Market Overview: DAX 40 Futures

DAX futures moved higher last week with a possible DAX double bottom in a Broad Bear Channel. The bulls see a possible major trend reversal above the high of this week but the context is bad in a broad bear channel. The bears expect to sell above bars again this week expecting any move back to the moving average to be sold.

DAX 40 Futures

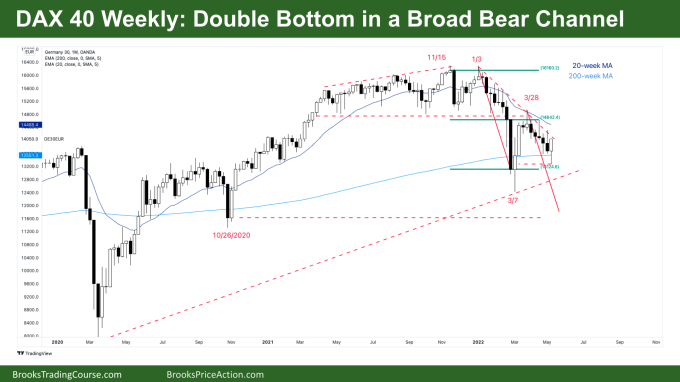

The Weekly DAX chart

- The DAX 40 futures was a bull bar closing on its highs with a large tail below so we might gap up next week. It was a DAX double bottom in a broad bear channel and a pause at 200-week moving average and at the prior breakout high.

- There were 5 bear bars in a row so we said last week it would be unlikely we get a sixth.

- We are still always in short, but traders bought below the lows of last week.

- The bulls see a higher low major trend reversal. They see bears were unwilling to sell below to get down to March lows and scalped out.

- They see another bounce at the 200-week moving average and we are sitting on the prior trading range high which could act as support.

- Traders expected two legs sideways to down after the lower high major trend reversal in January. The bears see we are in the second leg still. The bulls see the second leg has just finished.

- The bulls want consecutive bull bars closing above their midpoints to swing long. But look left, the last time that happened bears sold above the highs until they collapsed.

- The bears want another reversal here for a double top with March 28th. They know buying 5 consecutive bear bars is a low probability trade, so bulls would likely scale in lower.

- We can expect sellers above around the trendline and up to the moving average.

- Al likes to consider which stop and limit order traders are making money. Limit order bulls are making money as well as limit order bears, which means we are likely in a trading range.

- Expect sideways to down next week as traders decide.

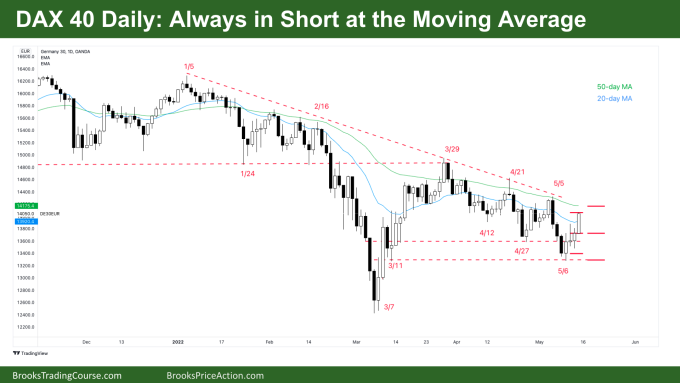

The Daily DAX chart

- The DAX 40 futures on Friday was big bull bar closing on its highs so we might gap up on Monday.

- It was a High 2 buy signal trading above Thursday. It’s now 4 bull bars in a row so traders might be hesitant to sell.

- But look left, 3 huge consecutive bear bars closing near their lows so likely we are still always in short.

- Big up, big down, big confusion, trading range. Traders should Buy Low Sell high and Scalp.

- The 50-day moving average has been resistance for 3 months so expect sellers there again.

- The measured move target for the buy signal is nearly exactly at the 50-day MA which will create a reasonable place for bulls to exit, and bears to sell again.

- The bulls see a higher low major trend reversal on March 7th and a double bottom with March 11th.

- The bears see a broad bear channel with 3 consecutive bear bars closing on their lows so we are always in short still. They expect to sell the first moving average gap bar, they know it has been over one month since the bulls got a bar completely above the moving average.

- Depending on how you draw your measured move targets, either the bulls hit it on Friday and we will reverse down, or we have a little further to go up the moving average – either way the location is bad for stop order bulls. No one wants to buy high at resistance.

- The bulls want a pullback to the prior High 2 breakout point for a lower risk double bottom to get long.

- The bears want another strong reversal around here and they might get it.

- Expect bears to sell above bars next week.

- Middle of a trading range from March so no matter how bullish it seems stop entry traders should be careful.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.