The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

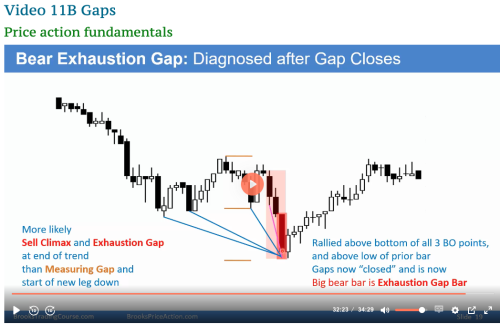

In Slide 19 of the Video 11B, Al mentioned that because bears aren't able to get out from the sell climax, the chances are that we get down to the sell climax or bottom. Why would the market allow the bears to get out at their breakeven points instead of squeezing the bears out after the exhaustion gap bars? Should I understand that it is a nature of a shift, within probabilities, of the market cycle from strong bear trend to trading range instead of changing the market behavior abruptly like sharp up trending? Or, would that be because of bull bars after the climax that are not particularly strong?

I am not picking on one sentence but more curious and trying to understand about the Al's reasoning behind why market has to search for more sellers over buyers in this context. Always there are so much valuable comment from his subtle nuance when it comes to his understanding of market moves. Thank you very much for taking your time to answer in advance. 🙂