The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello Support Forum

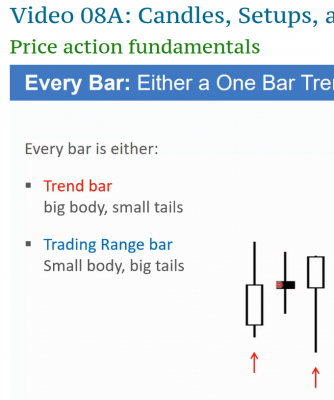

I was wondering if someone is able to clarify why the third bull bar on slide 2 is classified as a trend bar? It looks more like a trading range bar to me, because the body is less than 50% of the bar range. I understand the classification of bars can be subjective.

It's a trend bar because the bar closed on it's high?

Thank you.

Chee

Actually the body of the bar is more than half of it, isn't it? Yet a bar can still be a trend bar having a long tail above, here the close of this bar was clearly above the close of the prior bar, so the price trended during that 5 min.

@jeffrey-prunbox-com Yes, but remember that H1s are only setups in strong trends and here the first 3 bars largery overlap (we can't see the bars to the left).

Actually the body of the bar is more than half of it, isn't it? Yet a bar can still be a trend bar having a long tail above, here the close of this bar was clearly above the close of the prior bar, so the price trended during that 5 min.

Sorry I still don't get it. We're talking about this third bar right? The body is less than 50% of the bar size, and your answer doesn't seem to match that bar.

He was not referring to the third bar but to the third "Bull" bar, so the 4th bar in the chart!

@ludopuig ah, you're right!

In that case then, I have a doubt on the third bar in my pic above. The body is less half the size of the bar, but yet it is still classified as trend bar. Is it because it has relatively big body (in terms of ticks/pips, rather than relative to bar size)? If that's the case, is there any rule in terms of minimum ticks/pips in order to be classified as trend bar?

Thanks!

@bennystosia-com A bar trended if it closed on the high (and it was not a doji) or, at least, the bar closed above the mid-point. In this case it is very close to the mid-point but, in any case, you need the context (bars to the left) that we do not have here. If the previous bars was another bull bar, I would say this was a trending bar; if not, it was not clear, which is the hall mark of a TR and, then, you could think of it as a TR bar.

Hi all,

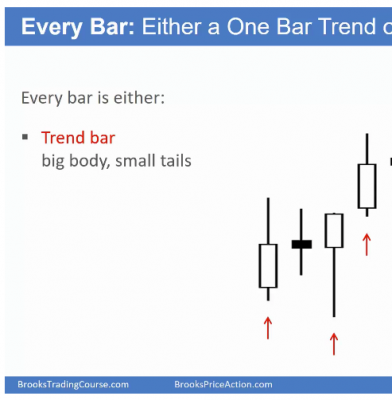

I believe the last bar on the right is what's being discussed. It is a trending bar because:

1) Small bottom tail, this means that market dipped from the opening but failed to significantly break to the downside. The direction is clearly up.

2) Body is large and is about 1/2 of the size of the whole candle. Again, this confirms the strength (large body) and direction (up) of the trend.

3) It overlaps minimally with the previous bar. Price moved definitively away from the last bar's high. In fact, it gapped up.

My two ticks =)