Market Overview: Weekend Market Analysis

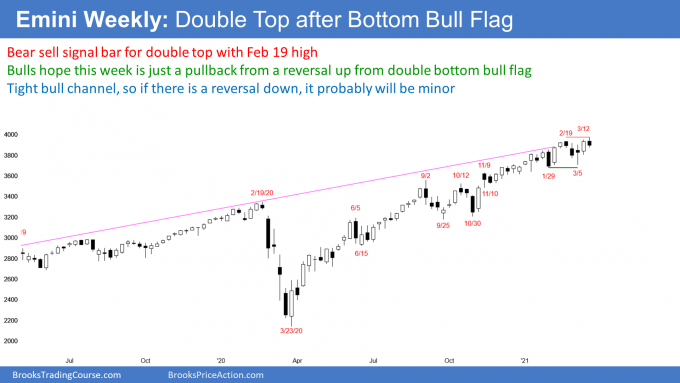

The SP500 Emini futures in strong bull trend on all time frames. However, there is now a sell signal bar for a small minor double top on the weekly chart, just below the 4,000 Big Round Number. Traders expect higher prices, even if there is a 1- to 2-week pullback first.

Bond futures are in extreme sell climax in a support zone so traders expect a profit-taking bounce soon.

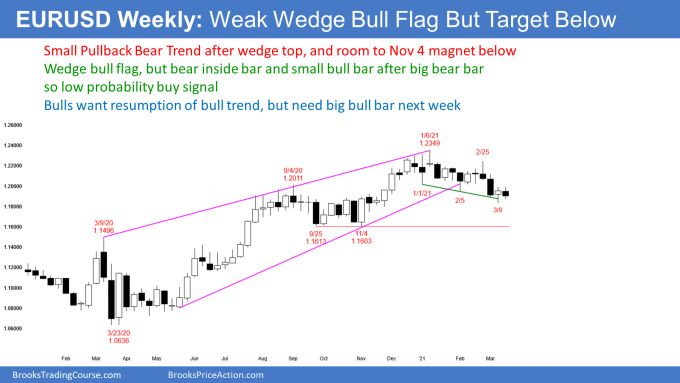

The EURUSD Forex in weak reversal down from last year’s wedge top on the weekly chart. November low at 1.16 is target below.

30-year Treasury Bond futures

The Bond futures weekly chart: Sell climax near support

- Nine consecutive bear bars so traders are still eager to sell. Should reach January 2, 2020 major low this year.

- But this is unusual, and therefore unsustainable and climactic. Stop for bears is far above, and easiest way to reduce risk is to reduce position size.

- Extreme sell climax now near bottom of bear channel, and in late 2019 trading range, so should get profit-taking bounce soon.

- Prior 3 weeks had a lot of overlap, which means hesitation and minor profit taking. Possible small Final Bear Flag.

- 1st reversal up will be minor after 9 consecutive bear bars. That means it will be a bear flag. But because tight bear channel has lasted long time, profit taking could last a couple months, and it will probably have a couple sideways to up legs.

EURUSD Forex market

The EURUSD weekly chart: Small Pullback Bear Trend after wedge top

- Selling off for 3 months after 10-month wedge top. Broke below bull trend line (bottom of wedge bull channel), but the breakout has been more sideways to down instead of strongly down. This is not yet a strong breakout.

- Reversal from wedge top typically tests bottom of final leg up, which is November 4 low around 1.16.

- Selloff is Small Pullback Bear Trend and Endless Pullback from strong 2020 rally. It has had many reversals, and overlapping bars, so probably not a bear trend reversal. More likely protracted pullback from 2020 bull trend.

- Last week was buy signal bar for a wedge bull flag. This week did not go above last week’s high to trigger the buy signal. The setup is weak because this week is a bear bar, and last week was small bull bar following a big bear bar. Also, the 3-month bear channel has been tight.

- Bulls might try again this week to get reversal up, but probably only minor. Could go sideways to up for several weeks, like in February.

- Bulls need consecutive big bull bars to convince traders that 2020 bull trend is resuming.

S&P500 Emini futures

The Monthly Emini chart: Small parabolic wedge top

- Bull bar but small body, and close below February high, so loss of momentum. Traders buying, but less aggressively.

- Eight trading days remaining in March, so plenty of time for bar to look different when month closes.

- Nearby target above is 4,000 Big Round Number.

- If month has big tail on top when it closes, then micro wedge with January and February. It is nested within a parabolic wedge, where the 1st 2 legs up were September and January.

- 13-month tight bull channel so traders will buy 1st 1- to 2-month pullback.

- If reversal down, only 30% chance of 20% correction.

- This is the 4th month of the breakout above the 17-year bull channel. An average breakout above a bull channel has 75% chance of starting reversal down back into the channel within about 5 bars (months). Because 13-month rally is so strong, odds here are 50%.

The Weekly S&P500 Emini futures chart: Small double top

- Bear bar so sell signal bar for minor double top with February 16 high, at top of bull channel.

- 40% chance that a reversal down from this area will test November 10 low at 3500.

- 30% chance that a reversal from this area will test the September/October double bottom at 3,200.

- Bears need big bear entry bar next week, if expecting test of 3,700 bottom of 3-month trading range. More likely, a reversal down will only last a week or two, before the bulls buy again.

- Since 13-month bull channel is tight, the best the bears probably can get is another trading range, like in September and October.

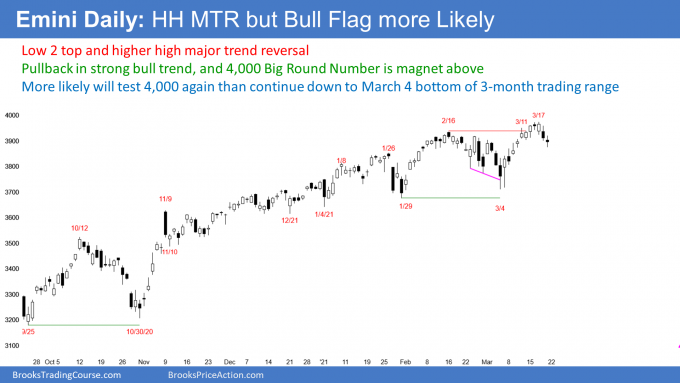

The Daily S&P500 Emini futures chart: Higher high major trend reversal, but likely will become bull flag

- Sideways for 7 days just below 4,000 Big Round Number.

- Bulls want strong breakout above 4,000.

- Bears want reversal down from around 4,000. This 3-day reversal is a higher high major trend reversal.

- Wednesday was the 3rd top in a 5-day micro wedge. That is a wedge top on the 60-minute chart. Thursday reversed down.

- Thursday was a big bear day after a big bull day, with very little overlap of the 2 bodies. This means the bulls who bought during the bull day, are now trapped and it increases the chance of lower prices.

- Bears need consecutive big bear bodies to flip odds, in favor of a selloff, down to bottom of 2021 trading range at 3,700. Without that, traders will continue to buy 1- to 3-day selloffs, expecting another new high.

- Even if bears get 10% correction to bottom of 3-month trading range, a bounce and a continuation of the range is more likely, than a breakout below and a 300-point measured move down.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time (the Emini day session opens at 6:30 am PT, and closes at 1:15 pm PT). You can read background information on the intraday market reports on the Market Update page.