Market Overview: DAX 40 Futures

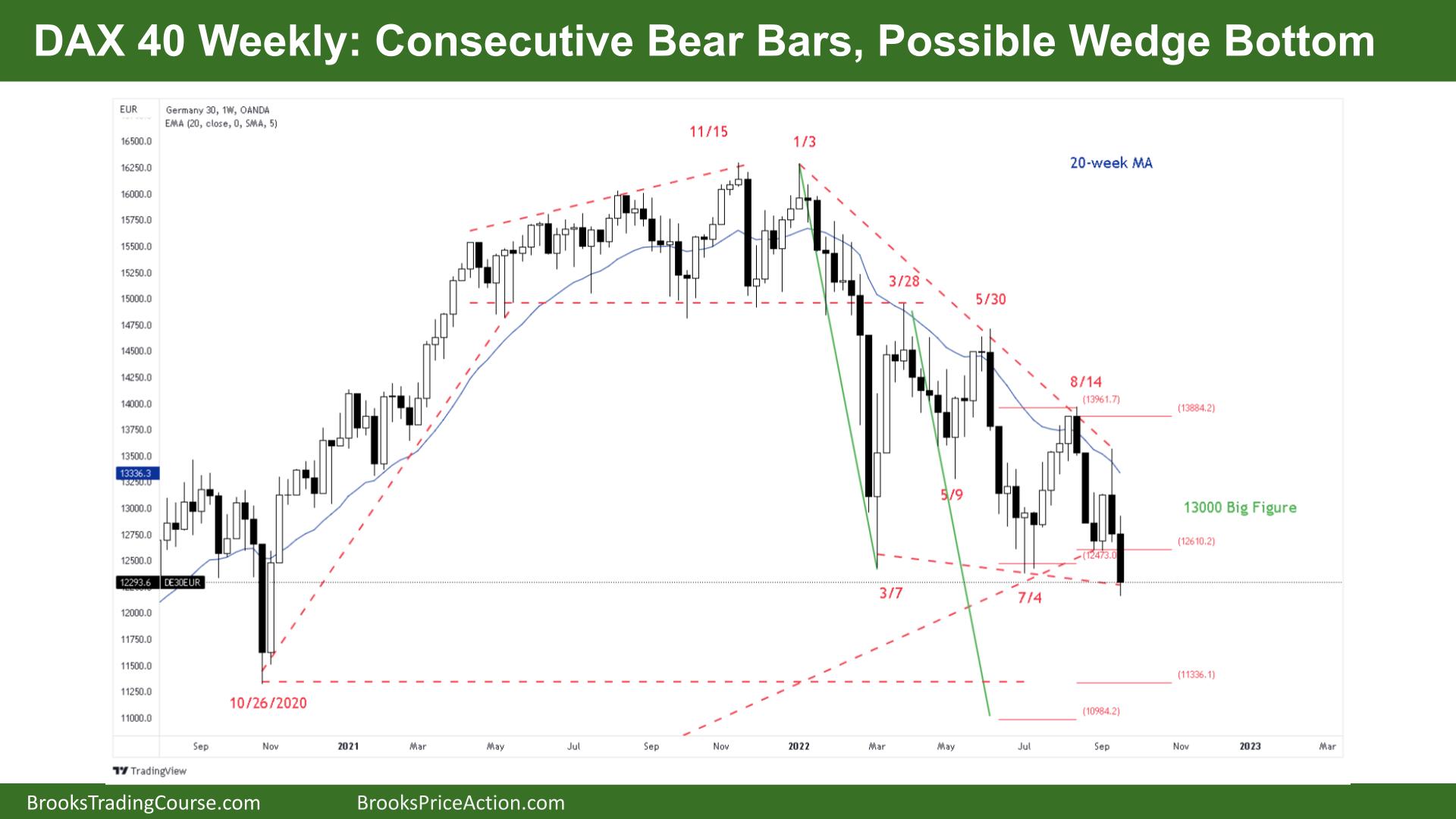

DAX futures moved down again last week with DAX 40 consecutive bear bars and setting up a possible wedge bottom. The bears got a break below the March lows, but we have been going sideways for many weeks, it might form a tighter trading range here. Bears want a follow-through bear bar closing below this week confirming the breakout, and bulls will buy below this week betting on more sideways to down. The bulls got 4 weeks of continuous buying in July and August so it’s not as bearish as it could be.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bear bar closing near its low so we might gap down on Monday.

- It is also the second consecutive big bear bar closing on or near its low, so traders might expect a second leg down.

- For the bulls it’s a lower low and a possible wedge bottom – they will look for a reasonable buy signal to buy for 2 legs sideways to up.

- But it’s a bear bar so a sell signal and with two measured move targets below and a harmonic we have been expecting for months.

- The bears see we are always in short, 2 legs and consecutive bear bars they can sell on close and sell pullbacks for a possible third leg down.

- We have been sideways for 6 months, so limit order bulls have been making money and will likely buy again new lows expecting a retracement above prior lows.

- No gaps on the weekly mean it’s a trending trading range and not a strong bear trend. This could change if the bears get a strong breakout below the wedge and start a measured move down.

- Better to be short or flat. Because 3 weeks ago was a reasonable buy signal, the next weekly bull bar will attract more buyers and we will likely go 50% back to that bar or up to its entry point.

The Daily DAX chart

- The DAX 40 futures was a bear bar closing below its midpoint on Friday so we might gap down on Monday.

- It is a 9-bar tight bear channel so most traders should only be looking to sell.

- The target was the March lows and we closed just below it at a harmonic move down from the chart.

- The bulls see 2 legs down after a strong bull channel and see a lower low major trend reversal. They see Friday as a sell climax and sell vacuum test of the lows.

- Limit bulls have been buying below bars for months and making money so will continue to do so as 80% of breakouts fail and a trading range is more likely.

- The bulls want a reasonable High 1 buy signal to get long, currently, there is only sell signals.

- The bears see a second leg down and a tight bear channel. They expect the first reversal to be minor and might get the third leg down.

- They want the third leg to be reasonably past the March lows so as not to set up a wedge bottom buy signal.

- It’s a bear breakout bar and a lower low but they need follow-through to convince traders of a measured move down. There is a weekly target below.

- The bulls know there are no gaps so it is more like a trending trading range, not a bear trend. That means limit-order traders are making money and it is not a strong trend.

- If the bears can get a breakout and a pullback that does not go above the recent lows, that would create a gap for a measured move.

- With consecutive bear bars on the weekly chart expect more sideways to down next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.