Market Overview: FTSE 100 Futures

FTSE 100 futures moved higher last week after a dip down with an outside up bar closing on its high. Swing bulls are still in their longs and have been buying the 200 MA as support. The top third of a trading range, so we will see next week if bears step in. The bulls need one more bar to seal it.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures moved higher last week after a dip down with an outside up bar closing on its high.

- The bulls see a broad bull channel, a higher low in October and a higher high in December.

- The bulls are still on the swing buy from the double bottom or any buy at the 200 MA.

- The bears see a failed breakout above a DT, a possible wedge bear flag in the top third of a trading range.

- My only problem with this view is the bears would have been stopped out of their shorts in December.

- Only new bears could have faded the trading range. Most will give up after 2 strong bull closes. We have just had the second.

- They had a bear microchannel and a second leg down, which is likely finished.

- We are either in breakout mode or long.

- We are probably always in long, so it is better to be long or flat.

- Some bulls want to see a second consecutive bullbar above the MA. Other bulls are looking to buy only below bars until it is clear.

- The bears see an outside up bar, so there is a lower probability buy signal. They wanted a second leg and got it. They probably have one more chance here, or they will give up.

- The bulls want a measured move up above the December high. They see the bears as having given up already.

- There is also a small open gap above, which is probably the next target.

- Expect sideways to up next week.

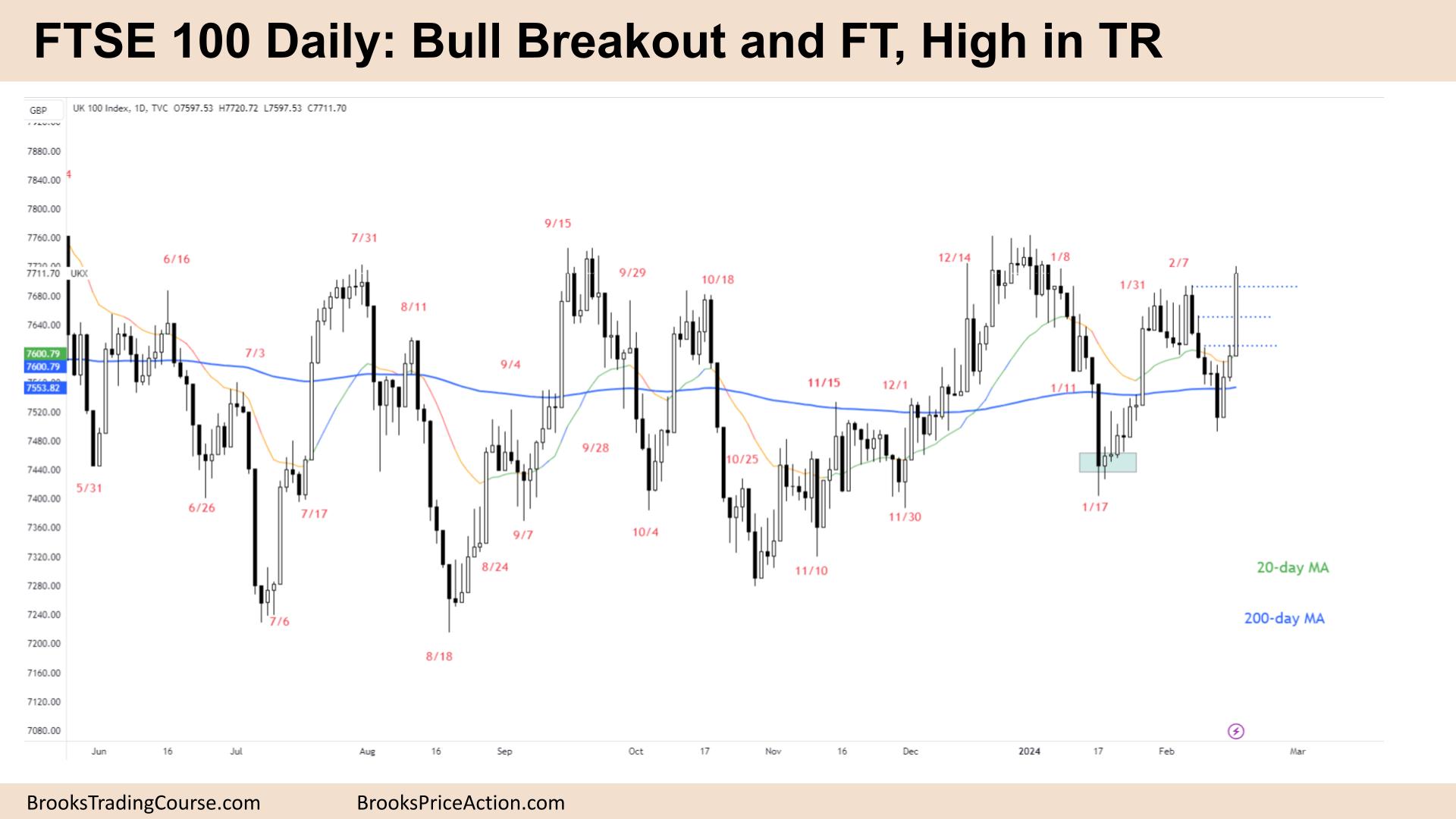

The Daily FTSE chart

- The FTSE 100 futures moved higher on Friday, with 3 consecutive bull bars closing on or near their highs.

- Bulls see a strong breakout and follow-through, as we exceeded the previous February high.

- Bears see we are still in a trading range, and they are yet to get stopped out of their shorts from January.

- But I suspect 3 strong bull closes will mean the bears won’t let that stop get hit.

- New bears might fade a second entry above the TR, betting on an expanding triangle. But this move is strong.

- Traders should be long or flat.

- Next week, expect sideways to up. We might need to test the bear microchannel fade areas above the bars to the left.

- The pain trade will be if we don’t come back to those entries. Bears will have to give up higher, causing a stronger breakout.

- The bulls want a small bull follow-through bar after such a bull surprise. The bar is climactic and will probably result in profit-taking.

- The bulls must test the breakout point but not close bear bars back into that range.

- Disappointing would be a two-bar reversal here.

- The bears see a trading range and know that disappointment will be common.

- Higher time frames support the bulls.

- So in a trading range like this, not only should traders BLSHS, but select the higher probability side (55%) and stick to entering in that direction. That will prevent a massive loss on the breakout.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.