Market Overview: EURUSD Forex

EURUSD pullback after bull micro channel finally formed on the weekly chart after 7 bars. As stated during the prior report, odds favored buyers below the first pullback below such a strong bull micro channel. The bulls think that the bullish inertia is strong enough to close the gap between the price and the 2022 high. The bears hope that the move up is simply a buy vacuum test of the February 2 trading range high. The bears would wait for a strong break of the minor bull trend line and retest the leg extreme high, forming a major trend reversal, before looking for a credible short.

EURUSD Forex market

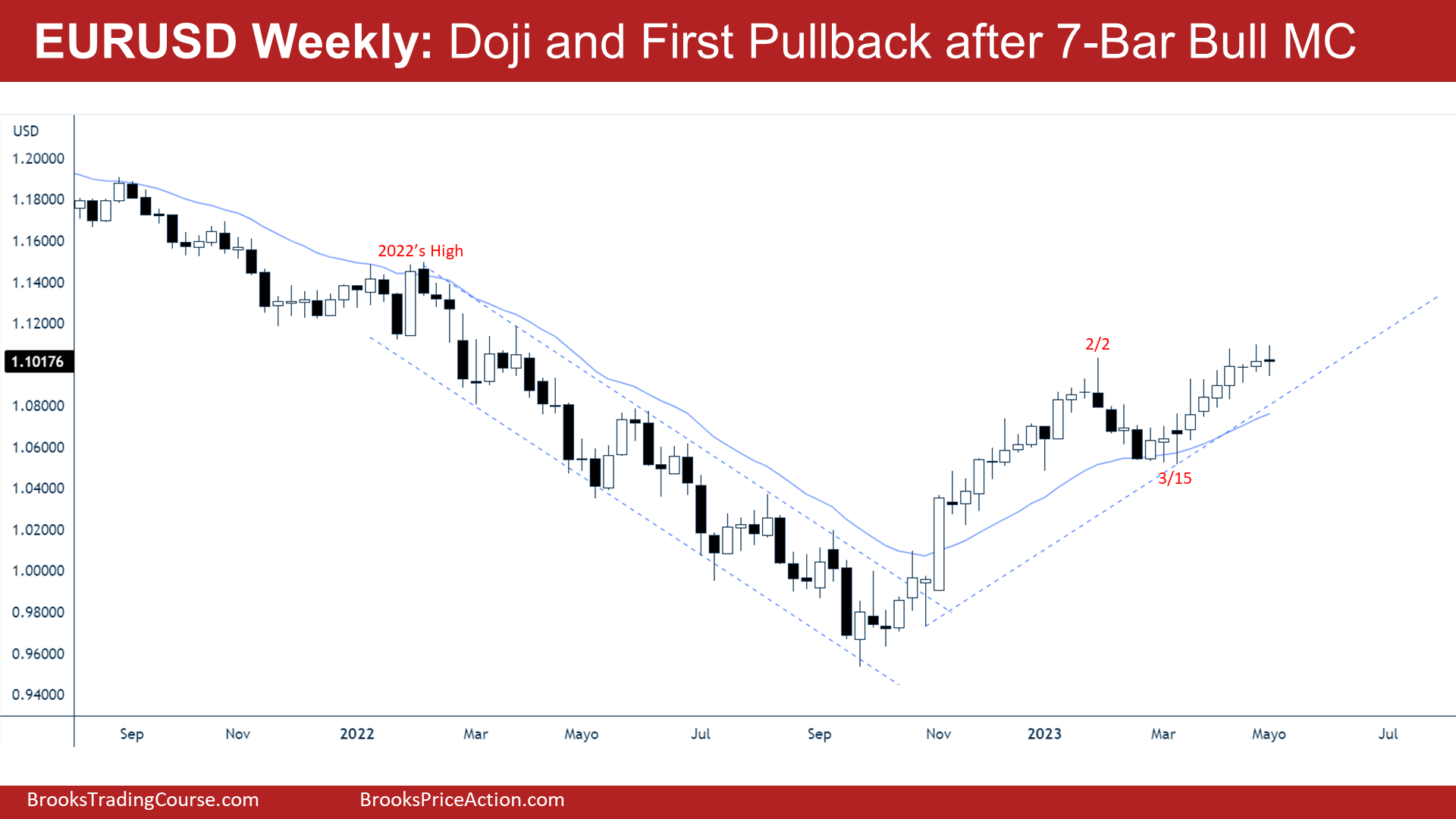

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bear doji with a long tail at both ends.

- The move up since March 15 is in a tight bull channel and the bulls have a 7-bar EURUSD bull micro channel. That means strong bulls.

- As we have said during the prior report, the first pullback below such a strong bull micro channel often has buyers below, as happened during the week.

- The bulls want a strong breakout above February 2 high and another strong leg up, possibly retesting February 2022 highs.

- For that, they need to create follow-through buying breaking far above the February 2 high.

- The current move up is strong enough for traders to expect at least a small second leg sideways to up after a pullback.

- The bears want a reversal down from a higher high major trend reversal.

- They see a wedge and a micro double top.

- They want a failed breakout above the February 2 high and a retest of the March 15 low.

- The bears hope that the strong move up is simply a buy vacuum retest of the February 2 high.

- The problem with the bear’s case is that the current move-up is in a tight bull channel and they have not been able to create any strong bear bars.

- Past week formed a micro double top and was a sell signal bar for next week, but was not a good sell setup since it was following a tight 7-bar bull micro channel, this is why bears failed this week.

- The bears would wait for a strong break of the minor bull trend line and retest the leg extreme high, forming a major trend reversal before looking for a credible short. A Low 2 has a better probability of leading to at least a scalp profit.

- The wedge and micro double top increase the odds that we may see a minor pullback begin at any moment.

- Odds will continue to slightly favor sideways to up, until the bears can create credible selling pressure (consecutive bear bars closing near their lows with follow-through selling).

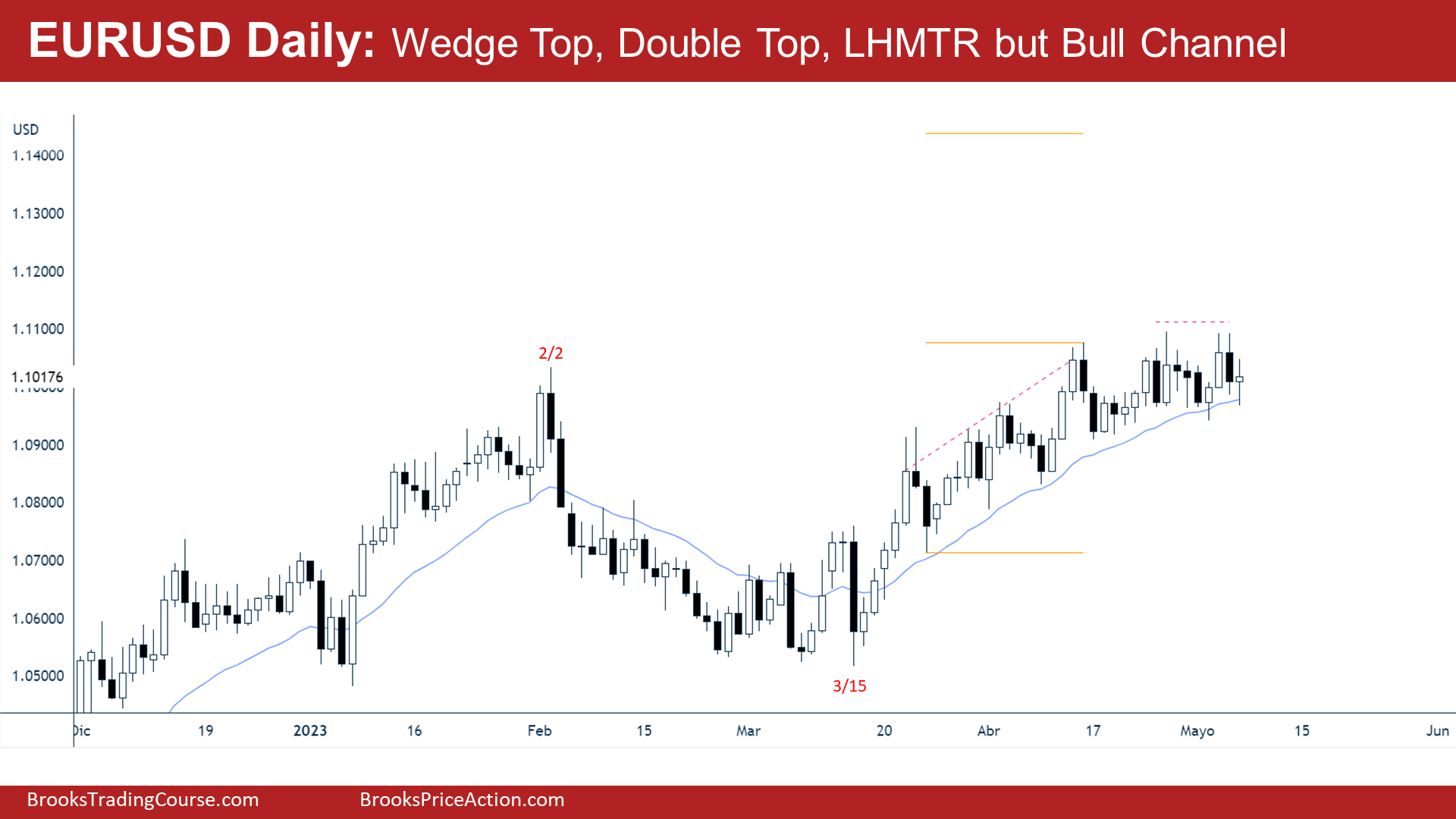

The Daily EURUSD chart

- The EURUSD created a double top lower high during the week.

- On Friday, the price triggered a Low 2 sell setup, but the follow through was bad.

- The bears wanted a reversal down from a wedge top and a double top lower high major trend reversal.

- The main problem with the bear’s case is that they have not been able to close below the 20-day Exponential Moving Average or create sustained follow-through selling since March 15.

- The bears need to create consecutive bear bars closing near their lows if they want to stop the bull channel.

- The move-up was in a tight bull channel. That means the bulls were strong.

- Bulls see a double bottom higher low at the 20-day exponential moving average, but Friday is a doji, so it is not a strong bull signal.

- They want a breakout above the February 2 high and another strong leg up.

- They want a measured move up based upon the high of the wedge top, a bet for a failed wedge top. 80% of wedge tops fail during tight bull channels.

- But the concern for the bulls is that they are failing to get bull closes above the wedge top, which means that the price might need to go down further to find buyers.

- Furthermore, the more trading range price action, the less probability of a bull trend continuation.

- Until the bears and bulls can create strong consecutive bars going their way, odds continue to favor sideways to up trading.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.