S&P500 all time high and Dow 20,000 big round number

Updated 6:49 a.m.

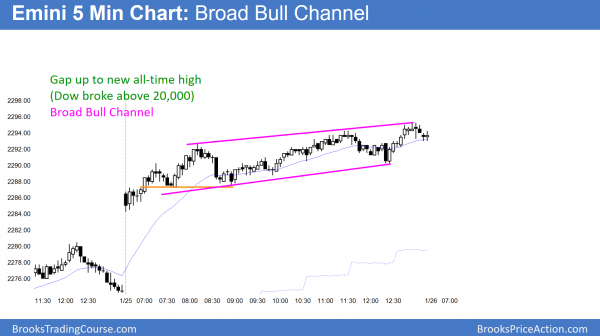

The Emini opened with a big gap up and the Dow broke above 20,000. It is Always In Long. Yet, the 1st bar had a big bear body. While it is possibly the low of the day, it is more likely not. The big tail is a sign of uncertainty and it increases the chances of a trading range for the 1st hour or two. This could also be the high of the day, but that big tail makes a trading range more likely.

The early tight trading range and bear bars make a test down likely. Whether or not the Emini closes the gap is not that important. If the Emini goes down to yesterday’s high and the moving average, and the selloff lacks consecutive big bear bars, bulls will buy the selloff. Therefore, a trading range would be likely.

Pre-Open Market Analysis

The Emini broke to a new all-time high yesterday. Furthermore, it did so with a 25 bar bull micro channel. While such an extreme move is climactic, it is also a sign of strong bulls. Therefore, the odds favor follow-through buying, even if there is a pause or pullback for a couple of days.

In addition, the Dow did not reach 20,000. Yet, yesterday’s rally had strong momentum. Hence, the likely follow-through today or tomorrow will probably lift the Dow above 20,000.

While a reversal can come at any time, especially from a new high, the momentum up was strong. Therefore, the best the bears can probably get over the next day or two is a minor reversal. Hence, a pullback that becomes a bull flag.

Overnight Emini Globex trading

The Emini is up 10 points in the Globex session. It is therefore about 4 points above yesterday’s high. Since the Dow’s high yesterday was about 50 points below 20,000, and that corresponds to about 5 points in the Emini, the Dow will probably open within about 0.1% of the Big Round Number.

I have been saying that the odds favored a breakout above 20,000 before any significant pullback. At the moment, the odds look like today will be the day. Yet, the Dow got to within 4 cents of the target 3 weeks ago and reversed down. While unlikely, there could be another strong reversal down today. If so, traders would begin to believe that the top is in for the next few weeks.

Yesterday was an exceptionally strong bull trend day. The odds are that there will be follow-through buying over the next few days, even if there is a pullback 1st. Furthermore, the breakout was strong enough so that the follow-through could last a week or more without much of a pullback.

Traders always have to consider the opposite of what is likely. Yet, when a rally is as strong as yesterday’s, the odds are that the 1st pullback will not last more than a day and a half. Bulls will probably be eager to buy.

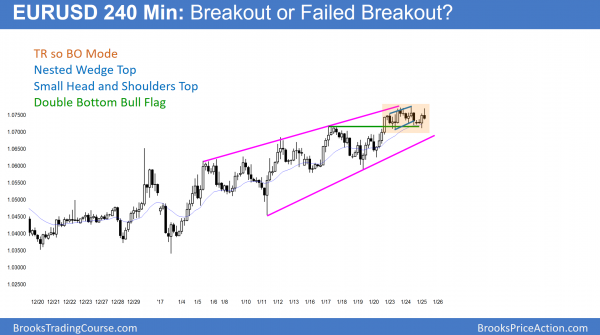

EURUSD Forex Market Trading Strategies

The EURUSD 240 minute Forex chart has formed a small Head and Shoulders Top at the top of a Brad Wedge Bull Channel. Therefore, odds favor a test down. Because every Head and Shoulders top is also a Double Bottom Bull Flag, the bulls have a 40% chance of a bull breakout.

The rally on the 240 minute EURUSD chart has stalled just above last week’s high. Because most breakouts fail and rallies in channels usually reverse at the top of the channel, the odds favor a test down over the next few days. Yet, there is still a 40% chance of a bull breakout and a test of the December 8 major lower high before there is a pullback.

Overnight EURUSD Forex trading

The EURUSD Forex chart has been in a 40 pip trading range for the past 5 hours. Furthermore, that range is withing the tight trading range of the past 3 days. While the odds favor a test down to the bottom of the channel on the 240 minute chart, there is no clear reversal down yet. Therefore, the chart is in breakout mode. If there is a strong rally above the 3 day range, the odds favor a test of the December 8 high around 1.0870. More likely, it will test down to the January 19 low around 1.0600.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini gapped up and rallied in a broad bull channel.

Because yesterday was a strong bull trend, the odds favored higher prices today. The Emini gapped up and rallied in a Broad Bull Channel. Furthermore, the Dow broke strongly above 20,000. This is therefore a continuation of the Trump rally and the January Effect.

While the bull trend is still strong, a broader channel increases the chances of a trading range day tomorrow. Yet, even if the Emini goes sideways for a few days, the odds still favor higher prices over the next week or two.

The bears want a gap down tomorrow or soon. That would therefore create an island top and a failed new all-time high. While they might get their top, the odds are that bulls will buy the reversal and the top will fail.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.