Market Overview: FTSE 100 Futures

The FTSE 100 futures went always in long last month with consecutive bull bars closing above the moving average. We left the wedge bottom and broke to the upside, so most bears got out of the way. It is a trading range, so most gaps should close, and pullbacks can be deep.

FTSE 100 Futures

The Monthly FTSE chart

- The FTSE 100 futures chart last month had a bull bar closing near its high, so we should go above it.

- It is the second consecutive bull bar closing above the moving average so likely always in long.

- The bulls saw a bull channel since the COVID crash, and we had a three-legged pullback to the moving average before a buy signal. A bull flag breakout and pullback long.

- The bears see a trading range and the market had trouble going above the pre-COVID highs. They saw a double top but got a weak signal down – a big bear bar closing at the moving average.

- The bears never got a good sell and tried to sell higher, but if they did, they are stuck.

- We should dip below the high of the prior ATH to let those bears out. They took a reasonable scalp. If they don’t get let out and the gap stays open, we should go higher for a larger measured move.

- The protective stop for the bulls is below that bear doji.

- It’s a trading range, so we should have overlapping bars next month, even if it is another bull bar.

- This is because the bears can argue that there are no open gaps. So, it is more like a trending trading range or late-stage channel. Bears will continue to fade highs until they get stuck.

- it is better to be long or flat.

- Expect sideways to up next month.

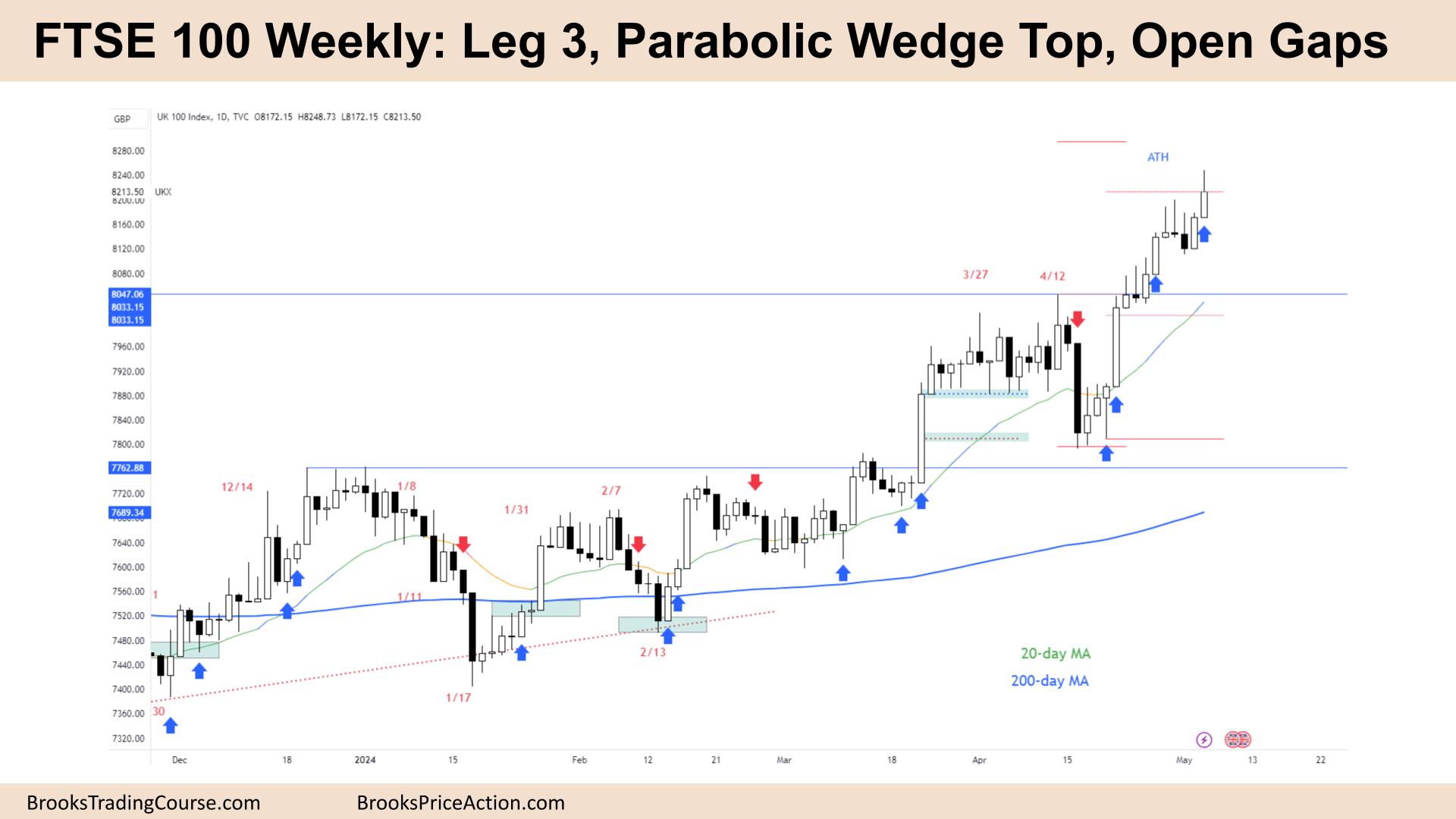

The Weekly FTSE chart

- The FTSE 100 futures last week was a bull bar closing on its midpoint.

- It was an attempt at a double top by the bears.

- It closed at the first measured move target from the earlier breakout. There is one more target above.

- The bulls see three legs up, a parabolic wedge top, so we should soon see a pullback with at least two legs sideways.

- But it is a tight channel, and there are open gaps below, so there is nothing for bears to sell.

- The bears saw a wedge top that triggered, but we went above it. So it is a breakout above a double top, and if they didn’t take the loss, they are scaling in two times that range above.

- The protective stop is far away, so it is better to wait for two legs sideways before looking to buy again. Traders could look for a High 2 buy above a good bull bar near the moving average.

- Can you sell here? No. There are consecutive bull bars again, so a sell here is a low-probability trade.

- Look at the upper tails above the bars. It shows the bears trying to fade the breakout, and they might be trapped. it also means to trade it like a channel and look to add on lower.

- The bears had a sell signal but it never triggered. There is a chance we get a measured-move up again from this gap, so better to belong or flat.

- We also triggered another buy signal on the monthly, so the first reversal is likely to be minor.

- Always in long so expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.