Market Overview: DAX 40 Futures

DAX futures pulled back again last week after consecutive bars in an overdone bull spike. We raced past 18000 and now came back to visit. Bears will likely get a second leg sideways to down but it has been quite lonely to sell in this environment for bears so better to wait to see them making money before you enter.

DAX 40 Futures

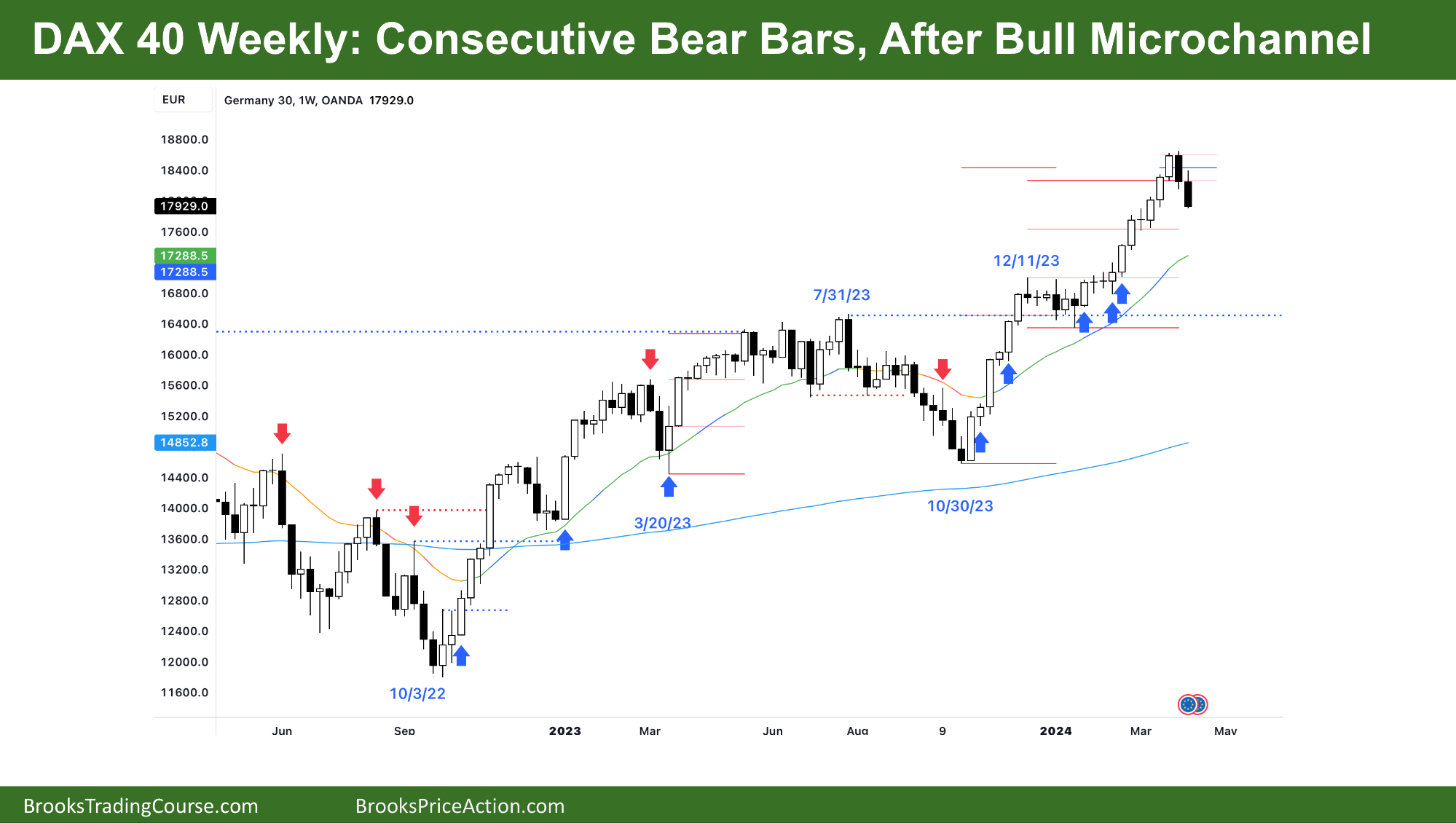

The Weekly DAX chart

- The DAX 40 futures last week was a big bear bar closing on its low making it consecutive bear bars.

- It is the second consecutive bear bar high after a strong bull micro-channel.

- We said last week that the microchannel had 3 pushes up and needed a couple of legs sideways to down to correct.

- Bulls bought below the low of the last strong bar, and will likely buy below the low of the second last one as well.

- The bulls see two clear legs up and perhaps will get one more after two corrective legs sideways.

- The bears got good follow through after the bear outside bar last week. It was a low probability sell below that bar, so if you took it, it is for a swing. You will scalp out disappointed if the reversal is strong.

- Bears are targeting the doji a few weeks back which is the last leg of the parabolic wedge top.

- Usually when you have these perfect dojos in a spike, the spike continues and comes back to test them.

- They act like a weak buy or sell signal. Opposite traders fade them and scale in back to them in late stage trends / spikes.

- Bulls want a reversal bar next week and will probably get it.

- We touched the magic 18000 number again so I wouldn’t be surprised if we get an inside bar next week.

- It is strong enough to expect a second piece sideways to down. That can sometimes be straight down, but I expect to come back and touch the big round number again next week perhaps.

- Most always in bulls would have exited below last week. Some others will now exit below the low of this weeks bar.

- Other bulls will fade strong adverse setups in this environment betting that the bears will get disappointed.

- The bulls in the final week did not get a chance to exit breakeven, which make me believe we need to get back there. But we could go down very far before coming back!

- I would argue no longer always in long, so trading range, and I expect buyers somewhere below.

- For bears after a strong bull spike it is better to be selling above something AFTER a bear breakout of a prior bar. So that would be above last week.

- But they can argue a strong bar closing on its low so they will sell and sell higher.

- Expect sideways next week.

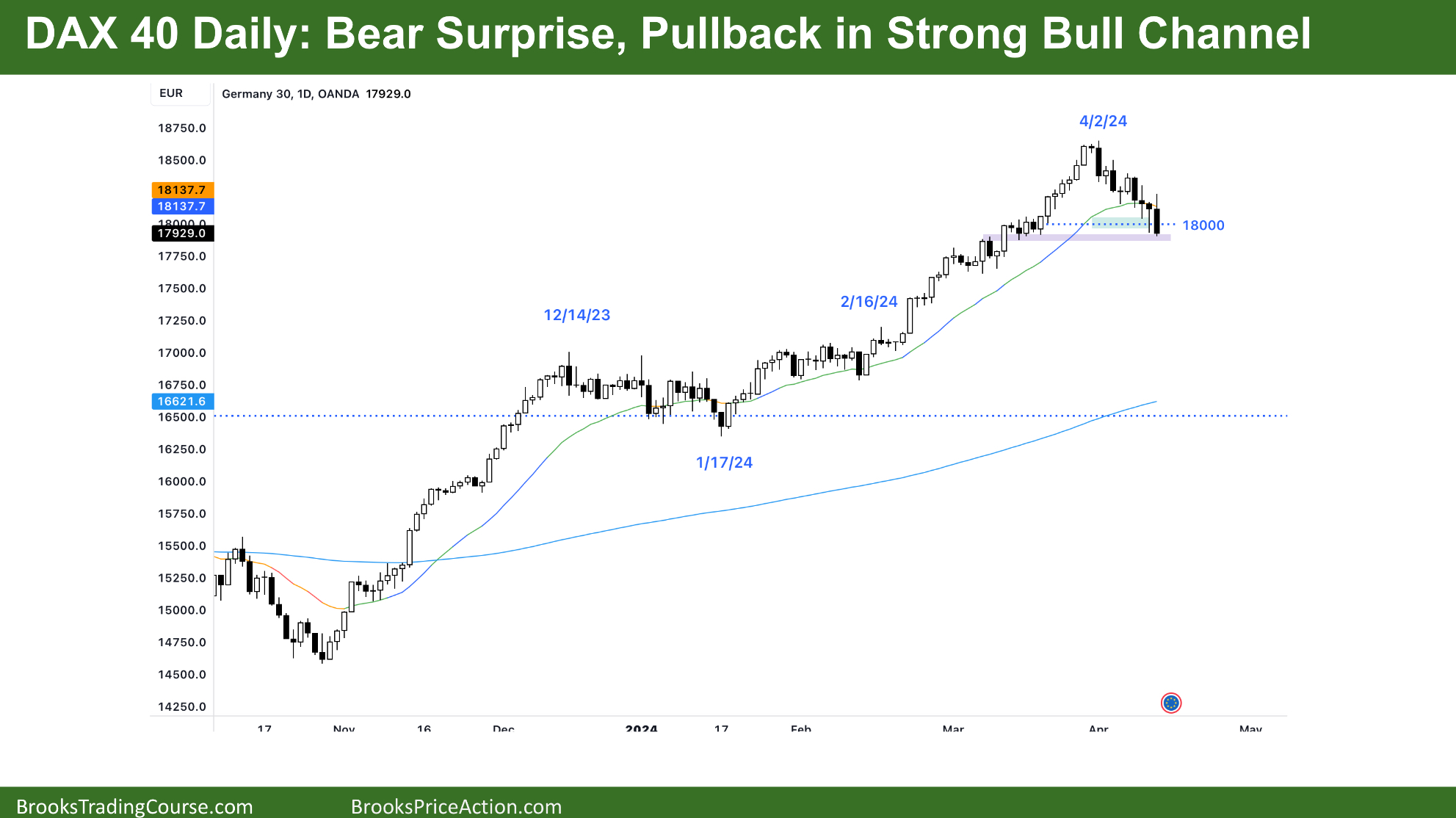

The Daily DAX chart

- The DAX 40 futures on Friday was a big bear bar closing near its low.

- It is also an outside bar – outside down bar.

- Bulls can argue two legs down after a spike – each leg has itself two parts.

- The High 2 failed near the MA and we broke below, so they probably need a High 4 to get long.

- Nothing to buy here for them.

- Bears see we retraced the last leg of the parabolic wedge on the weekly and are back to the tight trading range – the final flag.

- So what to do?

- Bulls are buying below this bull spike and probability says they will probably make money. They bought the last breakout point Thursday and will buy below the low for a scalp.

- Bears will argue we ran their stops, so will look to sell a measured move down from here to 17200 area.

- But first break of a strong trendline makes that unlikely right now.

- Bulls see the outside bar as a strong spike on a LTF from Thursday low, and a possible wedge bottom. But they don’t have a buy signal.

- Always in short on this timeframe so traders should expect sideways to down next week.

- If you sold above Thursday you made money on Friday. So limit order traders are making money on opposite days. Expect this to continue next week.

- Although we will see on Monday / Tuesday where bears are exiting below or not.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.