Second course offering open

The following article covers original course offering as well as Systems Academy 2 (SA2) which is now open. Admission is based on applying and participating in a discovery session with your coach if your application has been successful.

Systems Academy information: Quant Systems – Systems Academy Overview

You can apply here: SA2 Application Information

Introduction

Systematic trading is much more than trading based on a pre-determined algorithm. There are many parts in a trading system, and trading systems design of the system itself is only the strategic component of a trading program.

Let’s illustrate its impact using an example. Although there are no secret trading strategies, meaning strategies are known and freely available, why can’t most traders trade at least one strategy with a big enough position size so that the profits are meaningful and life changing?

The answer is simple: Risk of Ruin. Everyone understands that there is a real risk of losing their trading account, which worries them into trading small or not at all.

Systems Academy is a one-year program with the goal of taking intermediate to advanced traders through a comprehensive trading systems design and development program and teach them how to develop robust trading systems to trade systematically. But it doesn’t stop there and moved on to teach the student how to incorporate systems into a trading program and build a trading business.

The program is designed to teach you a very unique skillset that only few advanced professional traders possess.

As part of this program, you will learn how to reduce the risk of ruin of your systems to such a small percentage number that it is practically eliminated, yet maximize your system’s edge so that your returns are meaningful.

You will define the limits and criteria based on who you are and the goals you want to achieve and learn to develop your own systems to achieve those goals. In other words, your trading becomes «winning by design», with consistency, and at almost no or very little stress to you. We believe trading is a pursuit of happiness, so stress and inconsistency have no place in it.

Furthermore, the Systems Academy program guides you to put together a trading program. Most courses teach you strategies. A trading strategy is 1/5th of a trading system and a trading system is 1/5th of a trading program. So in reality, a strategy is 1/25th of what is required for consistent success as a trader. We will show you everything that is required through step-by-step methods and pre-made templates. It will take your trading up into the same realm as institutional trading and help you devise a trading program that suits your lifestyle and goals.

You will validate, with our help, the trading program you have developed, and put it in the market for live trading, but only after you have ascertained its success through comprehensive testing using the scientific method.

Watch the video below for more details (duration 1 hr 12min):

Top 10 problems solved through systematic trading

These are the primary reasons traders resort to systems instead of discretionary trading:

- Predictable Performance:

Systems are tested before they are put into production. Testing reveals the operational envelope of the system, so its performance characteristics are known before the first trade is put on.

- Safety of a Proven Strategy:

The trader proves the core strategy is viable during the test phase of system development process, so when the system goes online there is no doubt about the outcomes.

- Lower Workload:

Systems do all the analysis for the trader and result in much simpler trading processes and reduced workload.

- Increased Productivity:

Systems increase trader’s efficiency which automatically result in higher productivity as trader’s resources are freed up to be used in other areas, such as developing more systems, or implementing the same ones in new markets.

- Removal of Psychological and Emotional Barriers:

Some traders simply cannot execute discretionary methods well due to emotional and psychological barriers. Other traders need the clarity that research brings about before they can pull the trigger. Still others, cannot manage trades well and exit too early or too late. Systems solve all these issues by relieving traders from making a judgement call on each bar. They remove the burden of judgement that usually results in more joyful trading and ultimately trader’s happiness.

- Increased Capital Efficiency:

The system design process clearly defines risk. The risk management component of a trading system allows traders to trade full position size because risk and performance characteristics of the system are both known, resulting in optimal capital utilization and efficiency.

- Diversification while Scaling Up:

Systems reduce the work load on the trader, allowing him to scale up his trading operation into more markets while trading several systems in each market.

- Delegation of Duties:

Systems allow trading tasks to be delegated because the trading algorithm is documented with clear rules, which eliminate the need for a judgement call. So anyone with minimal training should be able to execute system’s signals.

- Automation:

Advanced traders with computer programming skills use fully automated systems to disengage themselves from trade execution and management tasks that allows them to trade multiple markets simultaneously.

- Sustainable High Performance over the Long-term:

Systems are the basic tool for ushering in sustainable high performance. High performance is defined as above average performance over the long term. Systems achieve high performance through consistency, diversification, time efficiency, and optimal capital efficiency. In other words, systems turn traders activities from the state of an expert craftsman into an industrialist businessman. It has the same effects of expanded scale and efficiency of an industrial manufacturing plant that produces lots of physical products with consistent quality. In the case of trading, systems produce lots of quality trades efficiently.

Systems Academy program goal

Our goal is to take you by the hand and lead you on to complete independence, so that you can take trading ideas and turn them into robust trading systems on your own. Then incorporate them into trading plans that help you achieve your financial goals.

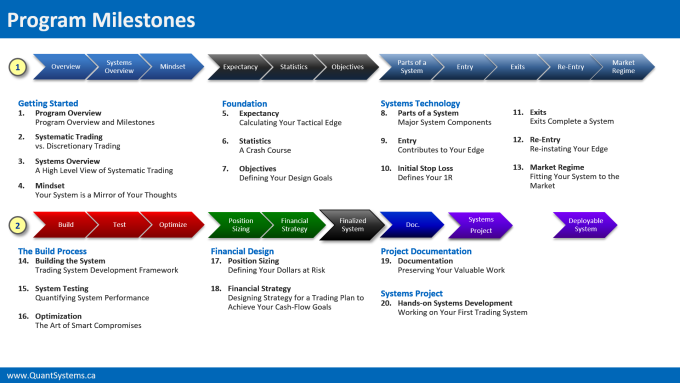

Systems Academy program milestones

Systems Academy assumes the student is already familiar with trading and has some live trading experience. The program begins with an overview of systems followed by building a solid foundation for the tools and techniques required for system development. It then gradually digs deeper into parts of a system, the design process, the build process, and testing and optimization.

To successfully complete the above steps, we required our students to do at least one system development project as they lean the concepts. So, the program has a strong hands-on emphasis on actually doing the work and helping students learn by doing.

Once the trader has built a robust system, the program then moves on to designing a robust financial strategy for that trading system, which will enable the trader to meet their cash-flow objectives.

Format

Systems Academy is an online course supported by live group coaching, assignments, and project work to teach you a rare and highly sought after skillset.

You will learn the system development process, trading system technologies, and skills by walking through the steps yourself through project work which helps you learn by doing.

This is a hands-on program and requires active participation.

What is included

This program consists of the following components:

- Systems Academy online course

More than 30 hours of recorded videos and over 400 slides.

- Systems Project

You will work on developing at least one trading system with your coach. If you like to do more, we encourage and support you.

- Frameworks and Templates

A complete set of frameworks and template used in system development, so that you can be absolutely clear on each and every step necessary to develop robust trading systems successfully.

- Group coaching

Weekly calls with industry veteran traders with a combined experience of more than 50 years, who have founded hedge funds and ran institutional trading departments.

- Bonuses:

- Bonus 1

Systems Portfolio

A collection of fully tested trading systems that you can use as templates and examples to develop your own systems from or just use to trade

- Bonus 2

Ali’s ground-breaking Breakouts Research

A comprehensive research whitepaper from Ali’s extensive work on breakouts with detailed statistics and probabilities of different breakouts and how each one can be used to build a trading system. Prior SA2 students have used this information to build high performance trading systems, including one of our students who manages an multi-hundred-million dollar institutional fund.

- Bonus 3

Systems Academy Code

A collection of innovative price-action based algorithms coded for TradeStation and MultiCharts platforms that could be used for learning how to write correct code for price action analysis, research, as indicators for live trading, or core concepts for further system development. Ali spent most of 2023 to put this module together. It is the result of over a decade of his trading and programming experience. This collection of software is easily worth more than the price of the SA2 program as other companies sell each piece of such software for thousands of dollars.

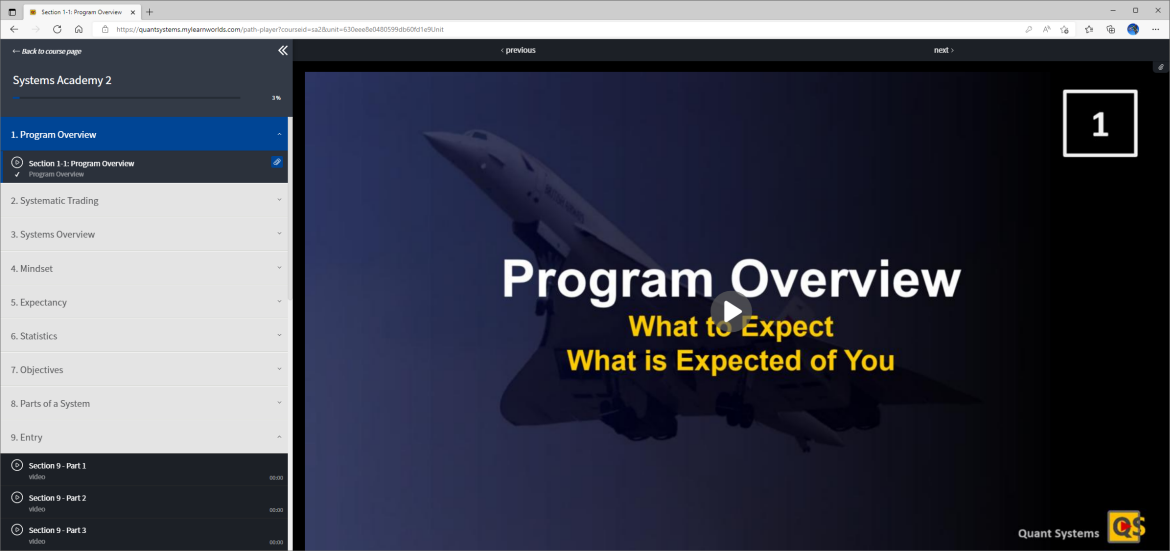

The e-Learning Experience

Here is how you will get access to the content. The screenshot below shows the course player. On the left hand side you see all the sections which you can open to view individual lessons, downloads, and support material. Videos are recorded in High Definition format and the audio is mastered for noise removal and frequency adjustment using the latest AI audio editing and enhancement technology.

The Coaching Experience

Ali, who is also the Systems Academy program creator, teaches most parts of this program. He is known to be an exceptional instructor with students raving about his teaching style. Please make sure you watch the example video of our Pro Trader Mentoring session to experience his teaching style for yourself (link at the bottom of this page) and also watch the two additional free videos below.

This year we have two other coaches, Brad Wolff and James Regan, who are both top graduates of the Systems Academy and bring a wealth of knowledge and experience to this year’s program. Please see below for more details.

Who is Systems Academy for?

Systems Academy is for intermediate to advanced traders who have live trading experience. It is for those who have come to the realization that the trading game is won by design and are now ready to learn how to design for success.

Years ago, I (Ali) wanted to sign-up in a high caliber program such as Systems Academy that is put together and taught by traders not gurus, but couldn’t find any. This program has been developed over a long period of time, as I read books, programmed and tested each concept, and added it in when I was satisfied that it works and it is useful.

I have studied the material regulators in the US and Canada require professionals to learn to get certified, such as Series 3 in the US and the CIM course in Canada. Unfortunately, none of them contribute in any meaningful way to becoming competent traders or system developers.

My goal was to have a comprehensive program to train future employees who are seen as professionals by the regulators but in reality are not traders yet. It raised the need for in-house training that actually works. So, we developed this program for our own staff, and later on decided to open it up to eligible students who share our passion for systematic trading and excellence.

You have an unprecedented and unique opportunity to work directly with professional traders who have a proven track record of success in their careers plus many years of experience.

Are you ready for it?

Student’s success criteria

We are looking for serious candidates who are ready to work on developing a unique set of skills that will set them apart from the majority of traders, even professionals. We spend the time to find talented and committed individuals who can both learn well and contribute to our exclusive community.

We expect our students to work diligently on the course material, come to our sessions prepared, and to work on their projects enthusiastically. This is not a program for someone who wants to watch videos and learn something. The program is very hands-on and requires active participation.

It is obvious that this is not a get-rich-quick program. Systems Academy is for those who want to build wealth and long-term financial independence using the stock market as their vehicle of choice, and need professional level guidance to get results without wasting time. They understand the importance of this goal and are willing to commit themselves to achieve it in the shortest amount of time possible, learn to perform efficiently, and with high quality.

Students’ Experience

A high attendance rate speaks to students’ experience. Compared to the e-learning industry standards, Systems Academy program has enjoyed an off the charts sales record since its release (version 1, taught in classrooms) which has carried over to now. The program has so far sold out before we could interview all of our interested candidates, resulting in a waiting list for our annual enrollment.

Read our clients’ testimonials: click here

Make sure you watch our Trader Development video series on YouTube: click here

The admission process

Systems Academy is an advanced high value program. To ensure the right candidates are admitted into the program, there is a three-step admission process:

- Step 1: Application

You will fill out and submit an online application form. If your application is successful and you meet the admission criteria, you will be invited to a zoom or phone interview.

- Step 2: Interview

The interview process is an opportunity for both of us to ask questions, discuss your personal circumstances, goals, and roadblocks in order to see whether Systems Academy is a good fit for where you are in your development journey. If we both see there is a good fit, you will be offered admission at the end of the interview.

- Step 3: Commitment letter

You will sign a commitment letter to work on your assignments and projects upon admission into the program.

The SA2 program is now open. You can submit an application at: click here

Systems Academy program cost

Systems Academy cost and value proposition is as follows:

- Systems Academy will cost between $15,500 and $19,500, for the first year. The exact cost will be announced when the program is ready for launch, depending on how many students express interest and cost factors not yet fully clear to us.

- It could be purchased by going through the admission process that is by invitation only.

- If you cannot complete the program in one year or need more time to develop more systems and still need continued support, you can buy additional support time on monthly basis for $499, which is much less than the first year’s cost because at this stage you will be working on your projects and likely require less day to day support.

- You will have lifetime access to the course material as long as the Internet exists.

Version one of Systems Academy was sold to a select group of private investors for $30,000 a seat. The current version:

- Is expanded more than 200% based on the lessons learned from version 1.

- Is more comprehensive, with more than double the number of slides.

- It comes with several high value bonuses such as a package of complete systems that you can use as templates and build upon or just use them outright.

- Is powered with the most high value new addition, which is the Financial Strategy Module that shows how to reduce risk of ruin without blunting your systems edge.

- Comes with hands-on project and coaching so that you can develop your first system successfully.

We are delivering at least 500% more value at less than half the cost of the original release.

Value proposition of Systems Academy

- You get to work with an expert who will spend about 200 hours in the course of a year on your improvement. About 80 – 100 of those hours is in a live session and the rest is spent reviewing your project work, communicate by email, and giving you direct feedback. The cost of the program comes to less than $100 an hour for that expert’s time, if we consider the value of the courseware itself, zero.

- The SA2 process, based on what we have seen from past students, speeds up your improvement and saves you about 3-5 years of time. What is the value of 3-5 years of your life?

- We install systems in your trading that allows you to trade six figure and larger accounts with safety.

- You will learn professional level knowledge and acquire skills that very few traders have. You cannot learn this material by becoming a certified professional asset manager. I have studied those courses myself. SA2 is about hedge fund level knowledge and skills.

- I walked this path alone, and it took me over a decade, plus reading more than 200 books, and travelling internationally to work with other experts, paying tuition fees in the range of $25 to $50K, multiple times. Do you have that kind of stamina and resources to do it alone?

- Access to the SA2 library of software, I have developed and coded for professional trading.

- Finally, SA2 is a hands-on course and you graduate with at least one working system, if you do the work. The process of building that system under supervision will ensure your knowledge becomes a timeless skill, so that you can build new systems on your own.

- SA2’s goal is to create independent thinkers in this field, who do not follow anyone.

Who are the coaches?

We created this program as part of our corporate training for our staff. You will work with the authors of this program directly, Ali Moin-Afshari and Kirk Cooper, who are also hedge fund co-founders, managers, and professional traders.

Ali has more than 20 year of experience as an IT professional and more than 15 years of experience as a trader, with over a decade of full time trading experience. His work on developing unconventional systems through first principals and out of the box thinking provided the technological foundation for a new startup firm in Canada. He has written more than four million lines of code for these systems.

Kirk has more than 30 years of experience in finance, working in all levels of institutional trading. He has held C-level executive positions with major international financial institutions, managed trading teams, and co-founded two hedge funds, one of which was bought by Fiera Capital, the largest hedge fund in Canada with over $180B assets under management.

James Regan is one of SA2 top graduates who has done stellar work in coding and system design. James brings a lot of educational and training expertise along with his computer programming and system development skills. View James’ video interview: Click Here

Brad Wolff is another one of SA2 top graduates who is an expert in price action trading and an active contributor to Brooks Trading Course content, trading room coach, and trainer. Brad is one of the few top traders in the world who excels in price action trading. He is a licensed investment management professional.

Quant Systems

QuantSystems.ca is our website dedicated to helping traders take the next step in their professional development, which is systematic trading.

The focus of my work is to help serious traders who have already mastered the basics and have graduated from the beginner level with about 2 years or more of trading experience, to fast track to advanced or even professional levels. That is why we do not offer anything at the beginner level.

Dr Brooks worked with me directly and that collaboration reduced the decade it took for him to become a professional trader to half for me. I am doing the same for others now and our history with our past clients show that we have been able to still reduce that period further down to one quarter, or about 1-2 years.

Frequently Asked Questions

Who has gone through this program before?

Prior to public release, we have only offered this training once before to a private group of investors who paid three time more for it than the price we are currently offering the program. Last year was the first public offering of SA2 and we achieve graduation rates 500% above the online education industry norms. 50% of students became consistently profitable, some trading 7, 8, and 9 figure accounts both on the personal and institutional sides. Please view our Trader Development playlist on YouTube to see some their results: click here

What if I cannot finish the program in 1 year?

You will not lose access to your course material and bonuses. At that point, you have the option of extending your coaching by purchasing extensions.

Do I need to travel?

Absolutely not. We work remotely with students all over the world.

Do I need to know computer programming?

No, but if you already know computer programming, we can help answer your questions. We encourage everyone to at least develop their first system using other computation methods, such as Excel to gain a deeper understanding.

Do I need to have a strong math background?

No, but you must be comfortable with high school level math. We have made the process as simple as possible without heavy math, but you must be able to solve simple equations and read simple math notation.

Do I have to know statistics?

No. We prefer a very basic familiarity with general probability concepts such as the bell curve, but Systems Academy program covers everything that is needed including a module on statistical topics that are directly used in systems testing. We have streamlined and simplified the process so that you don’t have to learn heavy statistics.

How much time do I need to have?

It depends on your background, education, and experience, but in general you should be able to dedicate at least 10 hours a week for one year, possibly more.

What kind of performance should I expect from a trading system?

It depends on the system and your objectives. There are systems that win 70% or more and generate a lot of trades, and on the other hand, there are systems that win 40% of less and keep you in a trade for months. We will work with you to find what is right for the trader who you are, so that you can reliably and comfortably trade the system that you build.

How much capital is recommended?

Considering the time and effort you will put into this program, you will most likely have a six figure trading (or retirement) account, to be worth your investment. We have had students who trade five figure accounts but that is mostly for learning and building experience.

How long does it take to become a systematic trader?

It depends on your educational background, experience, and time and effort you put into learning these skills. It also depends on what you want to achieve. For example, one of the systems Ali has developed, took him five years and only the signal generator part went from 250 lines of code in version 1 to over 4000 in version 34, but that is an institutional grade system and one that is built on unconventional methods, so it needed extensive research and new technology development. In general, you should be able to gain a good grasp of the skills after completing a few systems projects on your own, which typically takes about 1 to 2 years or so.

What is the greatest challenge in this work?

It is understanding who you really are as a trader and what your true limits are. For example, someone might think they are OK with a system that produces 21% drawdowns but makes 55% profits a year, only to find out that after a 10% drawdown they are so nervous that they can’t execute on systems signals.

How many systems do I need to develop?

In general you need at least three non-correlated systems to get a smooth equity curve. We recommend 4 to 6 however, if you are a fully systematic swing trader, that work as a portfolio of systems that manage your portfolio of assets. If you are a day trader, you will need at least two non-correlated systems.

How much work is there once I have my portfolio of systems?

It depends on the nature and number of systems in the portfolio. A day trading system is obviously very involved, but a group of systems that work on daily bars generally need about 15 to 30 minutes of your time per day and about 2 hours during the weekend to prepare for the new week. This is assuming you stop the development work and only run those systems.

Can I just get your systems and start trading them?

We do not recommend it. Numerous studies and trials have shown that traders can trade the system they have developed themselves better than someone else’s system. It is theoretically possible, but you will likely find that your psychology gets in the way of proper execution of systems developed by someone else and ruins the system’s edge due to all kinds of mistakes.

Is there a money back guarantee?

Yes, if you complete your assignments and finish and submit your project and are still unsuccessful in generating consistent returns, we will refund your tuition. If you do not complete the program or do not finish your projects, you do not qualify for our money back guarantee. There is also no trial period. You know this is right for you if you are ready. This guarantee does not cover human factors of trading. If, for example, you develop a valid system and for emotional or psychological reasons cannot trade it well, we can’t help you since we are not psychologists, we are technical traders. This case is not covered by the money back guarantee because the work product of the course was achieved.

Why is systematic trading important?

It is the “one thing” that makes the difference between consistent long-term success and inconsistent results. It is the skillset that enables the trader to reduce their chance of ruin to an infinitesimally small value (practically almost zero) while maximizing the return on their edge. Most traders do not understand this concept and even when they do, they do not know how to implement it.

Bonus support videos

When I was getting started, I wanted to have an opportunity to take a look under the hood. I think you might feel the same, so I made these videos to show you exactly that.

In the first one (Systematic Mindset) I talk about a business-like and systems-driven approach to organizing your trading and show examples of my work in support of this approach.

The second video (Behind the Scenes) takes you on a tour of researching a concept, recording the results, and how the signals generated by the production-ready computer algorithm we did the research for, looks on a chart.