is close enough to grasp what Al is alluding to by saying 80% of breakouts fail.

Of course I defer to Richard to determine if this is consistent with Al’s method.

Just an observation, not a definitive solution. My understanding is that 50% of breakouts fail. Of those 50% of occasions, 50% of them reverse...

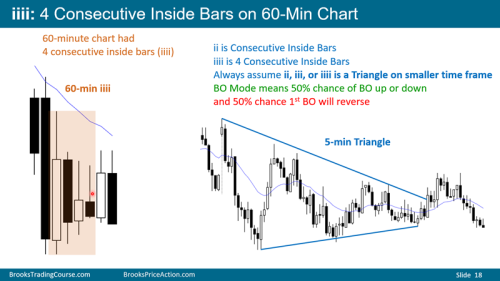

Good point too Charlie which leads me to the following slide from upcoming Bonus Video on ii, ioi, OO topic. Yes, any Breakout Mode situation can be viewed as 50% in line with the reality of random market behavior - although some (50%?) do not accept a random market. 🙂

Your 75% is in line with Al's guide for channel breakouts.

Thank you for this question and the responses, very helpful!