The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi all support members,

I would like to ask for help... much appreciated.

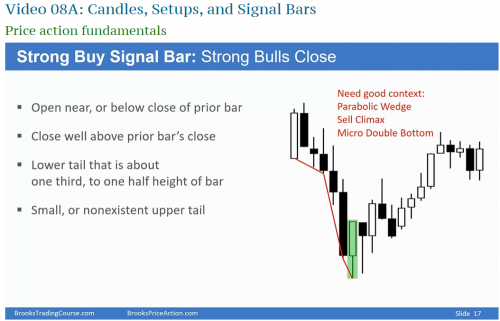

I am confused with the above slide, which appears to be a context with strong bear trend with consecutive bear bars. And in strong bear trend, I am confused why buying (As we should only look for sell?) and what it means by parabolic wedge & nested wedge (What's the difference)...

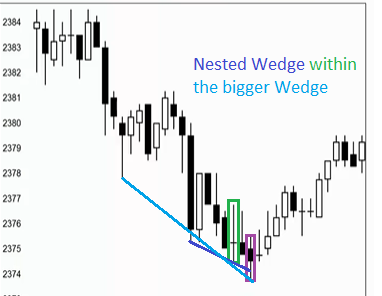

As for the 2nd slide, I am confused why it is a signal bar (the purple highlighted rectangle bar)... I see that the signal bar is a doji/TR bar, but there are lots of doji/TR bars above the trend (For example the green highlighted rectangle bar). Can you help me explaining why that particular bar is the signal bar for buy and not the others? I totally don't understand the nested wedge and parabolic wedge concept...

I am a slow learner, much appreciated for all the help I can get here, and the patience in explaining.

Lots and lots of thanks!

Best Regards,

Jason Fong

I am confused with the above slide, which appears to be a context with strong bear trend with consecutive bear bars. And in strong bear trend, I am confused why buying (As we should only look for sell?) and what it means by parabolic wedge & nested wedge (What's the difference)...

The bear bar before the bull bar is too big and is the third push (parabolic wedge) so the probability of a reversal goes up. Once you got the bull bar closing on the high, the bears were clearly trapped and they exited in the next bar (this partially created the tail).

Here you only had a parabolic wedge, no nested one... but wedges are dealed with in next videos (videos 24) so don't rush and visit that section later.

Can you help me explaining why that particular bar is the signal bar for buy and not the others?

Short answer: The context.

A reversal bar needs a close on the upper half of the bar so the green bar does not qualify. It is also an outside bar so this lowers the probability even more. The purple highlighted rectangle bar does qualify but it is a bear bar so lower probability even tho if the context is good (like here, you have a big wedge and a nested wedge) you can take the chance or, rather, wait for a bull bar closing on the high (here you got tails so still low prob).

I totally don't understand the nested wedge and parabolic wedge concept...

This is why we all needed the course. Had we known in advance, we wouldn't but, if you can't wait, go to videos 24 and see. Another source to check is the encyclopedia, you have dedicated sections for parabolic and nested wedges there.