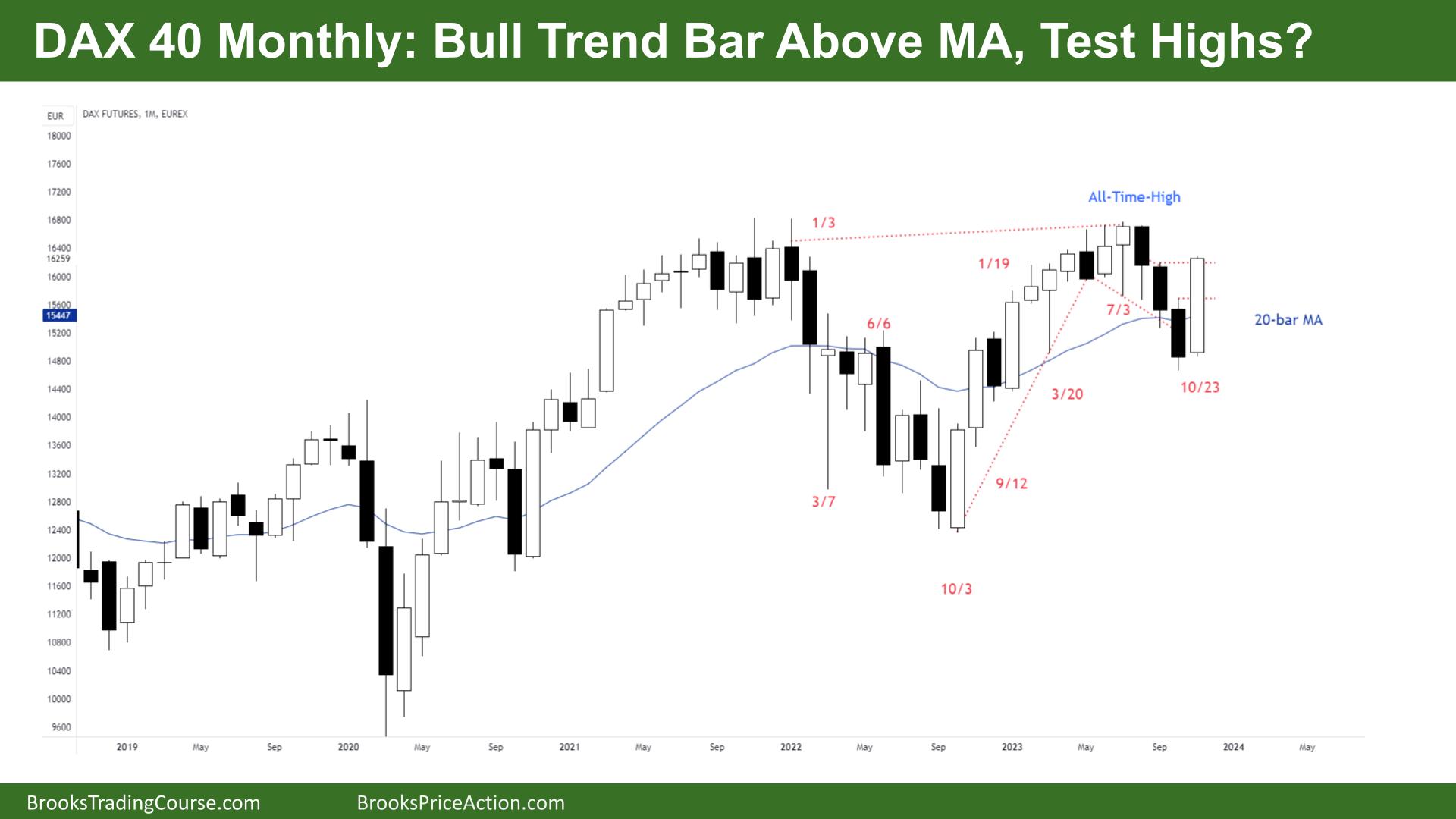

Market Overview: DAX 40 Futures

DAX futures had a bull trend bar last month, closing on its high. It is a buy signal for next month, but the 1:1 target would be a new ATH. It is also reasonable that if we get up to the high of that sell climax, those 3 bear bars, there will be sellers; that might be where we need to go. We have also been going sideways for the past few weeks, so after a big bar there is often profit taking.

DAX 40 Futures

The Monthly DAX chart

- The DAX 40 futures printed a bull trend bar, closing on its high and above the MA.

- It is a strong buy signal for a test of the highs, but what about the 3 bear bars?

- The bulls see a broad bull channel, a new high and a higher low. They want a new ATH.

- The bears see a double top and a strong bear microchannel to under the MA.

- Sets of 3 consecutive bars rarely happen in trends, so this is likely a form of a trading range.

- There will be sellers above the high. Will be vacuum up to there?

- Selling above the last two bear bars in a bear MC is a high-probability trade. So we should come back to test both. The pain trade will be if next month gets follow-through, and those bears must exit.

- The buy was a low probability signal – a High 1 in a tight bear channel. Bulls bought the close after the bears could close the gap from last December at the MA.

- Closed gaps mean a TR, and big bars in TR have a high chance of failing – the breakout does not close beyond their close in that direction.

- Big bars, mean big risk, some traders will buy small and look to add on at 50% of the bar, or at the MA, where bears might be trapped.

- If it is a strong bull trend, we should test the high close of 4 weeks ago.

- 3 bars in a row, usually you get a pullback and then one more bar, so this month should be a bear bar

- Expect a bear bar next month or sideways to at least a test of the trapped bears at the bear bar high.

The Weekly DAX chart

- The DAX 40 futures was a big bull bar last week closing near its high.

- Five consecutive bull bars in a tight microchannel. That is climactic, and we should pull back soon.

- The trouble is there is no sell signal for the bears.

- Bulls that buy here should be able to buy lower and make money.

- It is an expanding triangle, so climactic moves happen in both directions. It makes limit-order traders chase the market down and does not provide second legs.

- Bulls see a bull channel and a deep pullback, an LL DB and want a test of the high. But the stop is large now, so there is a high risk and high probability.

- The bears see a HH DT; they want an LH MTR but haven’t had a reversal attempt yet. There will probably need to be 2 reversal attempts for a move this strong.

- Some traders see a wedge and expect two legs sideways to up.

- Bulls in a bull trend can usually avoid a loss – 80% of the time. Buy the highest close and scale in. We probably need to get back there.

- Always in long so expect sideways to up next week.

- We have a possible parabolic wedge top – move, pause, move, pause, move – we should pause next month.

- But the expectation would be a correction for two legs and then another move up.

- It is a bull trend bar on the HTF so probably buyers here and below.

- The move from last week was very strong. That means anyone who bought last week made big profits – more than 2:1 – those traders will likely exit.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.