January effect and Dow 20,000 Big Round Number

Updated 6:52 a.m.

The Emini rallied on the open, continuing yesterday’s bull reversal. Yet, the follow-through was bad. While the Emini is Always In Long, this disappointment reduces the chances of a strong bull trend day. Since most days lately have been trading range days, today will probably be one as well.

While most days over the past week sold off early, yesterday was a bull reversal. That lowers the chances of an early high of the day. Confusion is a hallmark of a trading range day. Hence, this early confusion is a sign that the initial rally will probably be a bull leg in a trading range day.

Pre-Open Market Analysis

Yesterday was the 5th consecutive day with an early selloff. Because the Emini has been in a trading range, this is unusual. When there is a trading range, the Emini typically changes its pattern every few days. Yet, there was one chance yesterday. The Emini broke above a 4 day channel. Hence, the early selloff yesterday was a pullback from the breakout. In addition, the 4 hour tight trading range was a higher low major trend reversal.

The bulls need follow-through buying today. Since the Emini is still in the middle of its 4 week range, the odds are that the trading range will continue. Therefore, even if the bulls get follow-through today, they will probably just create a bull leg in the range.

The bears want yesterday’s bull breakout to fail. Yet, the daily chart still has a 20 gap bar buy setup. Therefore, the odds still favor higher prices. The bears need a strong downside breakout before traders believe that the bears have taken control.

Overnight Emini Globex trading

I mentioned yesterday that because the Emini was still in its December trading range, it was unlikely to do the same thing for more than a few days in a row. I said that made a bear trend day from the open unlikely yesterday. Yet, the bulls have continued to fail to break strongly above Dow 20,000.

In addition, there is still a gap below the December range and the August trading range. Because gaps late in trends usually fill, the odds are that the Emini will trade down to 2185. This is true whether or not the Dow goes a little above 20,000 first.

Therefore there is a target above (the all-time high) and one below. Hence, the Emini will probably reach both in the next month or two. It is now deciding which will be 1st.

Yesterday’s rally was strong. The odds therefore favor some follow-through buying today. The Emini is up 5 points in the Globex session. Since it is still in its month-long trading range, the odds are that this rally will disappoint the bulls and fail to lead to a breakout. Furthermore, most days have been trading range days for a month. The odds are for that to continue.

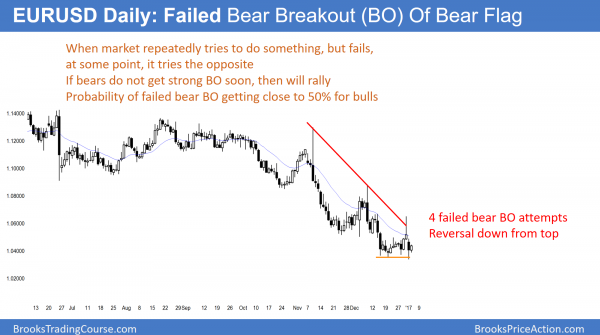

EURUSD Forex Market Trading Strategies

The daily chart reversed up again. The chance of a bull breakout is getting close to 50%.

The EURUSD sold off strongly yesterday. Yet, it reversed up from an Expanding Triangle Bottom and wedge bottom on the daily chart. However, the reversal up was not even to the middle of the 4 week range. In addition, yesterday did not close near its high. As a result, the daily chart is still controlled by the bears. Yet, it would not take much for the bulls to gain control. This is because there are bottom patterns at support.

Overnight EURUSD Forex trading

While the overnight rally was only 50 pips, it is still important. Yesterday was the 4th time that the daily chart tried to break below the 1 year trading range. When a market repeatedly tries to do something, but fails, it usually then tries the opposite. The daily chart is getting close to that point.

If the bears do not get their breakout soon, they will buy back their shorts. I addition, they will look to sell higher. Furthermore, the bulls will become more confident. Furthermore, they will scalp less and swing trade more. As a result, if this change in price action reaches a critical mass, the EURUSD can reverse up.

The sign of a reversal is a series of strong bull trend bars. If they come, traders will expect a rally above the major lower highs of the past 2 months. This will convert the bear trend on the daily chart back into a trading range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

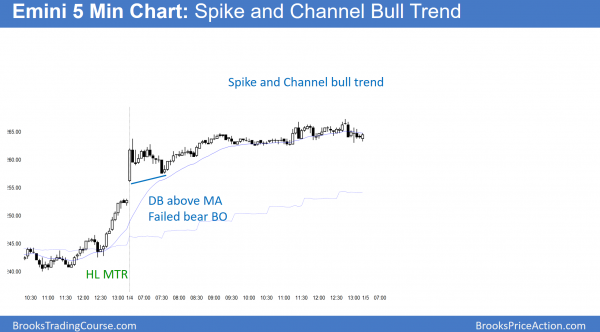

After yesterday’s late bull breakout (spike), today was a bull channel. In addition, it was weak. It will probably evolve into a trading range tomorrow.

Today was the 2nd day of a spike and channel rally. Channel’s usually lead to trading ranges. In addition, the Emini tested the top of last week’s bear reversal. Hence, the odds favor a pullback tomorrow and a transition into a trading range.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.