Weekend report co-author Andrew A.

Market Overview: Weekend Market Analysis

SP500 Emini rallying to channel top after a brief pullback on Thursday. It is trading just under the 4404 measured move target with the 4500 trend channel line a magnet above. Might transition into trading range for a week or two after the streak of 11 days without a pullback ended this week.

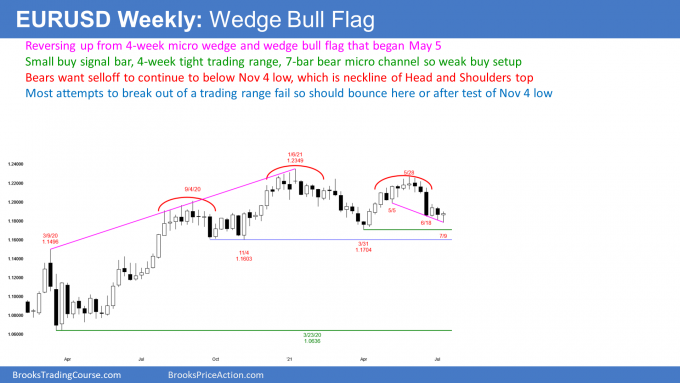

The EURUSD Forex market is reversing up from a wedge bull flag, but there is a 7-bar bear micro channel. Also, it has been in a trading range for 4 weeks and this week is only a small bull doji buy signal bar. This so far is a weak lower low double bottom buy signal bar. If there is a bounce, it might form a small double top bear flag with the June 25th high.

EURUSD Forex market

The EURUSD weekly chart

- The EURUSD market reversed higher this week after testing the neckline of the Head & Shoulders Top, and it closed as a small bull bar with a long tail below.

- The long tail below indicates that there are more buyers than sellers below the prior week’s low.

- There is a wedge bull flag that started on May 5th. This week is the buy signal bar.

- However, it has been in a tight trading range with many overlapping bars for 4 weeks. Also, there is a 7-bar bear microchannel. Therefore, it is a weak bull setup, which makes a minor reversal up more likely than a bull trend.

- If next week trades above this week’s high, the EURUSD could move up to test the June 25th high around 1.1975, potentially forming a double top bear flag.

- Because of the 7-bar bear microchannel, odds are the first bounce will likely be sold.

- The yearlong trading range will likely continue.

- Should the EURUSD break below the Mar 21 and Nov 20 lows, odds are it will reverse back into the trading range again. Most attempts to break out of a trading range fail.

- The bears want a break below the neckline of the Head & Shoulders top. The bigger the breakout bar, the more it closes on its low, and the more bear follow-through bars, the more likely the breakout will lead to a measured move down.

- Until there is a strong and credible breakout from this yearlong trading range, traders will bet on reversals.

S&P500 Emini futures

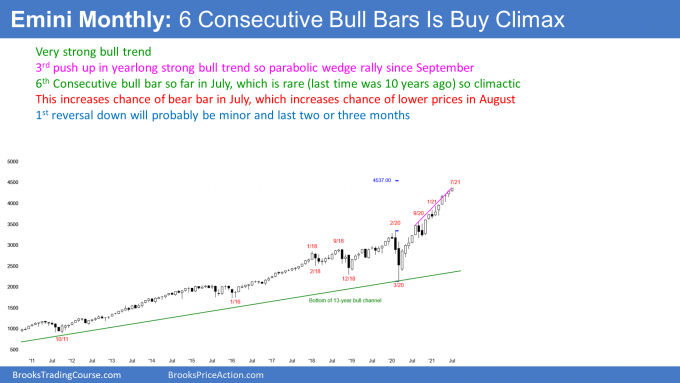

The Monthly Emini chart

- July currently is a small bull bar trading at all-time highs.

- The is a 3rd push up in a tight bull channel since the pandemic lows. The rally therefore is a parabolic wedge buy climax, which often attracts profit takers.

- July is the 6th consecutive bull bar, which is extreme. The last time we had 6 consecutive bull bars was in 2011. This increases the chance that July will close below the open of the month.

- If there is a big bear bar closing near its low, it would increase the chance of 2-3 months of a sideways to down move.

- However, because rally has been in a tight bull channel, bulls will buy the pullback, even if it is 20%.

The Weekly S&P500 Emini futures chart

- The weekly bar was a small bull bar at a new high with a big tail below.

- The tail below indicates bulls bought the test of last week’s low, but the small body indicates a loss of momentum.

- Because the bar closed near its high, next week might gap up. If there is a small gap, it will probably close early in the week because small gaps usually close before the bar closes.

- The top of the trend channel around 4500 is a magnet above.

- The Emini has been in a small pullback trend since the pandemic low. This is a very strong bull trend.

- A small pullback trend ends when there is a bigger pullback. The largest pullback since the trend started was in September, which was 10% and lasted 2 months.

- A small pullback bull trend ends with a big pullback. It would then probably be 10 – 20% and last at least 2 – 3 months.

- Traders should buy the pullback for a test of the highs. The Emini might then either resume the bull trend or reverse down and form a trading range.

- A strong bull trend does not usually turn into a bear trend without first forming a trading range.

- There is a larger measured move up target around 4967 using the pandemic low with the Sept 20 highs. There should be a 15 – 20% pullback before the Emini gets there.

- There is another measured move target around 4654 using the height of the Nov 20 to Feb 21 move.

- If the Emini reaches the top of the trend channel at around 4500, there is a 75% chance of a reversal down to at least the middle of the channel. The reversal down typically begins by the 5th bar with a high above the channel.

- Traders continue to expect higher prices because every potential bear setup has failed.

- Sometimes the bears give up and stop selling. This can lead to an acceleration up. That usually attracts profit taking. When there is a climactic reversal, that last leg up is called a blow-off top.

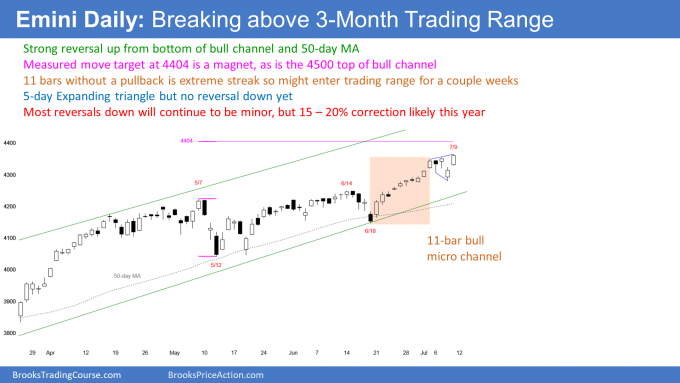

The Daily S&P500 Emini futures chart

- The 11-bar bull micro channel ended this week when Tuesday traded below Monday’s low.

- Bulls typically buy the first pullback in a bull micro channel, which they did here.

- There is a 5-day expanding triangle, but no reversal yet.

- Traders continue to expect higher prices, but there is often a 5- to 10-bar trading range after a buy climax, like a micro channel. Look at the April bull micro channel as an example.

- The measured move at 4404 and the top of the trend channel line around 4500 are magnets above.

- Since the buy climax is extreme, there should be a 15 to 20% correction before the end of the year. However, traders will not believe it until it is already half over.

- The bulls will continue to buy every 1- to 3-day reversal down, betting that each reversal will fail and lead to a new high.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.