Posted 7:01 a.m.

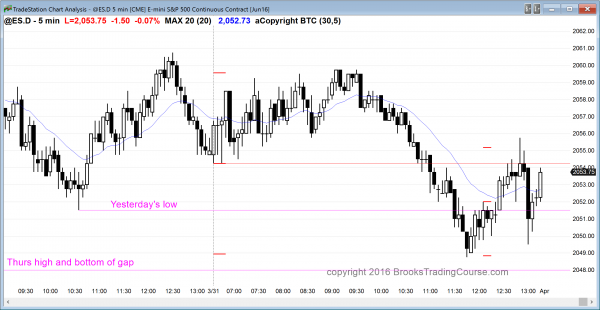

The Emini began with a tight trading range within yesterday’s range. This increase the chances of a lot of trading range price action today. A trading range day has at least one leg up and one leg down, but it is impossible to know which will come 1st until after it has already begun. The bulls want a small bull reversal bar near the low or a strong bull breakout. The bears want a strong reversal bar near the top or a strong bear breakout. Until either happens, traders will scalp with limit orders or wait.

While today could be a bear trend day if it triggers the short below yesterday’s low, the odds are that there will be buyers below the sell signal bar. It could also trigger the buy by going above the December lower high, but the odds are that there will be sellers above. Unless there is a strong breakout up or down, the odds favor mostly trading range price action today.

Pre-Open Market Analysis

S&P 500 Emini: Online day trading when the price action is quiet

The Emini yesterday gapped above last week’s high. That made yesterday a sell signal bar for today. If the Emini trades below yesterday’s low, that is an entry for a failed breakout, and it would be a sign that the strong bull trend might be evolving into a trading range. If today or tomorrow gaps down, then there would be a 1 or 2 day island top, which could be the high for weeks. The Emini is unchanged in the Globex session. It might be waiting for tomorrow’s unemployment report to gap down. There are also magnets above. There were 3 lower highs in the 3 month trading range of October to December. Yesterday traded to within 3 ticks of the lowest one and the turned down for the rest of the day.

Since the Emini has been in a trading range for 2 years and it is now very close to a cluster of lower highs, it probably cannot escape the gravitational pull of that resistance. What often happens in a trading range when there are 2 or 3 resistance levels that are near one another, and the Emini is close to all 3, is that the Emini goes above 1 or 2 and then turns down without going above the highest resistance level.

If it gets above that October high, the all-time high is only 6.75 points higher, and that would be a very strong magnet for at least a slightly higher rally. The Emini would probably break to a new all-time high. However, there would be only a 50% chance of a successful breakout and a sustained move up. There would be a 50% chance of the breakout failing within 5 – 20 bars, and reversing back down into the 2 year trading range.

Since tomorrow’s unemployment report is important, today might be another trading range day, like yesterday, and then decide whether to gap down on the report and create a 2 day island top, trade down below today’s low and trigger a sell signal, or trade above one or more of the 3 lower highs in the 3 month trading range.

The odds are that today will not be a big trend day,and it probably will be another trading range day. However, it if trades below yesterday’s low, it will trigger a sell signal, and it could make the bulls give up. This could lead to a big bear trend day that reverses Thursday’s rally. If the reversal is to happen, it probably will come after tomorrow’s report. If the selloff comes without getting above the December 29 lower high, the selloff probably will not last more than 5 days.

The odds at this point favor a test above that lower high, and maybe above the December 2 lower high of 2086.25 as well. The odds also favor a failure to get above the November 3 lower high of 2093.25 on the 1st attempt. If the Emini is to get above that lower high, it will probably have to reverse down for a couple of weeks. If the buyers see the pullback as only a pullback and not a bear trend, they will buy again and try to get above the all-time high.

Forex: Best trading strategies

The 240 minute chart shows a nested wedge rally where the 3rd leg subdivides into a small wedge, and that smaller wedge has a 3rd leg that also subdivides into an even smaller wedge.

The EURUSD broke to a 4 month high overnight and is about 100 pips below the major October lower high of 1.1495. If it gets above that, it will probably then test the August 24 high of 1.1712, which was the start of the 5 month selloff, and the top of the year long trading range. It is the neck line of the double bottom of the past year. If the EURUSD gets above it, there is a 50% chance that the breakout will fail and form a big 2 legged bear flag on the monthly chart. There is also a 50% chance that the EURUSD will rally for a measured move up. Since the range is 1200 pips tall, that would project up to around 1.3000, which is the middle of the 10 year triangle.

The 4 day rally has been strong. The EURUSD has rallied 90 pips overnight in a tight bull channel on the 5 minute chart. The 60 minute chart has had 10 consecutive bull trend bars. While that is a sign of strength, it is unsustainable and therefore climactic. Buy climaxes are usually followed by trading ranges. With the uncertainty of tomorrow’s unemployment report, the EURUSD will probably be sideways for at least 2 – 3 hours today, in an attempt to be more neutral (less bullish) going into the report. However, the bulls are clearly in control on the 60 minute chart, and the 1st reversal down will probably be minor.

A minor reversal means that it will be bought, and the best the bears can probably hope to see over the next 10 bars (hours) on the 60 minute chart is a trading range, and not a bear trend. Bulls will probably buy pullbacks, confident that the 1st reversal down will probably fail to fall far.

Even though the EURUSD 5 minute chart is in a tight bull channel, bear scalpers have been able to make money buy selling above the prior high. They either sell at the prior high and sell more 10 pips higher, or they simply sell 10 pips higher. When there is a strong bull trend (here, a Small Pullback Bull Trend) and the bears are beginning to make money, day traders see that as the 1st sign that the trend might be evolving into a trading range. Bulls continue to buy pullbacks, but they are now taking profits above prior highs instead of holding onto their entire position. Bears will not sell with stops below bars until there is more selling pressure (more big bear bars and deeper pullbacks). However, that is the next step in the evolution into a trading range. If the EURUSD falls 12 pips below a sell signal bar, the stop entry bears will have been able to make money. That is more evidence that the bull trend is becoming a trading range.

Those who trade the markets for a living know that while the 4 day rally has been strong, it is the 3rd push up from the December low, and it is a nested wedge (this 3rd push up from the March 10 low also has 3 legs; the 240 minute chart has even a smaller wedge within the 3rd leg of the 3rd leg). A nested top increases the chances of a TBTL Ten Bar Two Legged pullback at resistance, around the October 15 lower high.

Whenever a rally has 3 strong breakouts, as it has since December 3, the odds are that there will be a TBTL pullback rather than a strong breakout above resistance. Since the resistance is about 100 pips higher, and the 4 day rally has been strong, the odds are that there is more to go. The bears will probably need at least a micro double top before they can begin any pullback that lasts more than a couple of days.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a tight trading range for the 1st half of the day, but then fell below yesterday’s low in a series of consecutive sell climaxes, triggering a sell signal on the daily chart. It closed back above that low and formed a doji day.

Even though today traded below yesterday’s low and triggered a sell signal on the daily chart, today was another trading range day. The Emini is neutral going into tomorrow’s unemployment report. Anything can happen. The Emini could gap down and form a 2 day island top. It could gap above today’s high and test the December lower high. It could open unchanged and break above or below today’s range. It could be another trading range day. What happens is important because the daily chart is deciding whether to continue up to the all-time high, or instead enter a trading range for the next month. If the Emini reverses down below last week’s high, the odds begin to favor the trading range.

Today was the last day of the month and the month had a strong bull body, but the monthly chart is still in a 2 year trading range. The bulls want a close above the December high, but that is only of minor importance. Until there is a breakout above the all-time high, this rally is still only a bull leg in a 2 year trading range, which has had many other strong legs up and down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.