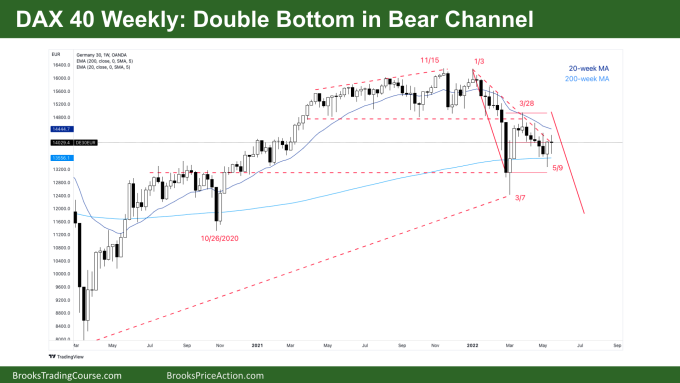

Market Overview: DAX 40 Futures

DAX 40 futures moved slightly higher last week with a DAX 40 double bottom in a bear channel. It is a tightening range so it’s breakout mode. It looks more bullish on the daily chart however with a possible higher low major trend reversal. The bulls want some follow through to break the bear trend into a trading range. The bears are still selling above bars, and at the moving averages, and will continue to do so, it is likely we will go sideways next week again.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 weekly futures index was a small bear doji bar. with long tails above and below.

- We said last week that we would trade sideways to up and to expect sellers. We also said that there might not be buyers for the follow-through bull bar.

- The bulls see a double bottom buy setup with March 7th, but with no follow through last week they might need to drop lower to find buyers.

- They see we rejected the 200-week moving average so we might need to go sideways before going back up.

- Bears see a broad bear channel, and that we are still always in short. But it has been a tight trading range for the past 8 weeks and we closed right in the middle of this even tighter trading range – so it is breakout mode.

- Bears have been selling above weekly highs for 8 weeks so expect more sellers at and above the moving average.

- The bulls want a follow-through bar like 2 weeks ago, for a double bottom higher low major trend reversal and they might get it. But it could also be a bear flag and a good sell signal, so likely sideways to down for the time being.

- The bears want the follow through to finish after 2 weeks as a bull trap for a continuation move down, hopefully forming a harmonic with the move down from January to March. But it might take a while to get there – maybe all year if we get there at all.

- For the bulls, it’s a High 3, so it’s a wedge, looking for a follow through buy signal and measured move up. But we are below the moving average so they might scalp.

- The math is bad for the bears, that is why we are stalling here. We are at the bottom of a tight trading range, in the bottom third of a larger range so the risk is big and the reward is small.

- Bulls are happy to buy because it’s a swing buy in the bottom third of the range and the bottom third of the tighter trading range – low probability but a higher reward.

- Some bulls are swinging with a target high up at the range highs so they will likely scale in lower as bears give up. If the double bottom holds they will start to more aggressive.

- Bears want a follow-through bar to break through the range and set up the larger second leg but it might have finished last week.

The Daily DAX chart

- The DAX 40 futures index was a bull bar on Friday with a tail on top.

- Although we are still always in short, last week there were 2 large bull bars closing on their highs so it is not as bearish as it could be.

- The bulls see a higher low major trend reversal with March 7th.

- There is also a wedge reversal, three pushes down with April 12th and April 27th so traders might expect 2 legs up. We may have completed the first leg last week so may not necessarily see another move.

- Traders also see a possible inverse head and shoulders with the neckline at Tuesday’s high.

- The bulls want a measured move from Tuesday’s high. But the context is bad, we have been going sideways with reversals since February 24th. We are right in the middle of this range so it might be too far for the swing bulls to hold.

- If the bulls can get consecutive bull bars closing on their highs that might take us up to the breakout point in February, but unlikely higher.

- The bears see Tuesday as a moving average gap bar and it was a high probability sell signal in a bear trend. They sold it for a successful measured move based on the size of the bar and then scalped out.

- Bears will keep selling the moving average but if they were unwilling to hold their swings it is reasonable that they will keep selling above slowing down a large bull move.

- Wednesday closed on its low for the bears so if they can get another bar like that next week, we will likely move back down to the May 8th low.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.