Market Overview: DAX 40 Futures

DAX futures went higher last week with a bull doji in a bull spike. it is the second leg in their new push from October. Traders expected a big second leg and they got it. There are no sell signals, so it is likely to go higher. But at HTF, measured move targets, so sideways is reasonable here.

DAX 40 Futures

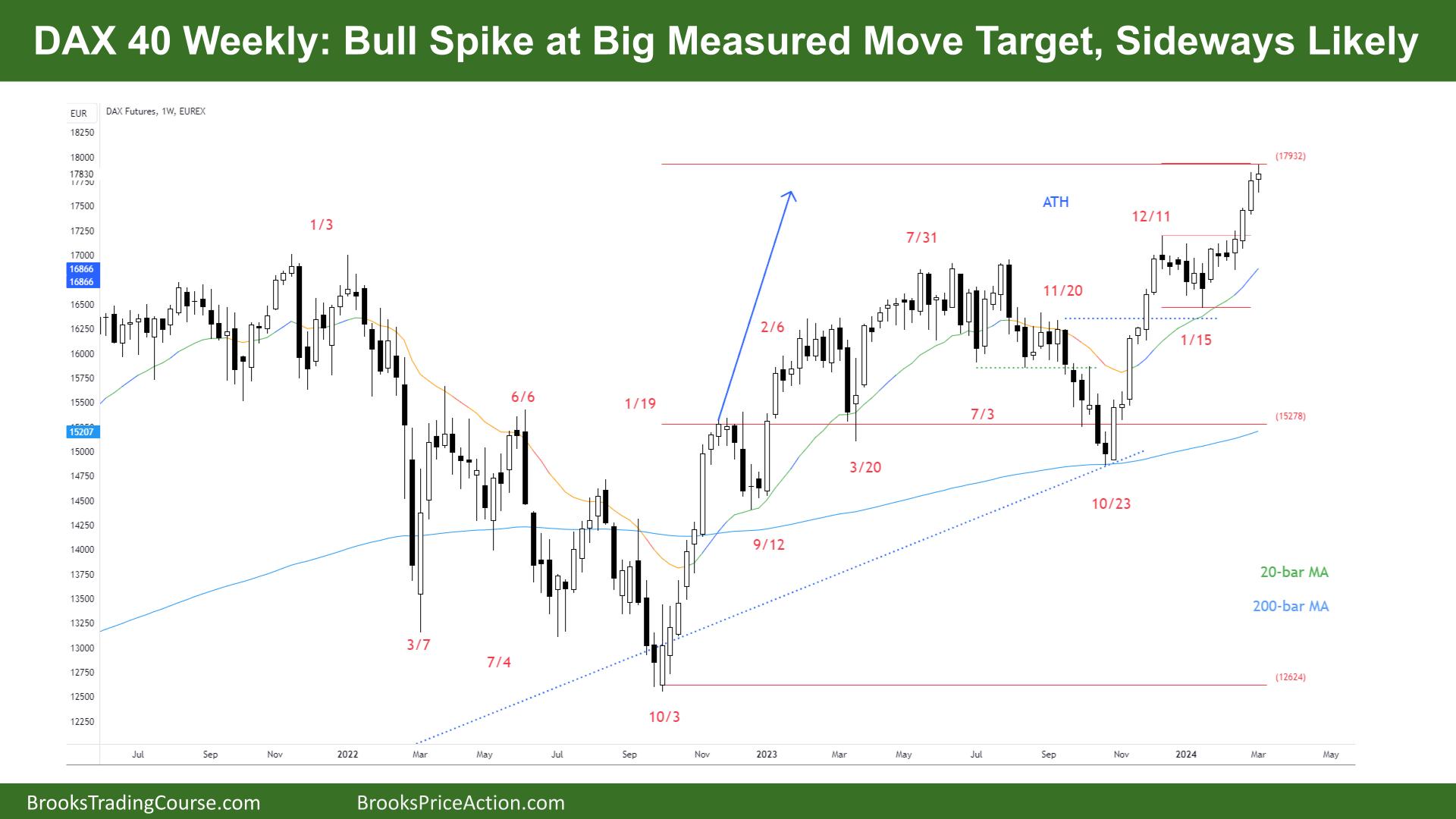

The Weekly DAX chart

- The DAX 40 futures went higher last week with a bull doji in a bull spike.

- It reached a big measured move target so we might go sideways here.

- The doji did not close above the high of the prior bull bar last week, which is a sign that the trend is weakening.

- But weakening doesn’t mean «go-short». It just means traders will transition from trading heavily above the high of bars to trading it more like a channel.

- Bull microchannel and bull open gaps so likely buyers below.

- The bulls might see it as strong enough to warrant a second leg. But there are at least two big legs now, so some traders expect two decent sideways to down legs before buying again.

- Always-in traders don’t need to exit as there is no sell signal.

- This leg already has at least two parts. Perhaps it will go sideways for a week, then there will be one more bar, and then it will be over.

- But trends can go on much longer than traders expect.

- Always in long so traders should be long or flat.

- Expect sideways or up next week, depending on where the scale-in bears turn up.

- Some traders will scale in lower expecting a move this strong to have a double top or micro DT at least to reverse. Bulls might argue that bears gave up with the two strong-trend bull bars below.

- Bulls are getting 1:1 and 2:1 on bars, so they will likely scale in below. But the later in the trend we get, the more likely the 1:1s become.

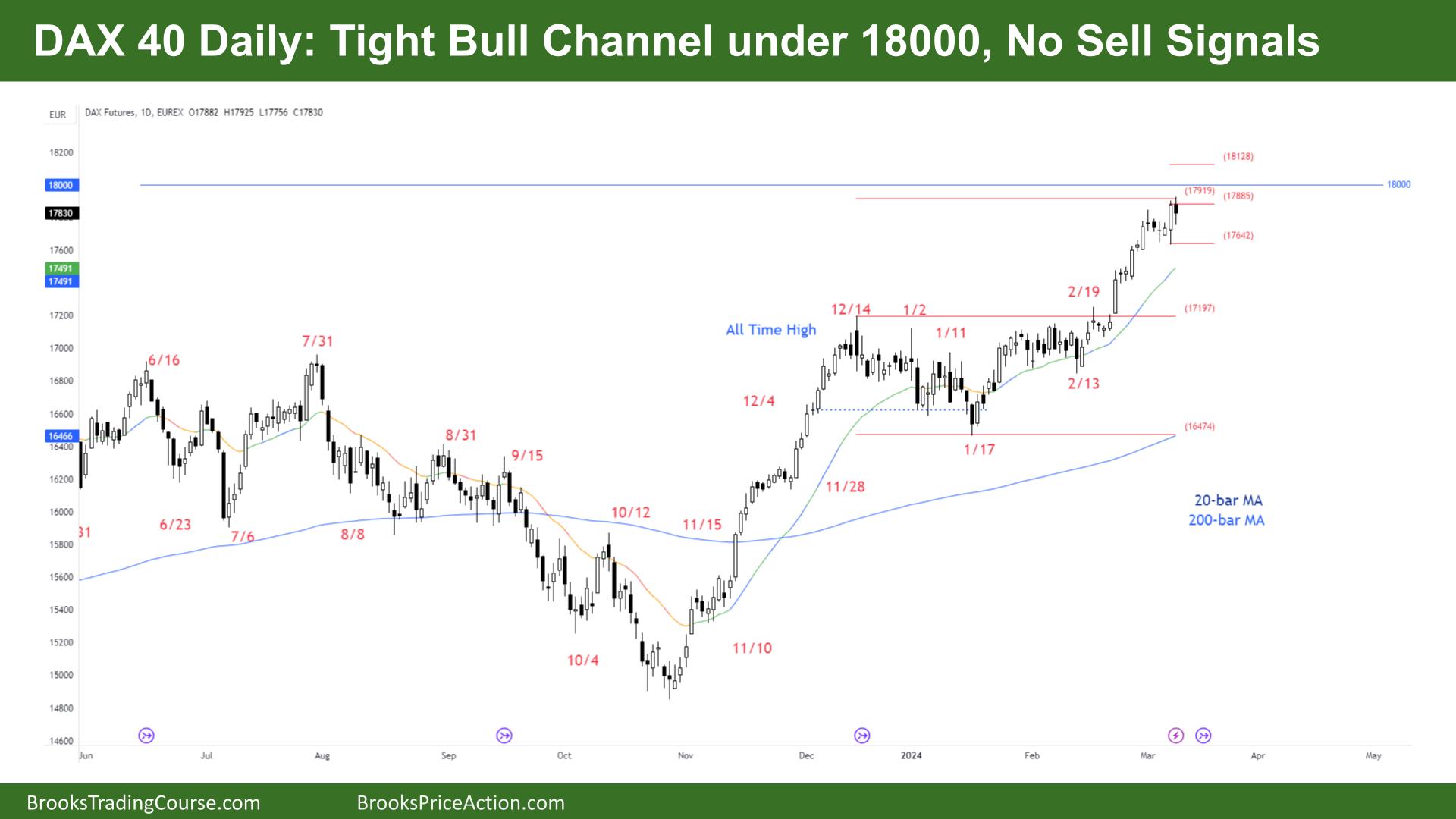

The Daily DAX chart

- The DAX 40 futures went higher last week but a little lower on Friday with a bear doji with tails above and below.

- it was a pause bar after a strong bull trend bar. But the bar was an outside up bar, so some traders waited for follow-through.

- It could be a parabolic wedge top, but a tight channel, so buyers are below bars and at pullbacks.

- There are many dojis in this leg, so it will likely be the last leg in a trading range.

- This was not a good sell signal, so some traders bought low on Friday to test the prior breakout point of the bull inside bar on Wednesday.

- Bulls see a tight channel, which has more sideways price action, so they buy lower and take profits at new highs.

- Bears see a tight trading range, a possible final flag in a strong bull move.

- Likely buyers below Friday.

- Always in long bulls don’t have to get out below that bar.

- Can you argue the second-entry short? Technically, it is a second attempt. But because of Friday’s weak close for the bears, they will likely need one more doji like that to convince limit order bears to sell.

- Some aggressive bulls might buy the weak reversal, betting on a small pullback bull trend.

- Bulls will scale in below the bull outside bar, betting on a double bottom and trading range before the sell-off.

- Always in long so traders should be long or flat.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.