Market Overview: Nifty 50 Futures

The Nifty 50 futures gave an bear close for the month with disappointed bulls on failed 2nd entry long, bears now much confident after bad follow through after High 2 buy signal bar. Monthly chart gave an downside breakout of a tight bull channel 6 months ago but heading sideways since last 6 months. Weekly charts still in an expanding triangle, but now giving a possible formation of broad bear channel.

Nifty 50 futures

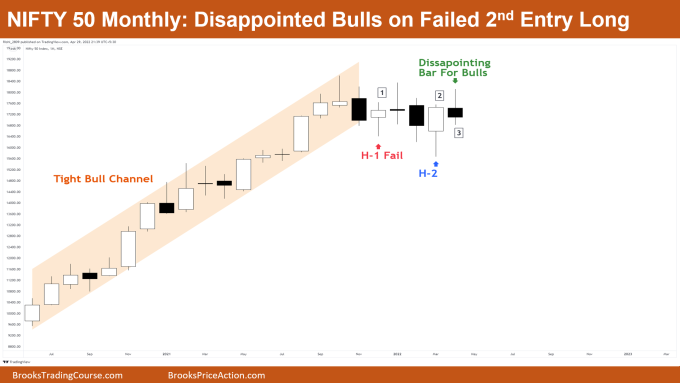

The Monthly Nifty 50 chart

- General Discussion

- Nifty 50 was in a strong uptrend and now finally takes a halt (going sideways).

- Given a bear close this month which suggests that possible short bear trend may be seen on lower time frame charts (5min/15min…) if the Nifty 50 breaks below the low of bar 3.

- My bias for the next week would be bearish below bar 3 Low as disappointed bulls on failed 2nd entry long would exit below bar 3 (ie any bearish trades taken on 5min chart would have higher probability of success).

- Deeper into the price action

- As we know the market cycle (Trends ➠ Channels ➠ Trading Ranges), here market has a breakout from a strong trend, that means that there are higher chances that this bear leg would just result in a bull flag.

- Also, we are clearly able to see too many tails in the bars, which clearly means that bulls are buying at prior lows and making money.

- Similarly, bears are selling prior highs and making money. This is a limit order market where bulls and bears enter the market with limit orders.

- Stop order market is generally a trending market (see tight bull channel), that is when the bulls place their buy orders at high’s of bars rather then below bars, and bears place their sell orders at low’s of bars.

- Patterns

- Breakout from tight bull channel seen on the monthly chart, whenever you see breakdown of a tight bull channel, do not be eager to sell as there are very high chances that market may resume its trend after trapping traders on a 2nd entry short.

- Bar 3 is also a 2nd entry short, but you always have to be skeptical when shorting in a strong bull trend, as chances of losing are much higher.

- Pro Tip

- Don’t restrict yourself as a trader to take one fixed risk-reward entry only… example many traders say I always take 1:1 / 1:2 and so on.

- That is wrong, you have to change your risk-reward based on market structure.

- Example: If you trade bar 3 as a 2nd entry short, then this would be low probability so plan for a high risk-reward, that may be 1:2 or 1:3 even 1:4.

- Example: If you are trading a strong trend, and got High 1 then you can reduce your risk to reward to 1:1, because your probability of winning is higher in this case.

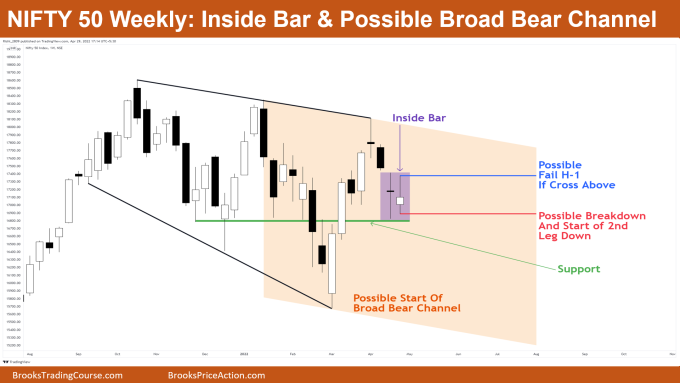

The Weekly Nifty 50 chart

- General Discussion

- Nifty 50 still in an expanding triangle, but now higher possibility of transition to a broad bear channel.

- Market is near the prior support level, and gave a weak bull close this week.

- Market at 50% level of the last bull leg which makes the current support level to be really strong.

- Deeper into price action

- Market generally likes to move in two legs (that is two legs up / two legs down), similarly this inside bar formation could be the end of the first leg and any break below it can result in the 2nd leg down.

- We talked about limit order and stop order markets earlier, currently the weekly chart is in a limit order market.

- Which generally states that market is not at all in a breakout / trending phase, but market may be in a broad channel phase or trading range phase

- Patterns

- Market forming bull inside bar near strong support. The bull close of the inside bar is generally not considered a strong signal bar for the bears.

- Always remember shorting on bear bar and buying on bull bar would always improve your probability of success for that particular trade.

- Currently Nifty 50 is near a prior congestion zone which means that any breakout up or down always would come with a lower probability of success. I recommend that any trade should be taken with a higher Risk:Reward (as discussed above).

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.