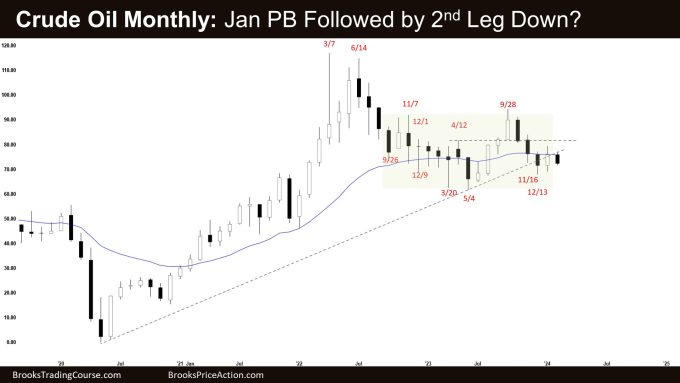

Market Overview: Crude Oil Futures

The monthly chart is forming a Crude Oil trading range. The bulls want a reversal from a higher low major trend reversal and a double bottom bull flag (May 4 and Dec 13). The bears see January simply as a pullback and want a second leg sideways to down. They want a retest of the trading range low (May).

Crude oil futures

The Monthly crude oil chart

- The January monthly Crude Oil candlestick was a bull bar closing below the December high and slightly below the 20-month EMA.

- Last month, we said that while January could still trade lower, the Crude Oil is trading in the lower third of the trading range which is the buy zone of the trading range buyers.

- Previously, the bears got a reversal from a double top bear flag with the November 2022 high and a lower high major trend reversal.

- They see the market as forming a larger trading range.

- They see January simply as a pullback and want a second leg sideways to down. They want a retest of the trading range low (May).

- They need to continue creating follow-through selling to increase the odds of a retest and breakout attempt below the December low.

- The bulls see the pullback (Sept to Dec) simply as a deep pullback and hope to get a retest of the September high.

- They want the 20-month EMA or the bull trend line to act as support.

- They want a reversal from a higher low major trend reversal and a double bottom bull flag (May 4 and Dec 13).

- Since January was a bull bar closing in its upper half, it is a buy signal bar for February albeit weaker (long tail above).

- However, it is also following 3 strong consecutive bear bars. It is not a strong buy setup.

- The bulls will need at least a micro double bottom or a strong reversal bar before they would be willing to buy aggressively.

- December and January’s candlesticks are mostly overlapping each other. Currently, February is an inside bear bar which also overlaps the prior 2 candlesticks. The market is in a tight trading range.

- Poor follow-through and reversals are the hallmarks of a trading range.

- While the market is trading in the lower third of the trading range which is the buy zone of the trading range buyers, the market may have to test the trading range low (May low) before traders will be willing to buy more aggressively.

- Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction with sustained follow-through buying/selling.

- Side note: The renewed conflict in Syria, Iraq and Iran over the weekend can cause energy prices to be volatile especially if it escalates.

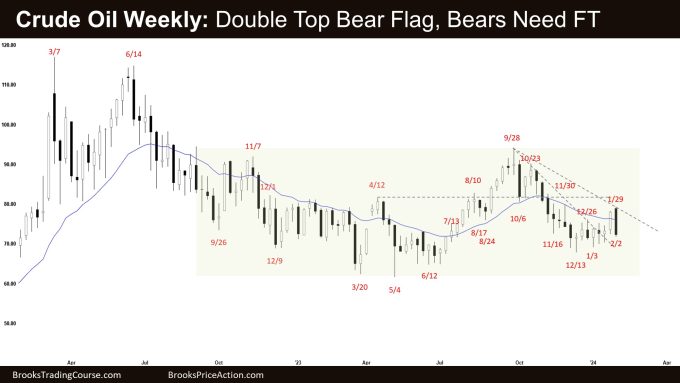

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a big outside bear bar closing near its low.

- Last week, we said that Crude Oil may still be in the sideways to up minor pullback phase. Traders will see if the bulls can create follow-through buying or will the market stall around the 20-week EMA area.

- This week opened higher but sold off for the rest of the week. The bulls did not manage to create follow-through buying.

- They see the selloff to the December 13 low simply as a bear leg within a trading range.

- They want a reversal from a higher low major trend reversal (Dec 13), a wedge bull flag (Oct 6, Nov 16, and Dec 13) and a small double bottom (Dec 13 and Jan 3).

- However, the lack of sustained follow-through buying indicates that the bulls are still not yet strong enough.

- The bears see the recent sideways to up pullback simply as a two-legged pullback and want the 20-week EMA and the bear trend line to act as resistance, forming a double top bear flag (Dec 26 and Jan 29).

- They want another leg down to retest the prior leg low (Dec 13) and the trading range low (May low).

- Since this week’s candlestick is a big outside bear bar closing near its low, it is a sell signal bar for next week.

- For now, the sideways to up pullback likely has ended and odds slightly favor the market to form a second leg sideways to down.

- Side note: However, the renewed conflict in Syria, Iraq and Iran over the weekend can cause energy prices to be volatile especially if it escalates.

- Traders will see if the bears can create a follow-through bear bar. If they do, the odds of a retest of December low and a subsequent breakout below will increase.

- Crude Oil is currently in a 78-week trading range. Traders will BLSH (Buy Low, Sell High) until there is a breakout with sustained follow-through buying/selling from either direction.

- The market is trading in the lower third of the trading range which is the buy zone of trading range traders.

- However, the market may have to test the trading range low (May low) before traders will be more willing to buy aggressively.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.