Market Overview: Special weekend report about the 2020 selloff

Containment of the coronavirus probably will not work. A vaccine is the realistic solution, but that is many months away. This could be the worst pandemic since the 1918 flu, which killed 50 million people.

The Emini sold off strongly this week. Traders should expect a strong short covering rally next week and then a 2nd leg down. Because the Emini is so oversold, the rally could last several weeks and retrace more than half of the selloff. But, it will probably then trade sideways to down for many months. There is a 50% chance of at least a 20% correction and a 30% chance of at least a 30% correction.

Bond futures broke to a new all-time high this week. Since the rally on the weekly chart is in a parabolic wedge, there will probably be a pullback within a couple weeks.

The EURUSD Forex market reversed up sharply from 1 tick above the bottom of the April 2017 gap. Traders should expect at least a small 2nd leg up after the first 3 – 5 day pullback.

30 year Treasury bond Futures market:

Parabolic wedge rally to new all-time high

The 30 year Treasury bond futures rallied strongly in January and February, despite 4 consecutive bear bars on the monthly chart (not shown). It is trading at a new all-time high.

On the weekly chart, there are now 3 legs up from the January low. If there is a reversal within the next couple weeks, the rally will be a parabolic wedge buy climax. Traders would then expect at least a couple small legs sideways to down.

The monthly chart had an 8 year nested parabolic wedge rally up to the 2016 high. There were two legs down over the next 2 years. However, the bull trend resumed over the past year.

In general, when there is a strong break about a wedge top, there is a 50% chance of a strong leg up. There is also a 50% chance that the breakout will fail and the market will reverse down.

American citizens will not tolerate negative interest rate. Also, the nested wedge is a reliable topping pattern. These 2 factors make it more likely that the breakout will fail.

However, there is no top at the moment and markets have inertia. They tend to continue what they have been doing. Consequently, the odds favor sideways to up trading until the bears create a good sell signal bar. It can come at any time, but until it does, traders will continue to bet on higher bond prices.

EURUSD weekly Forex chart:

Surprisingly strong reversal up from test of 2017 gap

The EURUSD weekly Forex chart reversed up 2 weeks ago from 1 pip above the April 21, 2017 high. That was the bottom of a gap on both the daily and weekly charts.

This week was a big bull bar on the weekly chart. It was big enough to generate confusion. Has the bear trend ended? Has a bull trend begun? Traders need more information, and therefore confusion typically leads to a trading range. Traders are not confident that any move up or down will go far. They therefore take quick profits, which results in at least a few sideways bars.

Did the 2 year bear trend end with the test of the 2017 gap?

The bulls are hoping that the February collapse was just a sell vacuum test of the major support at the 2017 gap. If the 2 week rally continues next week, traders will conclude that the 2 big weeks down in early February was just a bear trap and an exhaustive end of the bear trend.

One problem with this scenario is that last week was only a small bull doji bar on the weekly chart. That typically is not a strong enough foundation to support a new bull trend. This is especially true when it follows 2 big bear bars. Traders therefore believe that the 2 week rally is a minor reversal up.

Will the selloff continue down to par (1.00)?

The bears want the rally to be just another bull leg in a 2 year bear channel. There have been many big rallies and each failed. The bears want a new low, which would close the 2017 gap. They also want the bear channel to fall below the 2017 low and then below par (1.00).

However, the 2 week rally was strong enough to lead to at least a small 2nd leg sideways to up. Consequently, the bears will need a micro double top. That minimizes the downside risk for at least a couple weeks.

Major trend reversals are uncommon

Trend resist change. Therefore most attempts at reversing a trend fail. I have said this during every rally over the past 2 years.

A major trend reversal means the 2 year bear trend becomes a bull trend. There are 2 things that would improve the chance of a major trend reversal. First, the two week rally could add several more big bull bars closing on their highs over the next few weeks. That would be a Bull Major Surprise.

Second, the rally could last for a few more weeks and then selloff again down to the low of 2 weeks ago. A strong reversal up from around that low would be from a double bottom.

In either scenario, if the momentum up is strong, there would be a 40% chance of a new bull trend. Anything less than a strong reversal up would lead to either a bear flag and resumption of the bear trend or a trading range.

It is important to understand that the current reversal is still minor. That means it will probably be either a bull leg in the 2 year bear channel or a bull leg in what will become a trading range.

Stock market overview

If you have been reading my reports over the past few years, I predicted several 5 – 10% selloffs, but I always made the point that the Emini was soon going higher. Each of those selloffs was likely to be pullback in a bull trend. I am not saying that now because of the size of this week’s selloff and the context (the bars to the left).

This past week was unusual. So what is going on? I discuss the technical factors below. There are some non-technical things also contributing to the selloff. The obvious two are the coronavirus and Bernie Sanders. Both require a repricing of assets. Everything now is less valuable. Obviously, if Sanders is elected and if he was able to get all that he says he wants, the stock market would fall.

I want to talk more about the coronavirus. As you know, I am an MD. I began my career as a medical scientist and have a lot of experience in the medical community and with major university medical centers. This experience influences my thoughts.

A pandemic is a vague term, but I think that we are either in one or that there will soon be a consensus that one has begun. The term does not matter. What matters is that the coronavirus outbreak is changing everyone’s behavior in ways that reduce consumption and production. The result is that companies earn less and are less valuable. The average price of all assets, including stocks, falls.

The coronavirus pandemic could be vastly worse than what the experts are saying. We are fighting it as hard as we can with all that we have, but what we have is not enough to win. At the moment, all we have is quarantining sick people, hand washing, and avoiding sick people.

This containment approach is the only current solution, but it has very little chance of working. And it has been failing. A vaccine is the only answer, and we need billions of doses. That means the solution won’t come until the end of the year.

Do the math. The flu kills 500,000 people worldwide every year. This is true even with an available vaccine. Incidentally, vaccines are only about 70% effective.

Coronavirus is equally contagious and 10 times more deadly. That means it is not unrealistic to expect to expect several million people to die this year.

Also, we now know that each patient infects an average of 4 people. Assume that it takes 7 days for an infected person to get sick and to infect 4 more people. If that went on for a year, the number of potential infections is millions of times more people than there are in the world. You have to wonder if half the world will be infected before there is a vaccine.

If 3 billion people get sick and 2% die, that is tens of millions dead. This could be the worst pandemic since the 1918 flu, which killed 50 million people. I know that sounds crazy, but that is what the math looks like to me.

Every year we get flu shots. We may now start to get annual flu and coronavirus shots.

A vaccine is the only solution

The coronavirus problem will be solved by the end of the year when a vaccine becomes available. If the pandemic is temporary, how much damage can it do? If I am right and it is a much bigger problem than what the experts are saying, it could easily lead to a 30 – 50% correction this year.

It takes time for information to come in, and it might be more than a month before experts begin to suggest that it could kill millions of people. There could be several strong attempts to resume the bull trend in the meantime. But if this is anywhere as big a problem as it could be, it could result in a serious bear trend.

Don’t forget the inverted yield curve in August

The 10 year note yield fell to less than the 2 year yield in August, 2019. That is an abnormal situation and it is called an inverted yield curve. All 7 recessions since 1970 were preceded by an inverted yield curve. Each recession came between 5 and 17 months after the inversion. We are now in that window. The yield curve is telling us that a recession is likely, probably this year.

Recessions are typically preceded by a stock market selloff coming about 6 months earlier. If we know there will probably be a recession and that it will be preceded by a stock market selloff, this week is a credible candidate for that selloff. Consequently, there is an increased chance that this selloff will lead to a recession later in the year.

Sometimes a stock market selloff can be a major contributing factor to a recession due to the wealth effect. That is the increase or decrease in spending due to a change in our perceived wealth.

If the stock market sells off, people who own stock will have less money. They will buy fewer things. Companies that make those things will sell less and make less money. The earnings drop exacerbates the selloff.

As they make less money, they cut back. One of the most common ways is to lay employees off. That means fewer consumers buying things.

Recession means 2 quarters of negative GDP

The result of all of this is that the economy can shrink instead of continuing to grow. GDP is the most common measure of economic growth. If it is negative for 2 consecutive quarters, then there is officially a recession.

Two quarters means 6 months after the start of the shrinkage of the economy. If the recession comes later this year, as I think is likely, the economy begins to shrink at least 6 months earlier. This might be the start.

Is this a crash?

No, but crashes occur almost every day. A crash is just a lot of bars in a strong bear trend. You can find them on the 1 minute chart several times every week. On even smaller time frames, they happen every day.

While those are crashes, that is not what people mean when they talk about a crash. In 1929, the stock market lost almost 90% of its value over 3 years in a bear channel. In 1987, it fell almost 25% in a day. Those are the only 2 times in the past 100 years when there is a widespread agreement that the market crashed.

The Emini crashed this week on the 5 minute chart and on the 60 minute chart. It has only fallen 16% and one week on the daily chart. Therefore, it has to fall much further before traders will refer to the selloff as a crash. Crashes are rare and therefore this will almost certainly not grow into a crash.

Why was it so fast?

The selloff was very fast. That is because 80% of equity trading and 90% of futures trading is done by computer algorithms. They instantly make decisions and execute trades without hesitation. They chase momentum and will continue trading in one direction until there are not enough computers left to take the other side.

Moves are also exaggerated by options trading. For example, in a big down day, half of the selloff can be caused by option gamma. That is the rate of increase in put values as the market falls.

Option selling firms are huge. They basically insure all institutions, which buy puts to protect their portfolios. If the market falls, the value of puts increase at an increasing faster rate. That is the gamma effect. Option selling firms have to hedge their short puts. They do so by selling stocks and futures, exacerbating the selloff.

This is probably not just another pullback

For the past 10 years, traders have bought every 10 – 20% pullback and made money. Well, here’s their chance. If you have traded for 10 years or less, you have never seen this before. I have been trading for 34 years and I believe this is not going to snap right back like the Emini did at Christmas 2018.

But I do believe next week will rally strongly enough to make traders wonder. That kind of reversal is rare and therefore unlikely. Also, this selloff was much stronger. There is a 70% chance that there will be a lower high and a 2nd leg sideways to down. Also, there is a 30% chance of a 30 – 50% correction this year.

What if this is the start of a bear market?

The definition of a bear market is a 20% drop from the high. So far, the Emini has fallen 16%. Here are some guidelines as to what to expect if the market falls 20%. Once the market falls 20%, it usually falls more. There have been more than 30 corrections of 20% or more since 1927 and the average was 30%. The final low comes after about a year after the selloff begins. It is important to note that it takes almost 2 years before there is another new all-time high.

I have been saying for a couple years that the market will be in a trading range for about a decade. Therefore, even once there is a new high, it will probably not last. Traders should expect reversals for many years.

There will be at least a couple 30 – 50% selloffs in the next 10 years. That is frustrating for investors but good for traders. For example, if a trader buys a 50% pullback and holds it until there is a new high, he will double his money. If he buys a 30% selloff and holds until there is a new high, he will make almost 50%.

This is difficult to do, but it will probably be the best approach for many years. Investors will probably be disappointed by the lack of gains like they were in the decade long trading ranges of the 1970’s and the 2000’s.

Remember January 2018

In late 2017 and in the 1st few weeks of 2018, I repeatedly made the point that the stock market had never been that overbought on the daily, weekly, and monthly charts in the history of the Dow or S&P. I said that there was going to be a 5 – 10% correction within weeks. The Emini fell 10% over the next month.

Why did I say only 10%? Because as climactic as the market was, it was also in a strong bull trend. Traders did not have a chance to buy even a 2% pullback in a long time. The odds were high that they would buy a 5 – 10% pullback.

However, when there is an unusually extreme buy climax, the market gets exhausted. There is typically another leg up after the 1st pullback and that leg often becomes the final rally before a bigger selloff.

One could argue that the 2018 – 2019 trading range was the pause after the 1st buy climax and the 2019 rally was the 2nd and final leg up in the 10 year bull trend.

It is too early to know, but last week’s selloff is consistent with this. There was the most extreme buy climax in history followed by a 2 year pause, then another extreme buy climax in 2019, and finally an unusually strong selloff this week.

How low can the market go?

I believe that there is a 30% chance of at least a 30% selloff this year. It could be more. Look at the 50% selloff in 2002 and the 60% selloff in 2009. It is foolish to think that selloffs of that size will never come again. They will.

Whether or not this is the start of a 30 – 50% pullback, I have been saying for a couple years that this unusually climactic rally will probably have around a 50% selloff starting within 5 years. This has nothing to do with the coronavirus. It was purely technical. You never know what black swan would cause it. Coronavirus is a good candidate.

I have said that the bottom of the 2014 – 2015 trading range was a reasonable target. The Emini tried to reverse there and again in late 2017. The bottom of prior reversal attempts are magnets for later reversal attempts. That 2017 trading range low is around 1800, which would be about a 47% selloff from the current all-time high.

Many stocks forming bearish patterns

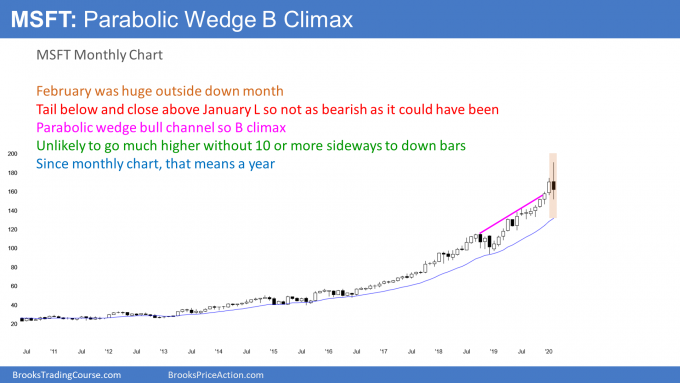

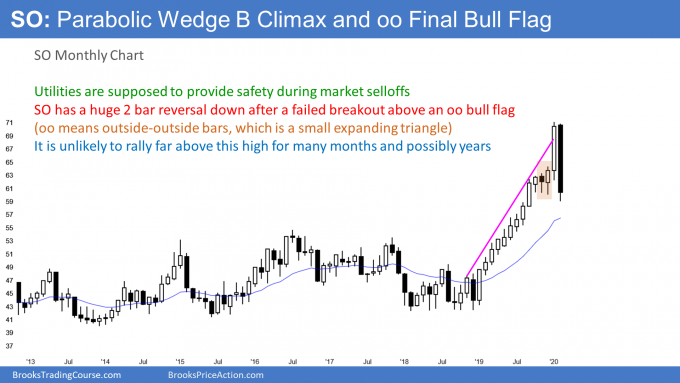

Many major stocks are forming bearish patterns on the monthly charts. MSFT has a huge bear reversal bar at the top of a parabolic wedge buy climax. That makes higher prices unlikely for many bars (months). There is a 50% chance of a deep correction that could last a year or more. AAPL, AMZN, GOOGL, MA, COST, NKE, KO, PHM, LMT, CP, LLY, and DUK have similar patterns.

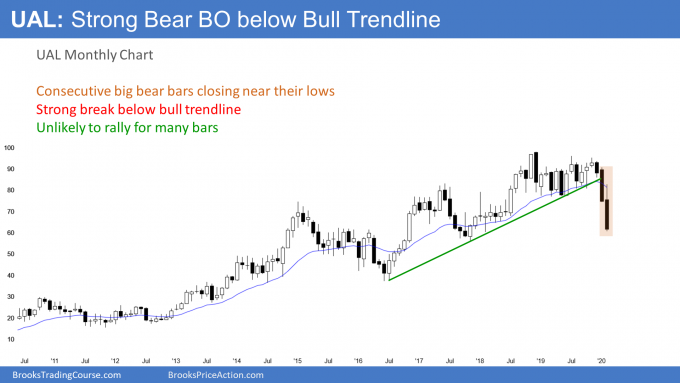

Other stocks are breaking below major topping patterns. For example, XOM has a big breakout below a 15 year head and shoulders top. That makes it likely that it will be sideways to down for many months. F, UAL, CCL, and many others are having similar breakdowns.

This means the selloff is broad and affecting many sectors. That increases the chance of significantly lower prices over the next year. At a minimum, it will make it difficult for the market to make a significant new high this year.

Monthly S&P500 Emini futures chart:

Emini 16% correction down from top of bull channel

Two weeks ago when the Emini was above the January high, I wrote that there was a 30% chance of a strong reversal down to below the January low by the end of the month. That is because January was a credible sell signal bar at the top of a 13 year bull channel and it was a bear doji. When there is a bear doji at resistance, the next bar often as a big tail on top as well. Therefore, traders needed to be open to the possibility of a sharp selloff at the end of February.

Obviously, the size of the selloff was a low probability event. When there is a low probability bear event, bulls are trapped into bad longs and many bears are trapped out of a good short. That means there is typically at least a small 2nd leg down.

Probably at least 2 legs down on the monthly chart

There will likely be at least a small 2nd leg sideways down on the daily chart after the 1st bounce, and maybe on the weekly chart. On the monthly chart, February is still only the 1st bar down from the high. The bears will need at least a few down months before traders will expect a 2nd leg down on the monthly chart. That has not happened since the 2015 selloff, but it appears probable again this time. This is especially true, given the incipient pandemic.

There were many bear bars over the past 2 years. That is selling pressure and it increases the chance of lower prices. Also, the Emini is late in a bull trend and at the top of the 13 year bull channel. Finally, February was a surprisingly big bear bar at resistance in a buy climax. These factors increase the chance that the Emini might be sideways to down for many months.

Reversing down from the top of the bull channel

I wrote in December that the monthly S&P500 Emini futures chart was breaking above a 13 year bull channel. I said that there was a 75% chance of a reversal down within 5 months. February is a good candidate for the start of a reversal.

What are reasonable downside targets when a market reverses down from above the top of a bull channel? The Emini has already fallen below the 20 bar EMA and it is now at the 20 month EMA. It is back in the March to October 2019 trading range. It was stuck there for 6 months and it might stabilize here again for a month or more.

Remember, I have written many times that the Emini would probably be in a trading range this year between 2900 and 3500. So far, this selloff has fallen 16% and about 1% below my 2900 target.

There are also targets based on the bull channel. The obvious one is the bottom of the channel. That is the 8 year bull trend line and it is currently around 2600.

These targets are based on the technical factors. There is always a 30% chance of a much bigger selloff. That is especially true in light of what I wrote above about the coronavirus pandemic.

What about March?

The Emini formed a big outside down bar in February. Its high was above the January high and its low was below the January low.

An inside bar often follows an outside bar. Therefore, the March low might stay above the February low. If so, there would be an ioi (inside-outside-inside) pattern on the monthly chart. That is a Breakout Mode pattern.

However, the monthly chart turned down from the top of a 13 year bull channel. That reduces the chance of much higher prices over the next few months. But because the monthly bull trend has been strong, any selloff will probably end within a few months.

The month after a big outside down month often trades below the outside down month. But because February was extremely big and its low is in a support zone, March will probably not be a big bear bar on the monthly chart. There might be more buyers than sellers below the February low.

This is especially true since the February low is in the support of last year’s 6 month trading range. If March trades below February and closed near its high, it would be a High 1 bull flag buy signal bar for April. However, February did significant damage to the bull case. Traders expect the Emini to be sideways to down for at least a couple more months.

Weekly S&P500 Emini futures chart:

Big reversal down from Low 2 top

The weekly S&P500 Emini futures chart formed a huge bear bar this week. Last week was a Low 2 sell signal bar on the weekly chart. When this week gapped down, it triggered the sell signal. This week is the entry bar. Since it had a big bear body, it is a strong entry bar. That increases the chance of lower prices over the next few weeks.

The Emini broke below the 20 week EMA and then below the yearlong bull trend line. A surprisingly big bear bar usually will have at least a small 2nd leg down. Therefore traders expect sideways to lower prices over the next month.

Sometimes a huge Bear Surprise Bar can be a Spike in what will become a Spike and Channel Bear Trend. That means a trend that has at least 3 legs down. The spike is the 1st leg. There is no reversal yet and therefore the spike might grow into a 2 or 3 bar breakout over the coming weeks.

What about a bear trap? Can the Emini complete reverse this week’s big bear bar next week? The bulls have a 20% chance of an immediate reversal up like after Christmas 2018. A huge selloff like this typically will have a sharp 1 – 3 bar (week) short covering rally. But the context and the size of this week’s bear bar make it much more likely that the Emini will be sideways to down for at least another month.

If I am right about the coronavirus pandemic, the charts could become much more bearish over the next couple months.

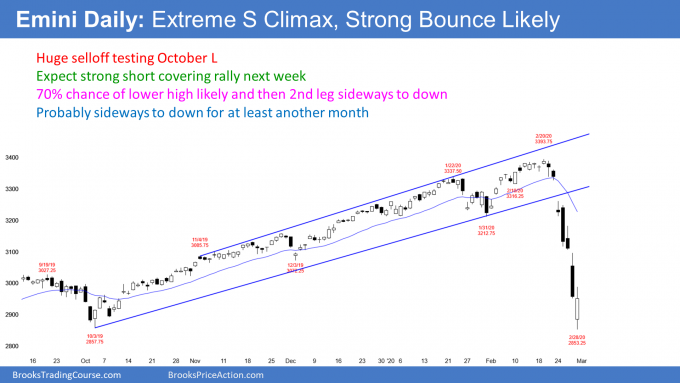

Daily S&P500 Emini futures chart:

Extreme sell climax so short covering rally likely

The daily S&P500 Emini futures chart collapsed this week. It broke below the 3000 Big Round Number and the top of the 2 year trading range. The low was also more than a measured move down from the 2 month trading range. Furthermore, the low was a 16% correction from the high.

The Emini is back in the March to October 2019 trading range. For 6 months last year, traders thought that area was a fair price. They still probably think that it is a fair price. Therefore, the Emini might get stuck between 2800 and 3000 for a month or longer.

When there is a sell climax down to support, the stop for the bears is far above. They have to reduce their risk. The easiest way is to cover (buy back) some of their shorts.

The bears who missed the 1st leg down will sell. Also, the bears who were short, but took profits will sell as well. Finally, many bulls who did not exit are eager to exit on the 1st bounce, hoping to avoid a bigger loss.

Will this be a repeat of the December 2018 climactic reversal up?

The bulls are hoping that this reversal up will be like the January 2019 climactic reversal. Markets only rarely go from a strong bear trend to a strong bull trend without forming at least a small trading range and some kind of double bottom. Even if the bulls get several bull days, the 1st leg up will probably be minor. Traders believe that the best the bulls will get over the next few weeks is a trading range.

The selloff was surprisingly strong. It is a Bear Surprise Breakout. Traders should expect at least a small 2nd leg sideways to down after the first short covering rally.

What we don’t know is what the market will do once it has that 2nd leg down. If the selloff is just a sharp pullback in a bull trend, the selloff will find support around the low of the current leg. The bulls will try to get a reversal up from a double bottom with the bottom of this current leg down.

Possible Small Pullback Bear Trend

The bears correctly see this week as exceptional. They would like the breakout will be a spike in a Spike and Channel Bear Trend or the start of a Small Pullback Bear Trend. This spike down would be the 1st leg down. The bears then would expect at least 2 more legs down. The bulls will then hope for a wedge reversal.

But what if the selloff does not have 2 or 3 strong bear legs? It would not be climactic. Instead, it could become a Small Pullback Bear Trend. That can last a long time and fall much further than what traders think is possible. That is what happened in 1929. The market keeps trying to reverse up, but each reversal becomes a small pullback in a bear trend that just keeps selling off.

No, this is not going to be a repeat of 1929. That is just an extreme example of the pattern. But there is a 30% chance that this selloff can fall about 30 – 50% down from the high before it ends. It might not end until a worldwide coronavirus vaccine is about ready to become available.

Emini has 50% chance of bear market

Again, traders should expect a very strong short covering rally within the next week. It could last 2 – 3 weeks, but it should then stall or reverse. Then, there will another leg sideways to down to test the bottom of the current 1st leg down. At that point, we will find out if the selloff will end or continue down much further.

There are far more important technical forces behind this selloff. This is true in terms of the duration and size of the developing move. They will likely affect the market for many months and possibly all year.

When there is a Bear Major Surprise like this, there is a 70% chance of at least a small 2nd leg sideways to down and a 60% chance of some kind of measured move down. Traders should expect the market to be sideways to down for at least a month. There is better than a 50% chance that it will continue for several months and reach at least 20%. That is the definition of a bear market. Remember, there is a 30% chance of a 30 – 50% selloff this year.

What to expect next week

I want to be very clear about one point. It is naive and convenient to say that the coronavirus is the sole or even major reason for this selloff. If it was just coronavirus, the market would have fallen only 5% and the selloff would quickly end because the coronavirus story will be minor within a couple months.

There are more important technical forces at work here. Remember, in December, long before the coronavirus was in the news, I said that the monthly chart should reverse down within 5 months because of a failed breakout above the monthly bull channel. This and the other technical factors that I mentioned above could affect the market for many months and possibly the rest of the year.

The fundamental factor of the coronavirus pandemic is difficult to assess with current information. Since I think the only solution is a vaccine and that is many months away, the fundamental problem might get much worse than what medical and financial experts are now saying.

An initial short covering rally often lasts only a couple days. Traders should expect at least a couple big bull trend days next week. This is true even if March briefly trades below the February low early in the week. But because this selloff was extreme, the rally could be big and last 2 – 3 weeks. It will probably make traders wonder if the repeat of the January 2019 rally. But it will not be. We’re going down.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.