The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

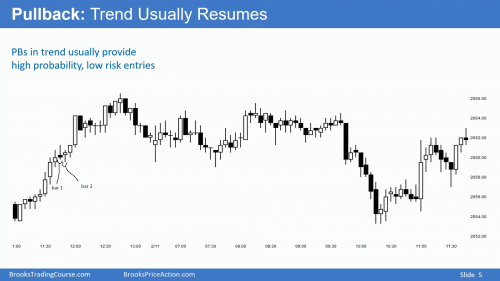

In this slide, Al discusses the different ways this pullback can be traded. Putting a buy stop above the PB-bar (bar 2), that I understand. But a few moments later, Al also says that limit orders can be placed, while pointing at the prior bar (bar 1). Does he really mean the bar he is pointing at, or do you have to place a limit order at close or low of last bar (bar 2)?

And a more general question. Isn't placing limit orders in those kind of situations a bit complicating things unnecessarily? First of all, you're expecting the market to go the other way than where you place your (limit) order, so many times, the order will not get executed.

And secondly, the reason why you place your limit order there, is because you had a (in this case) bearish intermezzo. When your limit order gets activated, you will have another bearish price move. So at least a little more selling pressure, in some cases maybe a lot more.

I get that when the market is strongly bullish, any reason is good enough to buy, because the market will probably go up anyway. But does slightly better R/R-ratio outweigh the slightly lower probability AND the possibility of not getting the order filled and missing the swing/trend resumption?

Thanks,

Marvin

Does he really mean the bar he is pointing at, or do you have to place a limit order at close or low of last bar (bar 2)?

The limit order should be below 1.

Isn't placing limit orders in those kind of situations a bit complicating things unnecessarily? First of all, you're expecting the market to go the other way than where you place your (limit) order, so many times, the order will not get executed.

Limit orders give you a way to enter in brief PBs. In this chart you got a H1 but many times the MKT goes up straight away or the stop entry SB is a bear bar and you miss the trade as well. In fact, this is fearly common.

And secondly, the reason why you place your limit order there, is because you had a (in this case) bearish intermezzo.

Not really, you are completely bullish but you know the PB will be small and brief and want to get in, so you don't wait for the stop entry that, as I said, many times looks bad, and get in early even tho the MKT can go against you before it goes up.

I get that when the market is strongly bullish, any reason is good enough to buy, because the market will probably go up anyway. But does slightly better R/R-ratio outweigh the slightly lower probability AND the possibility of not getting the order filled and missing the swing/trend resumption?

Depends on you reading: If you thought the PB was not going to be brief, yes, you could wait for the stop entry or even use a limit order not just below 1 but a few points lower. If, rather, you sense urgency, those entries may not come and the MKT can go up without you, if you don't buy below 1.

Okay,

That clarifies a lot.

Thanks (again 😅)