Traders see third quarter earnings as catalyst for breakout

Updated 6:50 a.m.

The Emini broke strongly below the 60 minute moving average on the open. The weekly chart has an ii pattern and yesterday traded above last week’s high. Henc, the Emini might now trade below last week’s low and turn this week into an outside down week. Hence, last week’s low is a magnet for the rest of this week.

While the 1st two bars were strong bear bars, the Emini is in a trading range on the daily chart. Therefore, the Emini will probably disappoint the bears over the next hour or two. The open made a bull trend day unlikely. Yet, the Emini had bad follow-through on the open over the past several weeks. Hence, today might enter a trading range over then next hour or two. Furthermore, if today is a bear trend day, it probably will be a weaker type, like a broad bear channel or a trending trading range day.

Because the Emini is Always In Short, traders will look to sell, especially a rally near the moving average. Yet, if the follow-through selling is weak, bulls will buy new lows with limit orders and today could be a weak bear trend day or a trading range day. While a strong bear trend day is possible, it is not likely because of the 3 week trading range.

Pre-Open Market Analysis

While yesterday gapped up, it quickly sold off. It then became a small trading range day at the top of the 4 week trading range. There is therefore still a 50% chance that the September 9 bear breakout is the 1st of 2 legs down to below the July 15 top of the 2 year trading range. The bulls still want a bull breakout above the month-long bear flag. Hence, yesterday added no new information.

As a result, traders will still look for brief trades while they wait for a breakout up or down. Furthermore, there is still a 70% chance of a break below the July 2015 high and a break above the all-time high. Traders simply do not yet know which will come first.

Emini Globex trading

As a result of the Emini testing the top of the 4 week trading range yesterday, traders expected the breakout to fail. The Emini is down 6 points in the Globex session. Today might gap below yesterday’s low.

The bears still believe they have at least a 50% chance of a 2nd leg down from the Tight Trading Range Double Top of August 15 and 23. They see the September 9 selloff as the 1st leg, and the rally of the past month as a bear flag. There is still a 50% chance of a brief big breakout below the July 2015 high by the end of the month. Yet, the odds are that bulls will buy it. As a result, the Emini would then probably make a new high by the end of the year.

The bulls understand this, and want to trap the bears by creating a bull breakout above the bull flag.

Forex: Best trading strategies

The EURUSD daily chart is breaking below its 6 week trading range. Yet, the breakout bar is not especially big and there currently is a tail below.

While the EURUSD traded below Friday’s pullback low, it held above Friday’s low, which was the bottom of a bull reversal. The daily chart has a micro wedge bottom since September 26 and a wedge bull flag since August 31. Yet, the bulls need a bull breakout.

The bears see the opposite. They think that the daily chart will break below the month-long wedge (or triangle). Until there is a breakout, the bulls and bears each have a 50% chance of a 200 pip measured move. While they wait for the breakout, the will continue to be quick to exit trades after a day or two. They know that every move up or down will probably fail.

>h3>Overnight EURUSD Forex sessions

The EURUSD Forex market sold off over the past 7 hours. It broke below the Triangle or Wedge Bull Flag of the past month. Yet, the selloff might still be just a 2 legged test of the August 5 pullback of 1.1045, The 1st led down is the 2 week selloff to the August 31 low.

As a result of the chart being in a trading range, traders are suspicious of breakouts that are not too big, lack consecutive big bear bars closing on their lows, and fail to break below all support. Hence, there is still a 45% chance that the breakout will form a double bottom at 1.1045 with the August 31 low.

EURUSD 60 and 240 minute charts

Furthermore, the 60 minute chart just had its biggest bar in over 20 bars of this swing down. The selloff might therefore be a sell climax. If so, bears will begin to take profits and wait about 10 bars (hours) before looking to sell again. Hence, the selling might have ended and today will probably form a trading range.

Finally, the 240 minute chart is at the bottom of a broad bear channel since the September 26 high. Hence, bears will take profits and bulls will begin to scalp. In conclusion, while the EURUSD is breaking out, the odds favor sideways to up trading today instead of a continued strong move down.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

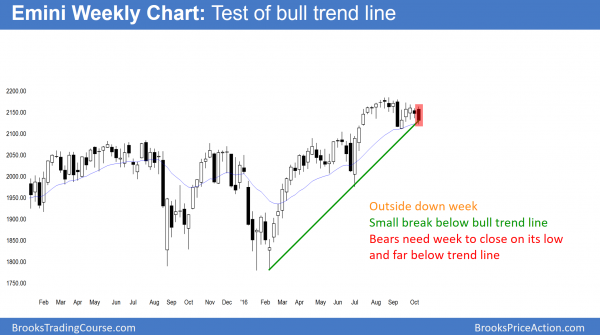

The weekly Emini chart sold off to below the bull trend line and below last week’s low, yet found buyers there.

While the Emini sold off strongly today, it reversed up strong from the daily trend line. Big Down, Big Up creates Big Confusion. Therefore a trading range is likely for the 1st couple of hours tomorrow.

The bears got a strong bear breakout to below the bull trend line from the February low. Furthermore, by trading below last week’s low, this week is an outside down bar on the weekly chart. Yet, the bears need follow-through selling tomorrow. Without it, today is just another bear day in a month-long trading range.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.