Market Overview: NASDAQ 100 Emini Futures

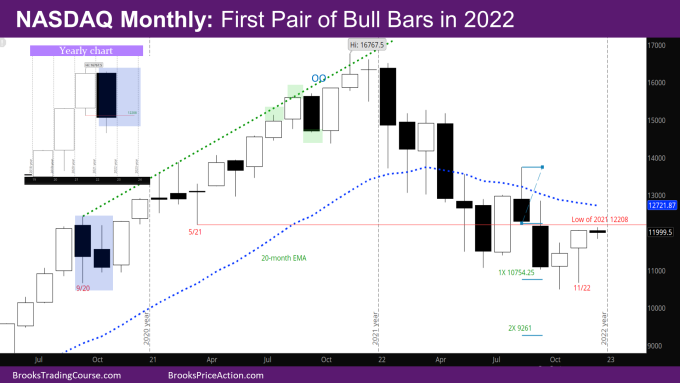

The November monthly NASDAQ Emini futures candlestick is a bull bar closing on its high although with a big tail below. This is also the first pair of monthly bull bars in 2022. It’s as good an entry bar as bulls could hope for after the big bear week in the 1st week of November. If not for the big bull day on the last day of the month, the month would have ended a bear doji bar.

The bulls need a good follow-through bar this month. There are bull targets above – the low of 2021 at 12208 and the monthly exponential moving average (EMA) around 12720. Likely the year will end somewhere in between, and December may be trading range bar again, this time at the top of the bar as bears will sell near the EMA.

NASDAQ 100 Emini futures

The Monthly NASDAQ chart

- This month’s candlestick is a bull bar with a big tail at the bottom.

- As expected, the market triggered the signal bar last month. Now the question is where the sellers come in – likely near the monthly EMA

- Possible bull targets –

- The year is still a big bear bar with a small tail below. The bulls would like to put a big tail at the bottom of the year. Minimally they would like to close above the low of last year at 12208.

- Monthly EMA around 12720.

- Possible bear targets –

- The August monthly bar was a credible Low 1 Sell Signal bar. Assuming a 40% chance of success, a 2X target based on size of the August bar would be at 9261. The market has already made the 1X target.

- The August monthly bar as a double-top (DT) bear flag with May high, with the neckline around July low, and a measured move (MM) down would be between 9000-9200.

- Since both October and November are bull bars, the bears will likely wait to sell higher. They will try for a Low 2 Sell signal at the monthly EMA in the next couple of months.

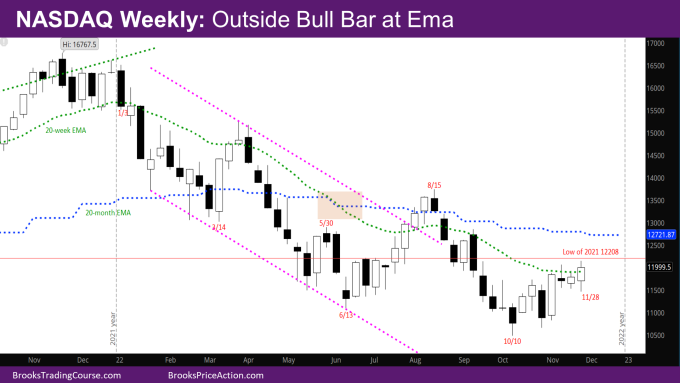

The Weekly NASDAQ chart

- This week’s candlestick is an outside bull bar at the weekly EMA with tails at the top and bottom.

- The market has tried going down twice in the last two weeks and reversed – last week triggered the sell-signal bar from two weeks ago and reversed. This week went below last week and reversed.

- The bears will try to sell next week, and it will likely be an inside week.

- If next week is a bull bar or a bear bar with a big tail below, it will signify higher prices for the next few weeks.

- As it stands there are bull targets above and the bears will likely wait to sell higher.

- One problem for the bulls still is that the signal bar from the week of 10/10 is a bear bar like back in June.

- This is still possibly a minor reversal from the October low and bulls will need a good entry bar in the next month or two around the bar from the week of 10/10.

- As mentioned above, the low of last year at 12208 will be a magnet for the rest of the month. The bulls want to close the year above the low of last year, while the bears want a close far below the low.

- Given how strong a bull bar last year was, it’s more likely this year will close around 12208 or above than far below it.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.