Market Overview: DAX 40 Futures

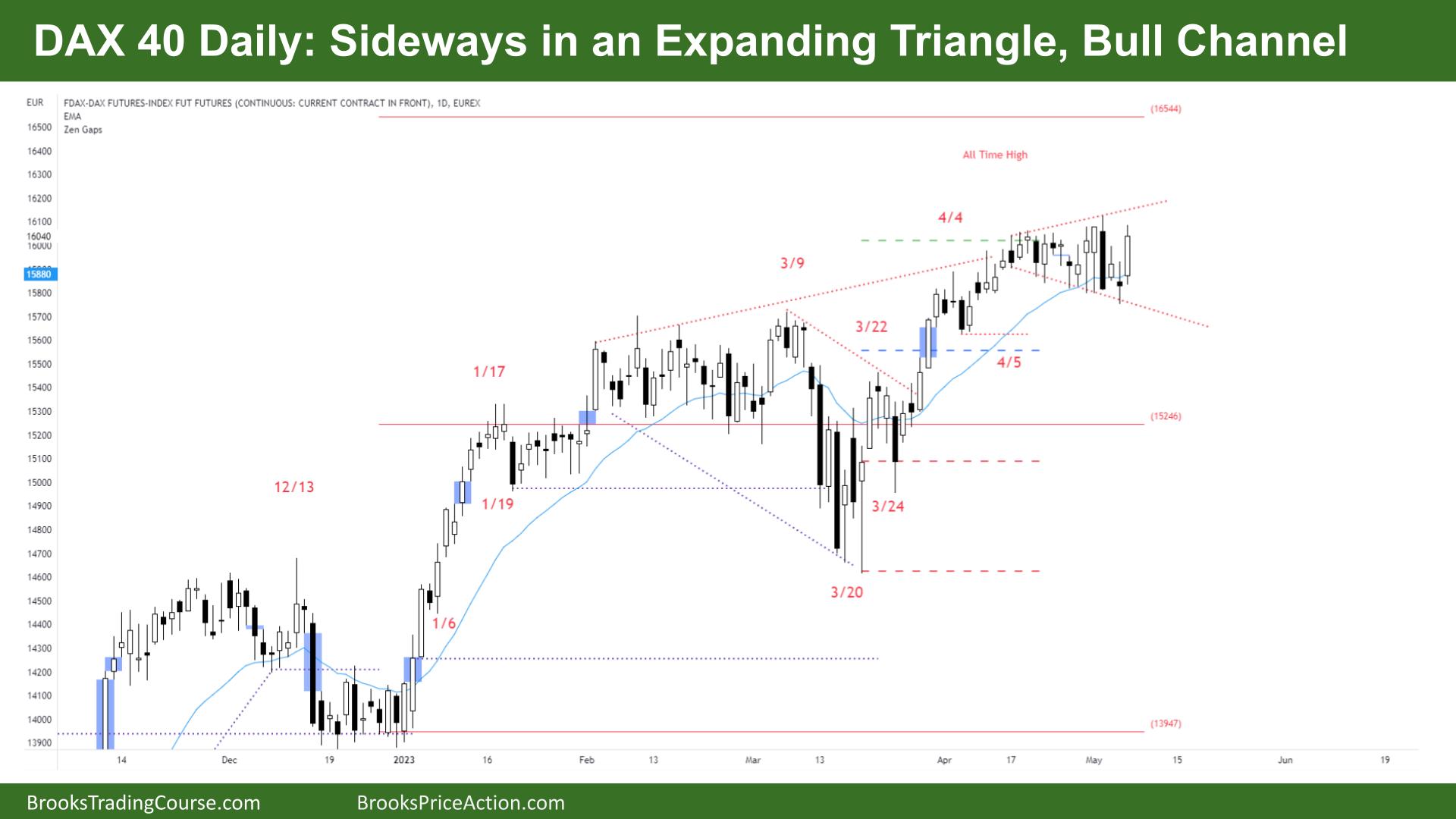

DAX futures was a OO, a Dax 40 Outside-Outside bar setup and expanding triangle high in a bull channel. The bulls want a break above and push to the all-time high (ATH) and their measured move target above. The bears want the bull BO to fail and reverse strongly back to the MA. The bears have been unable to make money on stop orders so even though they closed the gaps above, expect sideways to up next week.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures last week was an outside-outside pattern – consecutive outside bars.

- It is an expanding triangle on a lower timeframe and a tight trading range, so it is BOM.

- The bulls see 3 pushes up and want the expanding triangle to be the final flag before a final move to the all-time high (ATH).

- The bears see a failed breakout above a sell climax, high in a trading range and a test of the lower high.

- The bears want a second entry short to sell under – but these bars are not great for stop-entry traders.

- It’s an outside up, but it should trade like an outside down bar – the low broke out more below than above the prior bar. So there should be sellers above.

- If the sellers get trapped, we might move up to the ATH.

- The bulls want the measured move target above the ATH from the two consecutive big bulls bars. It is also a larger measuring gap – a body gap below March 13th.

- It’s a trading range, so it will likely disappoint traders. The bulls might get a weak bull breakout with bad follow-through. Or the bears get a bear bar with a big tail below.

- The first BO from a triangle often fails. The bulls want to trap the bears below and use that momentum to head up.

- But bulls are buying below bars, so we might need a couple of legs sideways to the MA to find buyers.

- Expect sideways to up next week.

The Daily DAX chart

- The DAX 40 futures was a bull bar closing on its high on Friday, so we might gap up on Monday.

- It’s a bull channel – maybe a small pullback bull trend – it’s been going more sideways for a few weeks now with a flat moving average.

- But you can see that bears have struggled to make money for months.

- The OO, outside-outside pattern, can also get a measured move as trapped traders scale-in against a big move. The pattern usually comes back to test the midpoint later on.

- It’s an expanding triangle which is breakout mode (BOM) – but traders are buying the MA so the bulls are still in control.

- Expanding triangles in trends have a high probability of continuation, so it might be the final flag before the final move-up.

- The bulls see a broader channel – leg one in January, leg two in March – and they want another leg to the ATH.

- The bears see sideways and look left – the last time there was an expanding triangle, there was a bull breakout that failed, and bears attacked the moving average.

- The bears will sell above that big bear bar betting the BO will fail.

- It’s not great for stop-entry traders, so most traders should be long or flat.

- The bears might see a broken trendline – a possible parabolic wedge from March to April – they want 2 legs down but so far have been unable to attract stop orders sellers.

- If the bulls get a breakout, they want to reach their measured move target above. But it might be too far without going sideways to down first.

- Bears closed the gap from March, so it’s reasonable for limit bears to sell above. Open gaps are a sign of trends – gaps close in trading ranges.

- The outside-outside pattern traps traders above and below, so be careful using stop-orders. Most traders should wait for a clearer-setup.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.