Market Overview: Nifty 50 Futures

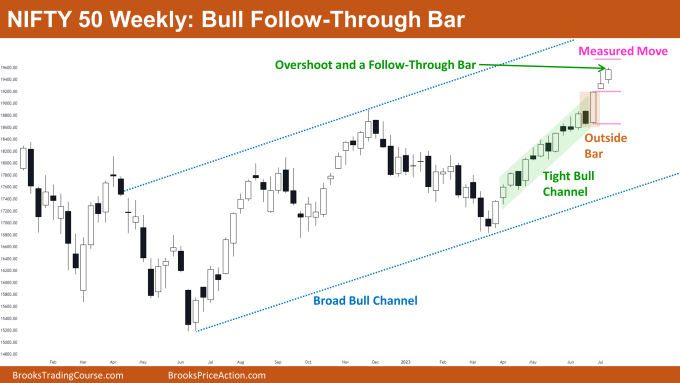

Nifty 50 Bull Follow-Through Bar on the weekly chart. After the formation of the strong outside bar, the market gave a reasonably strong close this week to carry on the upward trend. On the weekly chart, the Nifty 50 is trading inside a big bull channel. On the daily chart, the market reached the wedge overshoot measured move target this week and is currently trading within a bull channel. Bulls can look to buy on pullbacks (can enter on high-1 or high-2 entries) and bears should hold off selling as the market hasn’t recently formed any strong bear bars on the daily chart.

Nifty 50 futures

The Weekly Nifty 50 chart

- General Discussion

- With a strong bull close this week, the market has continued its strong bull leg, and there are good chances that it will eventually reach the outside bar measured move target.

- Therefore, bears should refrain from shorting the market.

- Because the market is currently trading inside of a broad bull channel, there is a chance that the price will increase and bulls can look to buy and aim for the channel’s high.

- Deeper into the price action

- Clearly, the market also overshot the tight bull channel, which may point to a different target for a measured move.

- After the overshoot, the market formed its third straight bull bar this week, which may encourage more bulls to start long positions.

- Bulls who are already long should keep holding their positions until the market forms a strong reversal bar or reaches the high of the broad bull channel.

- Patterns

- Because the market made yet another higher high, the broad bull channel is now confirmed to be valid, allowing traders to plan their trades accordingly.

- Following a series of small bull bars, the outside bar was a relatively large bull breakout bar, which prompted the measured move above based on the bull bar’s body (illustrated using pink colour).

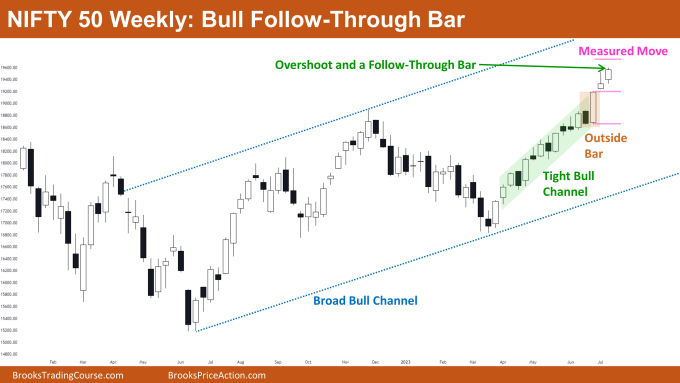

The Daily Nifty 50 chart

- General Discussion

- Because the market is currently trading close to the bull channel’s high, a slight pullback may be seen.

- The market may present a good opportunity for the bulls to enter this trade if there isn’t a pullback accompanied by strong bear bars.

- Some bears decided to sell on a bear bar and aim for a small profit as the market reached the peak of the bull channel.

- It is very difficult to sell in a strong bull channel like the one shown above because the trader must manage the trade properly to maintain a positive traders equation over the long term in these types of entries.

- Deeper into price action

- The bears attempted to form a small double top after the market overshot the measured move target, but they were unsuccessful in doing so.

- The market formed numerous bull gaps, and these bull gaps can result in a measuring gap measured move, so the most recent bull leg in this bull channel is very strong.

- Patterns

- traders should only concentrate on buying and not selling because the market is currently trading inside of a strong bull channel.

- The market has been trading in a narrow range this week; consequently, the market may break out on either side next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.