Posted 7:15 a.m.

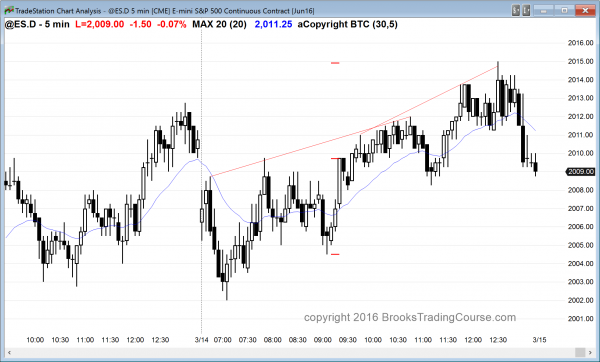

Yesterday was in a bull channel, but it contained mostly small overlapping dojis, which means that it was probably going to be a bull leg in a trading range. Today broke below the bull channel on the open, but the small bars continued on the open. This increases the chances that today will also have a lot of trading range price action, whether or not there is a trend up or down. Until there is a strong breakout with follow-through, online day traders will continue to take quick profits.

The Emini sold off for 4 bars and is Always In Short, but the bounce went above the breakout point. Unless the bears get bigger bars, this selloff will probably be a bear leg within a trading range. A trading range also has a bull leg. Day traders will look for the bear trend to end within the 1st 3 hours and be followed by a swing up or a trading range. This so far does not look like a trend day. It will probably have a lot of limit order trading.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade the markets after a buy climax

The Emini buy climax on the daily chart is continuing. Friday was another buy climax day, and it was the 2nd leg up after the March 1 breakout above the expanding triangle top. If there is a reversal in the next few days, it would be the entry for a Low 5 sell setup at a resistance area( the bottom of a 3 month trading range).

A buy climax at resistance is usually followed by a trading range. There is a 60% chance that the Emini will find an initial top to the trading range this week. The FOMC meeting on Wednesday might either lead to one more sharp up and then a reversal down, or simply a reversal down. There have been many trading ranges within the larger 2 year trading range. They have lasted about 1 – 3 months. This one will probably be average.

While it is possible that the bulls will win, as long as the Emini is in a trading range, it remains more likely that the bulls will be disappointed, just as they have been after many other strong rallies within the 2 year range, and as have the bears after many strong selloffs.

Please look at the chart my weekend post. You will see that the daily chart has 2 upper trading ranges and 2 lower trading ranges, and there was relatively little trading in between. This is a thin area, and thin areas usually get filled it with another trading range.

Since a trading range is likely over the next month, the approximate borders of the range would be just below the tops of the lower ranges, maybe around 1900, and just below the bottom of the upper ranges, where the Emini currently is trading.

With Friday being a buy climax in an overbought market, the odds are that today will be a small day. Also, with the FOMC meeting on Wednesday, the next couple of days will probably be small, even though the Low 5 sell signal could trigger within the next 3 days.

As always, if there is a big breakout up or down, traders will swing trade. However, because the Emini is overbought and at resistance, bulls will be quicker to take profits.

Forex: Best trading strategies

The EURUSD reverses up strongly last week on the daily chart. It has been forming lower highs and higher lows since last March and is at the apex of a triangle. The pattern has a series of shrinking 2 legged moves, as is usually the case in a trading range and especially in a triangle. As strong as Friday’s bull reversal was, it was also a 2nd leg up in a triangle, and the follow-through will probably disappoint the bulls.

A triangle is a breakout mode pattern, which means that the probability of a profitable breakout up or down is about equal. Also, there is only a 50% chance that the 1st breakout will be profitable. There is also a 50% chance that the breakout will reverse. This means that traders will have to be quick to make decisions if there is a breakout this week. Wednesday’s FOMC report might provide the excuse for the breakout.

Since Friday was a buy climax in a yearlong trading range, the odds are that the bulls will be disappointed by the lack of follow-through buying today. Today will probably be a small trading range day.

The 60 minute chart is forming a double bottom bull flag, but the range has been small for the past 5 hours There was a wedge bottom on the 5 minute chart in Europe, and there has been a 30 pip bull breakout over the past hour. The 1st reversal down will probably be bought, and there will then probably be a 2nd leg up, but the pattern is small and online day traders will probably scalp for 10 – 20 pips.

This trading range on the 60 minute chart is forming a triangle, and it is nested within the yearlong triangle. This is a nested pattern, and it is a sign that the EURUSD is preparing for a sharp breakout. However, betting that any rally or selloff will be the start of the big move is a low probability bet since 80% of attempts to break out of a trading range fail. Until there is a clear breakout, those who trade the markets for a living will continue to take profits near the top and bottom, no matter how strong the legs up and down are.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a broad bull channel today.

The Emini daily chart is overbought, and today is a sell signal bar for a Low 5 short. Because the day had a bull body, it is a low probability sell setup. However, because it is at resistance and is overbought, the odds are that it will begin to trade down this week. The FOMC report could be the start of a TBTL pullback on the daily chart.

The strong rally over the past month will probably evolve into a trading range for the next month or so. Less likely, the rally will continue up to a new all-time high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.