Market Overview: S&P 500 Emini Futures

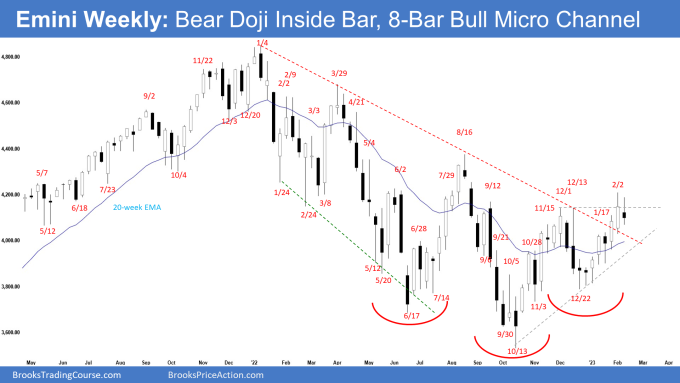

The S&P 500 Emini futures was a bear doji pullback on the weekly chart. The bulls have an 8-bar bull micro channel which may be broken soon. However, the first breakout below such a strong micro channel often is minor. The bears want a reversal lower from a higher high major trend reversal.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an inside bear doji with a prominent tail below.

- Last week, we said that traders will see if the bulls can create follow-through buying following the breakout above the December high, or if the Emini trades stall and reverses lower.

- The bulls did not get follow-through buying this week and the Emini stalled around the December high.

- They got a reversal up from a higher low major trend reversal (Dec 22) and a double bottom bull flag (Nov 3 and Dec 22).

- The bulls then got a larger second leg sideways to up from the rally which started in October 2022.

- They see the last 6 months as forming an inverted head and shoulders, with the December low being the right shoulder.

- However, inverted head and shoulders pattern often ends up as bear flags instead of a reversal pattern.

- The bulls have an 8-bar bull micro channel which means persistent buying.

- They want another strong leg up completing the wedge pattern with the first two legs being January 17 and February 2.

- By breaking above the December high, they hope the bear trend of successively lower highs and lower lows has ended.

- They need to create follow-through buying above December high and August high to signal the end of the selloff.

- The bears see the current move up simply as a continuation of the move which started in October 2022.

- They want a reversal down from a higher high major trend reversal. If the Emini trades higher, they want a reversal lower from a double top bear flag with the August 2022 high.

- Because of the strong move-up, the bears will need a strong reversal bar or a micro double top before they would be willing to sell more aggressively.

- While some traders may view December high as a major lower high, the bears want a break above the August high to be sure of the end of the bear trend.

- Until the bulls can break far above the August high, the broad bear channel may still be in play.

- After the spike and broad channel down from January 2022, the Emini may have transitioned into a trading range phase between 4300 and 3500.

- The move up from October 2022 may simply be a bull leg within a trading range.

- Since this week was an inside bar with a prominent tail below, it is a weaker sell signal bar. It also follows an 8-bar bull micro channel.

- There may be buyers below the first breakout below the bull micro channel.

- While we may see some pullback, odds slightly favor the Emini to still be in the sideways to up phase.

- Traders will see if the bears can get a consecutive bear bar or will the bulls get a retest of the February 2 high within the next few weeks.

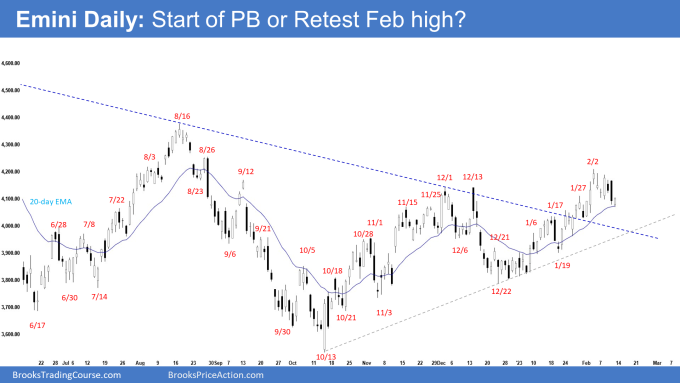

The Daily S&P 500 Emini chart

- The Emini traded sideways to down for the week with Friday being a small bull bar closing near its high above the 20-day exponential moving average.

- Previously, we said that traders will see if the bulls can create a strong breakout above December high or will the Emini trades slightly higher, but stalls and reverses lower around the December high.

- So far, the Emini seems to be stalling around the December high after trading above it.

- The bulls got a larger second leg sideways to up from a double bottom bull flag (Nov 3 and Dec 22) and a higher low major trend reversal.

- They then got a breakout above December high but did not get sustained follow-through buying.

- By trading above the December high, the bulls hope that the broad bear channel has ended, and the market has either transitioned into a trading range or a bull trend.

- The bulls hope that this week was simply a pullback and wants at least another leg higher to retest February 2 high.

- They hope that the 20-day exponential moving average will act as support.

- They need to create strong consecutive bull bars closing near their highs and trading far above the December high and August high, to convince traders that the selloff from January has ended.

- The bears see the move up from October simply as a 2-legged swing up and want a reversal down from a higher high major trend reversal.

- The Emini has 3 pushes up in the current leg therefore a wedge (Jan 6, Jan 17 and Feb 2).

- If the Emini trades slightly higher, the bears want a reversal down from a double top with February 2 high.

- The bears see the selloff from January 2022 as a broad bear channel, even though the Emini has traded slightly above the December high.

- They want the Emini to trade far above the August high to believe the broad bear channel has ended.

- So far, the pullback this week has a lot of overlapping price action. The bears are still not strong.

- The bears need to create consecutive bear bars closing near their lows to increase the odds of lower prices.

- Since Friday was a small bull bar closing near its high, it is a buy signal bar for Monday. It is not a strong sell signal bar.

- Until the bears can create strong consecutive bear bars, odds slightly favor the Emini to still be in the sideways to up phase.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.