Monthly S&P500 Emini futures candlestick chart: Double top after buy climax

The monthly S&P500 Emini futures candlestick chart is in breakout mode with both a double top and a double bottom after a buy climax.

The monthly S&P500 Emini futures candlestick chart has a lot of price action left to the month and it is too early to speculate how the month will end. This is a chance to learn how to trade the markets for a living when more trading range price action is likely. The 38 month buy climax was extreme, and that increases the chances that the pullback from the top will be bigger than just the 14% that we saw at the September low. The bull trend line is rising quickly and is close enough so that the chart is within its magnetic field. At some point, the low of a bar can get so close that the chart can no longer resist the pull. Then, the Emini falls to the trend line.

It can reverse up from just above or below it, or it can break strongly below it. If it breaks below it, the next support is the March 2000 high of 1610.75. That formed a double top with the 2007 high, and the strong bull breakout of 2013 has yet to test the breakout point. Below that is a measured move target around 1500, based on the height of the double top. At the moment, there is about a 55% chance of a test of the bear trend line before a new all-time high, and about a 30% chance of a selloff down to the 1500 measured move target.

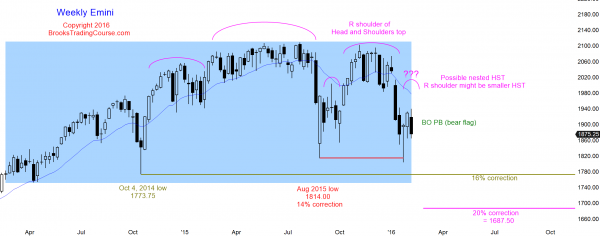

Weekly S&P500 Emini futures candlestick chart: Those who trade the markets for a living believe more trading range likely

The weekly S&P500 Emini futures candlestick chart is at the bottom of a trading range. The bears see the 3 week rally as a pullback from the bear breakout below the August low, and the bulls see it as a failed bear breakout and the start of a reversal up.

The weekly S&P500 Emini futures candlestick chart reversed up 3 weeks ago from a small breakout below last year’s low. The two big bear trend bars in January made it likely that the reversal up would be sold. If the bulls can hold the Emini above the January low, they might be able to test the moving average and then the all-time high. At the moment, the bounce is more likely a bear flag that will be followed by a breakout below the January low, or at least a test down to near that low.

The January breakout below last year’s low was small and it reversed up sharply. This is not how strong breakouts typically behave, and it reduces the chances that the breakout will ultimately succeed. At the moment, there is about a 55% chance that the Emini will breakout again to a new low. If it does, it might then break below the August 2014 low. The bears will then look for a measured move down of about 300 points, based on the height of the trading range. Because the reversal up and follow-through 2 weeks ago were strong, the Emini might have to go sideways for a few more bars (weeks) before it begins its next move up or down.

Daily S&P500 Emini futures candlestick chart: Bear rally failed at a 50% pullback

The daily S&P500 Emini futures candlestick chart reversed down sharply this week at the 50% retracement of the January selloff.

The daily S&P500 Emini futures candlestick chart had an extreme selloff below the August bear trend low. The Emini fell in a parabolic wedge. When there is an extreme sell climax like that, there is a 70% chance of at least a TBTL Ten Bar Two Leg rally. The rally up to this week’s high had two legs, but the channel up was tight. When that is the case, the two legged rally is more often just the 1st leg up in a more complex correction. The odds still favor one more leg up after the current selloff ends.

This week’s rally reversed down sharply after going only a couple of ticks above the 50% retracement level from the January selloff. When a market reverses down after only a brief test of major resistance, the odds are that there will be another test. This means that, despite the two strong selloffs this week, the odds still favor at least one more test of the 1940 level. The selloff tested the January 27 micro double bottom, and Friday might have formed a micro double bottom with Wednesday’s low. That is now 4 tests of the 1865 area, which so far is being support. It does not matter if the Emini reverses up from here or 1st breaks below this 2 week ledge and then reverses up. The odds of a test up are still 60%.

There is a 40% chance that this week’s high was simply the 2nd leg up of a double top bear flag, where January 13 was the 1st of the two tops. If so, the Emini might sell off relentlessly below the January bear trend low and then fall for a measured move. Since the double top bear flag is about 130 points tall, the target would be around 1680, which is below the monthly bull trend line.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.