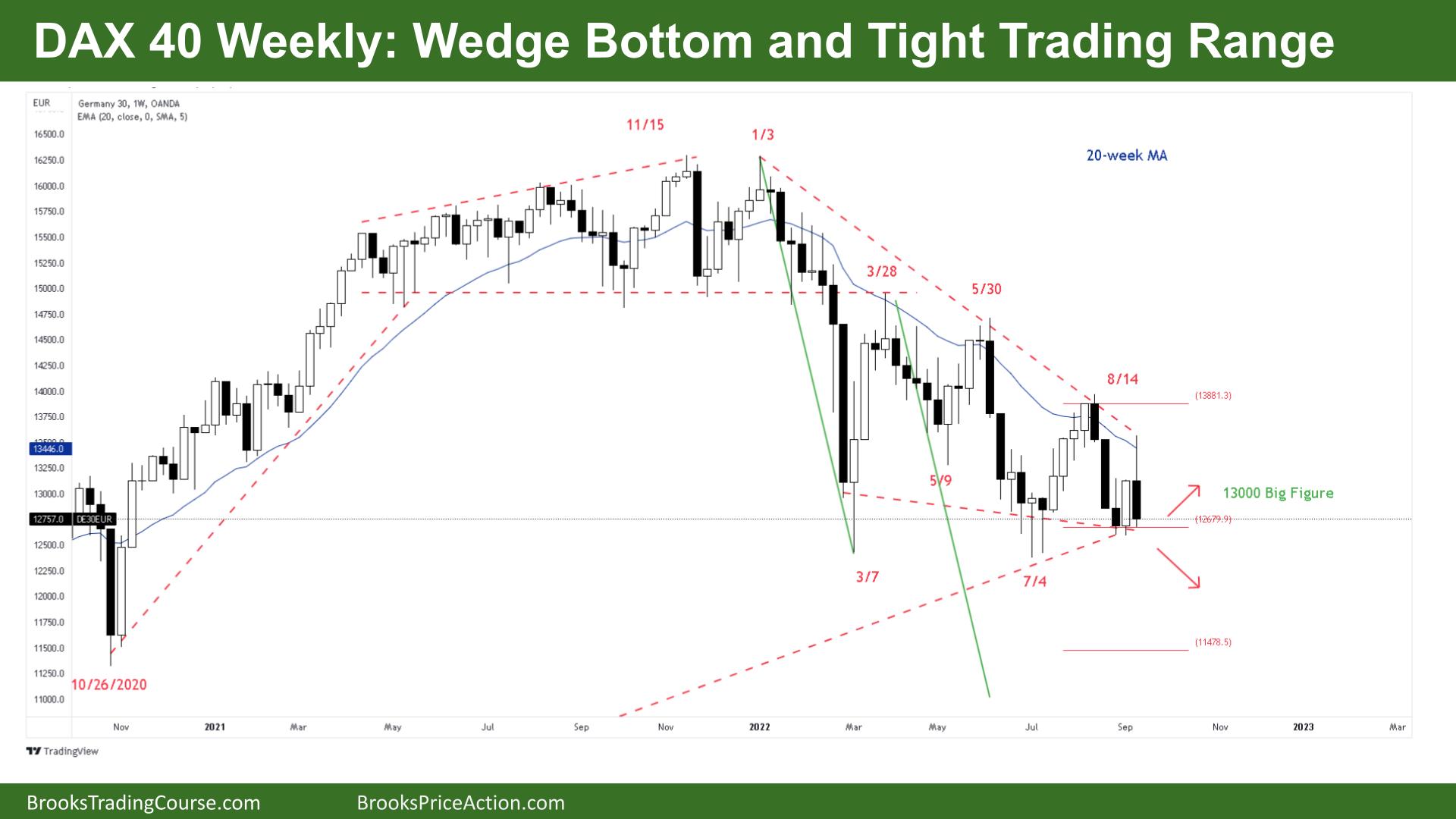

Market Overview: DAX 40 Futures

DAX futures was a DAX 40 wedge bottom and a tight trading range, low in a large trading range. it could be a double bottom buy setup, but bearish enough for a second leg down next week. Bulls are looking to swing for a break higher and measured move up. Bears hoping they can break down and make the wedge fail for a larger continuation down

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bear bar closing near its lows on the weekly chart and had a large tail above.

- The bulls see a possible wedge bottom, three pushes down with March and July and are looking for a reversal. It’s a micro double bottom buy setup, but it’s a bear bar.

- The bears see a broad bear channel, lower lows and 3 consecutive bear bars so expected a second leg. We may have just finished the 2nd leg.

- The bulls really want a major trend reversal, first a lower low and then a higher low and 2 legs up, possibly the range of the wedge.

- They see this week as a pullback and breakout test of last week and want another move.

- But they have failed to get consecutive closes above the moving average for many months.

- The bears have been selling the moving average all year and will continue to do so until it is no longer profitable.

- The bears want a breakdown of the wedge bottom and measured move down, which would be in the area of the previous harmonic retracement. But it’s a long distance away and bulls are buying new lows.

- Limit order bulls are making money which means the trend is not as strong as it could be. In fact, we have been in a range since March.

- The bulls were able to get 4 consecutive bull bars in July, so it’s not as bearish as it could be. If the bulls can get a pair of consecutive bull bars, one closing above the moving average, it could be a rapid push higher as bears cover shorts.

- It’s a decent bear bar so it’s a sell signal for next week, but it failed to get below the low of the prior bull breakout bar so it’s a pullback and possible buyers below.

- Bears will likely need a follow-through bar to convince traders to swing lower.

The Daily DAX chart

- The DAX 40 futures was a bear bar closing near its low on Friday.

- It’s the 4th consecutive bear bar, so it’s a micro channel. 3 of the bars are big and closing on or near their lows, so the momentum should have another leg down.

- It’s a bear bar, so sell signal for Monday, but also a reasonable place for profit taking, so bears might sell the first High 1.

- The bulls see a pullback from Sept 5th, a breakout test from a higher low possible major trend reversal. Bears have sold strongly in this area but were not able to break the March – July lows.

- The bulls will buy the triple bottom hoping for two legs breaking above the bear trend line and for a move higher.

- Currently, the bears have sold every test of the channel line.

- The bears see always in short, reversing down from above the moving average. It’s a higher low and a lower high so it’s a triangle and tight trading range, so it’s breakout mode.

- The probability is about 50/50. Even with a break below, low in a trading range is a reasonable place to buy a second entry for a move up to the top of the range.

- But the same applies above, once we move above September’s prices, the math favors selling again, that is what happened last week.

- It’s a possible double bottom with Sept 5th, but who wants to buy 4 bear bars? More likely we move sideways to down next week and see how many buyers are below.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.