Market Overview: EURUSD Forex

EURUSD big bear bar retested the July closing near the low on the weekly chart. Bears want a strong breakout below the July low followed by a measured move down. They will need to create a follow-through bear bar next week to increase the odds of a breakout attempt below the July low.

Bulls hope that the recent 4-week tight trading range pullback is the final flag of the move down which started in February 2022. They want a reversal higher from a double bottom major trend reversal with July low and a potential final flag.

EURUSD Forex market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a big bear bar closing near the low.

- Last week, we said that the EURUSD may still be in the sideways to up pullback phase. If the current pullback remains sideways, odds are the bears will return to re-test July.

- This week, the bears return and the EURUSD is re-testing the July low.

- The bears want a strong breakout below the 2017 low, and a measured move down based on the height of the 7-year trading range. This will take them to the year 2000 low.

- They got 2 bear bars closing below the 2017 low during the breakout in July, increasing the odds of a breakout and a measured move down.

- The move down is in a tight bear channel. That means strong bears. Odds slightly favor the EURUSD trading lower after the current pullback. It should have started this week.

- The bulls hope that the recent 4-week tight trading range pullback is the final flag of the move down which started in February 2022.

- They want a failed breakout below the 7-year trading range and a reversal higher from a double bottom major trend reversal with July low and a potential final flag.

- However, the bulls have repeatedly failed to create strong follow-through buying since the sell-off started in 2021. They failed to create a follow-through bull bar yet again this week.

- We have said that if the current pullback remains sideways, odds are the bears will return to re-test July.

- Since this week was a bear bar closing near the low, it is a good sell signal bar for next week.

- The bears will need to create a bear follow-through bar next week to increase the odds of a breakout attempt below the July low.

- For now, the EURUSD slightly favor sideways to down to test the July low.

- Traders will see if the bears manage to create follow-through selling or if next week trades lower but reverses to close as a bull bar.

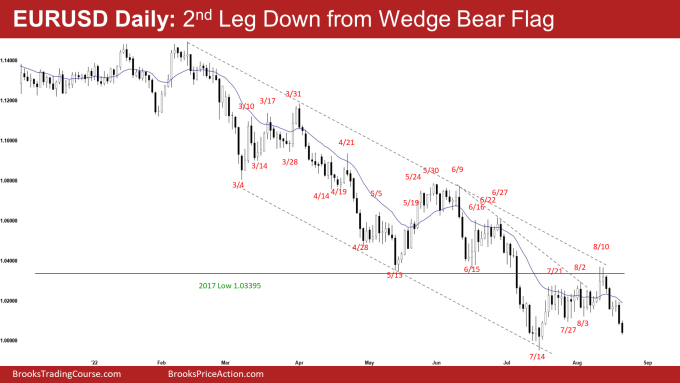

The Daily EURUSD chart

- The EURUSD broke below the 20-day exponential moving average on Monday and below the 4-week tight trading range on Thursday. The bears then got follow-through selling on Friday.

- Last week, we said that the EURUSD may still be in the sideways to up pullback phase. Odds slightly favor the EURUSD to re-test the July low after the pullback is over.

- It looks like the pullback has ended this week.

- The bulls want a failed breakout below the 7-year trading range.

- They hope that the current 4-week tight trading range is the final flag of the move down which started in February.

- The bulls want a reversal higher from a double bottom major trend reversal with the July low.

- However, they have not been able to create strong consecutive bull bars closing near their highs.

- The bear trend line is resistance above.

- The bears want a continuation down and a measured move down based on the height of the 7-year trading range. That would take them to the year 2000 low.

- They see the current move as a wedge bear flag (July 21, Aug 2 and Aug 10) and want a second leg sideways to down re-testing July low followed by a breakout and a measured move down.

- The second leg sideways to down following June/July sell-off should have started this week.

- For now, odds slightly favor sideways to down to test the July low.

- Traders will see if the bears can create consecutive bear bars breaking below the July low, or if the EURUSD stalls around the July low and reverses higher.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.