Market Overview: FTSE 100 Futures

The FTSE futures market increased last month, setting up a strong second entry buy. The bulls found support at the moving averages (MA.) The bulls see 2 legs sideways to down before trend resumption and a good buy signal. The bears see consecutive bear bars and a second entry short, so perhaps sellers above.

FTSE 100 Futures

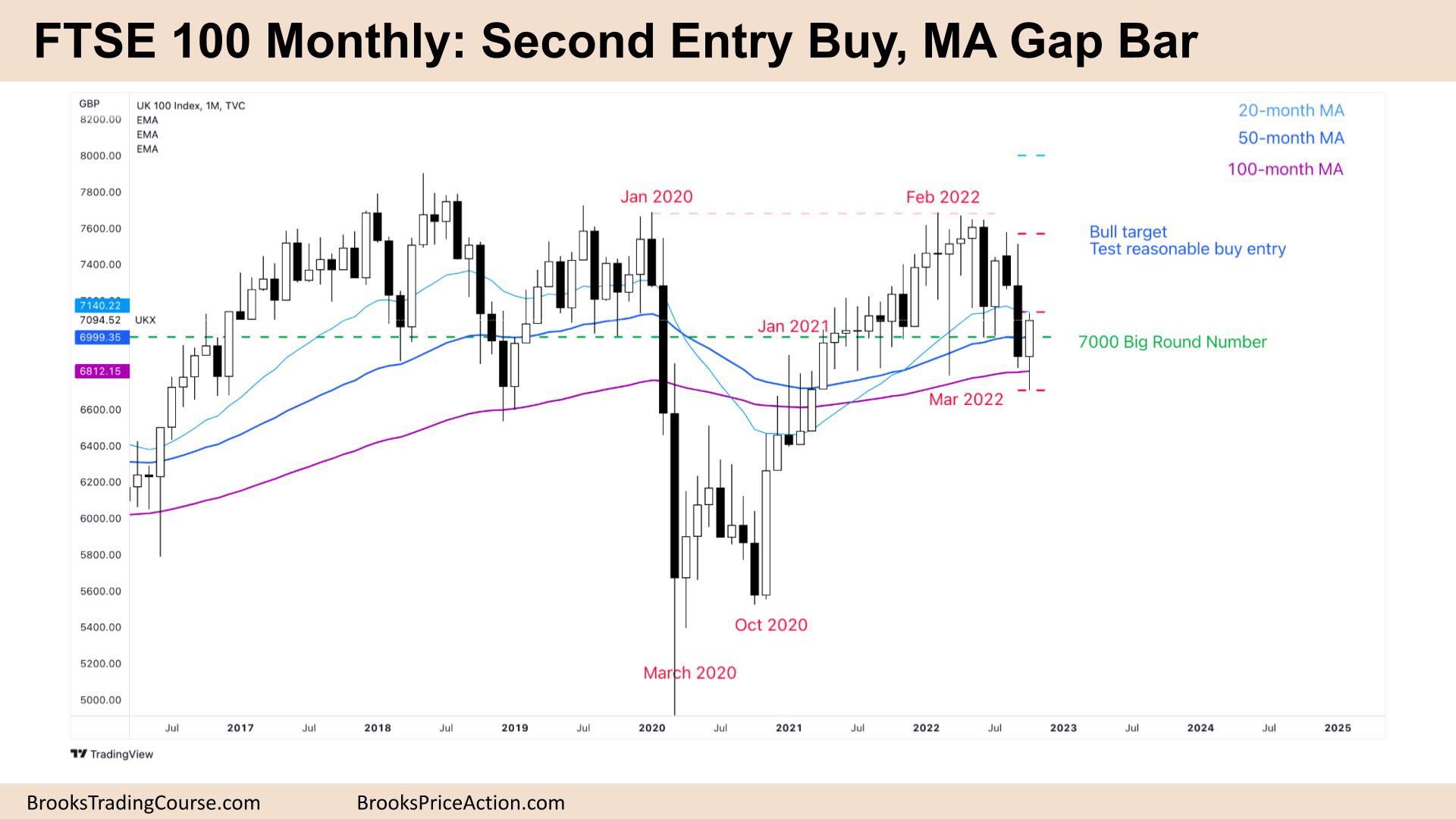

The Monthly FTSE chart

- The FTSE 100 futures last month was a bull bar closing on its high so that we might gap up.

- It is a second entry buy, so reasonable for always in traders to get long.

- The bulls see two legs sideways to down after a long bull trend. It is a moving average gap bar buy setup with a target back to the high of the first bull bar above.

- The bears see two legs sideways to down as a trading range and a second entry short, hence the bear bar the month before. Because it was surprisingly large, some traders expect a second leg down.

- The bulls want a High 2 buy setup above this month for a test up to the highs of the range.

- The bears want a pullback and another sell signal after the Low 2. Some bears might consider it always in short, but the moving average is too low to sell so they might look to scale in above September high.

- We have been sideways for many months and will probably disappoint both traders, with the 7000 big round number below as a magnet.

- The bulls have not had many stop-entry buys or swing trades on the monthly chart – or at least trades easy to hold long. A second entry buy is a higher probability trade.

- The bears have started to get better sell setups but are now low in the range.

- It is reasonable to be short or long here, so I suspect most traders will scalp, and we will go sideways to up.

- If bulls get the measured move, look to sell above. If bears get a move down, look to buy below and scale in trading back to reasonable first entries.

- Next month expect higher on the High 2 buy, then a sell-off.

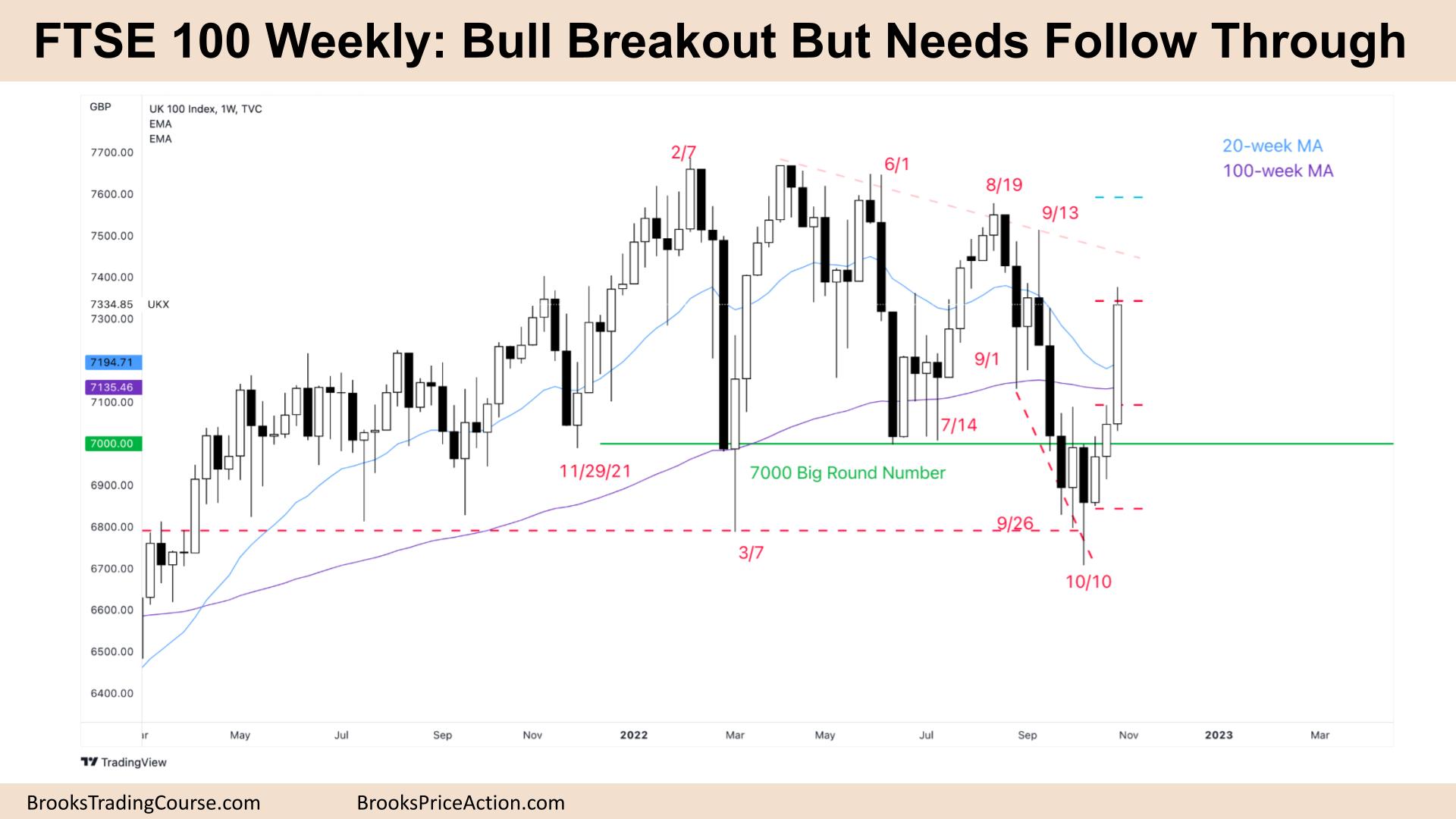

The Weekly FTSE chart

- The FTSE 100 futures last week was a bull breakout bar, so we might have a gap on Monday.

- It is the third consecutive bull bar, so we are always in long, and most traders will expect a second leg up. It was also a second entry buy setup on the monthly chart, so reasonable to stay long.

- The bulls see a spike and want a channel up, but high in a trading range, so there might be more sellers above.

- It is a 4-bar micro channel so we might find buyers at 50% of this week or below any bar.

- Bulls saw a parabolic wedge down, 3 pushes and wanted a second entry to buy, a High 2, and they took it. They quickly reached their measured move.

- Bulls want a small follow-through bar to reduce their risk to keep buying. And they might get it.

- Next week expect a doji as we see if bulls can get follow-through, it might be too big to risk to buy above.

- The bears see a lower high pullback from high up in a trading range or broad bear channel. They have successfully created lower highs for many months and are forcing bulls to give up earlier.

- The bears want a second leg trap, forcing weak bulls to buy too high and then a breakdown lower. They might expect a second push-up and look to scale in above a doji back, or any bar with a tail, or sell a good weekly bear bar.

- Trading ranges constantly disappoint traders so that it could be another follow-through bar and a reversal or inside bar next week.

- Big bars are a big risk so trade small.

- If you had to be in, better to be long or flat. Bulls take partials and get out below a good bear bar. Most short sellers should be waiting for more information.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.