Market Overview: DAX 40 Futures

DAX futures moved lower last week with a bear bar and a tail below. It is a DAX 40 breakout pullback for the bulls at the All-time High (ATH). The bears see a failed breakout (BO) above. But bears have failed to make money for months so traders should expect to stay long or flat until the bears can close the gaps below.

DAX 40 Futures

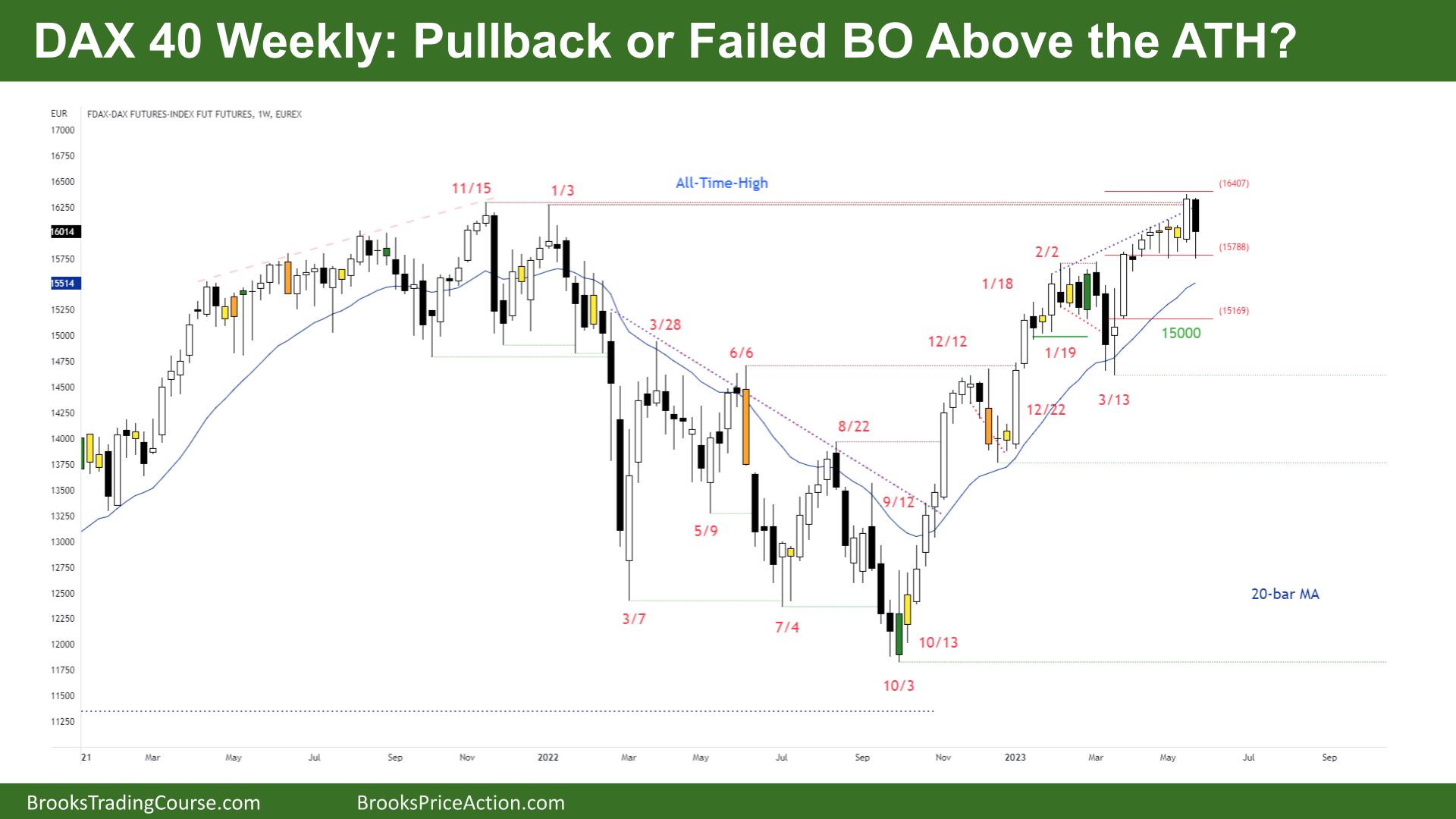

The Weekly DAX chart

- The DAX 40 futures was a big bear bar closing below its midpoint with a large tail below.

- It followed a bull breakout to the ATH last week. But we did not trigger the buy above that bar. So it is a 2-bar reversal.

- We closed back above the inside bar to the left – which was reasonable as BOs from inside bars fail at a higher rate.

- The bulls see a tight bull channel with 3 pushes up. They see the bull BO above the channel and want a measured move up.

- The bears see a final flag and failed breakout of the bull channel – so a wedge top and expect 2 legs sideways to down – likely to the moving average (MA) and maybe test the start of the last leg.

- The midpoint of those two is 15000, which has been an important magnet for 2 years now.

- The channel is tight, and the bears have not had decent sell signals yet. Lok left and see how challenging it was to sell to make money.

- Limit order bears are still unable to close the gap, so they haven’t made money yet – they need this coming week to close a bear body below the prior high.

- With the gap open, it is still more bullish and likely buyers below the tail from last week.

- If the bears get a breakout, expect buyers at the MA – there has yet to be a bar body touching the moving average. The first time the bears do anything, it will find buyers.

- Expect an inside bar next week or a bear bar with a tail and a bad close next week.

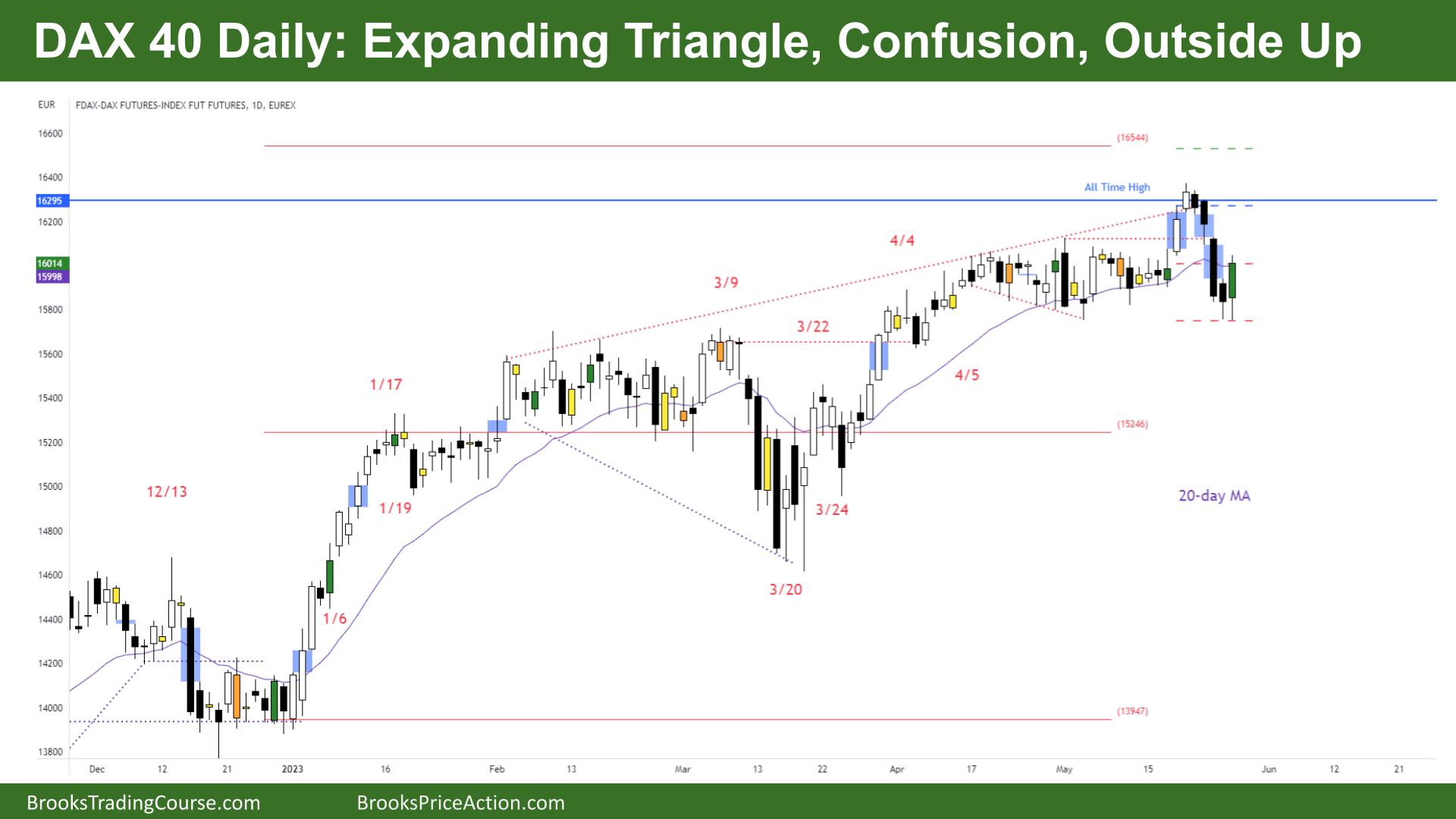

The Daily DAX chart

- The DAX 40 futures was an outside up bar closing back at the moving average.

- The bulls see a micro DB and a failed bear breakout.

- The bears see a failed bull breakout and a pullback.

- How can both sides see a breakout? It is a trading range.

- The bulls see an equal low, not a lower low, after a higher high so the swing point is still intact. But likely a magnet to test next week.

- There is still a bull breakout point above the bear outside-down bar on March 9th: support.

- The bulls see a deep pullback and a possible double bottom (DB). They want another buy signal, a High 2 to buy for a chance to get back to the ATH.

- The bears see a High 1, which is a bad buy signal in a bear spike and a reasonable place to sell. Although at the MA is not a great entry place for the bears in a bull trend.

- We said last week that the expanding triangle has a high chance of failure – bull channels usually have bear BOs. About 25% of the time, they break out strongly. We said it would reverse in about 5 bars, but it reversed immediately.

- This is likely to have trapped bulls up there.

- It triggered the buy on the Monthly chart. Most higher time frame signals trigger and then immediately pull back. The bar’s size on Friday indicates there is still buying pressure.

- Although bears broke a trendline, and they will be looking to create a lower-high and take out a swing low before bears start to strongly short.

- We have been sideways for 4 weeks now, so traders should expect more sideways price action next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.