Increased volatility before FOMC announcement

Updated 6:55 a.m.

The Emini reversed up yesterday from a Higher Low Major Trend Reversal. Yet, it was in a trading range for 5 hours. While the Emini continued Always In Long from yesterday, day traders are waiting for a breakout.

Because yesterday was an inside day and today is starting out as an inside day, and today is continuing yesterday’s trading range, the odds are that today will have a lot of trading range price action. While a strong trend can come at any time, today’s open and the context make a strong trend unlikely.

As always, if there is a strong breakout with good follow-through, day traders will swing part of their positions. In the meantime, they will mostly scalp, betting that breakouts will fail to go far before reversing.

Pre-Open Market Analysis

The Emini disappointed the bulls yesterday. There was a strong selloff on Friday. There is still a gap above the 2 year trading range. This makes it likely that the Emini will close the gap before going back to the old high. While it is possible that Monday’s reversal can lead to a new high, it is more likely that the Emini will first fall below the top of the 2 year range.

The FOMC announcement is next week. The Emini has had 3 violent moves over the past 3 days. As a result, traders are confused. They therefore will be hesitant to hold onto positions very long. Hence, they will take quick profits. This will therefore probably create a trading range going into next week’s FOMC announcement. The range will probably be big enough for at least one or two swing trades, but day traders might mostly scalp.

Emini Globex session

After yesterday’s inside day, the Emini traded within yesterday’s range overnight. Therefore, today might be a 2nd consecutive inside day. As a result, there would be an ii Breakout Mode pattern on the daily chart.

As always, day traders will switch from scalping to swing trading if there is a big breakout today. The odds are that the big moves will continue to shrink today.

Forex: Best trading strategies

The 60 minute EURUSD Forex chart is in a tight trading range. There are nested Head and Shoulders tops on the 60 minute and daily charts.

Head and Shoulders tops are trading ranges, and are often triangles or wedges. The EURUSD Forex market has been sideways for 4 days. It is at the apex of a triangle and the neck line of nested Head and Shoulders Tops on the 60 and 240 minute charts and on the daily chart. Therefore, it is in breakout mode. As a result, traders might be waiting for next week’s FOMC announcement. It continued in a tight trading range over night. Consequently, day traders continue to scalp, mostly with limit orders, as they wait for the breakout.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

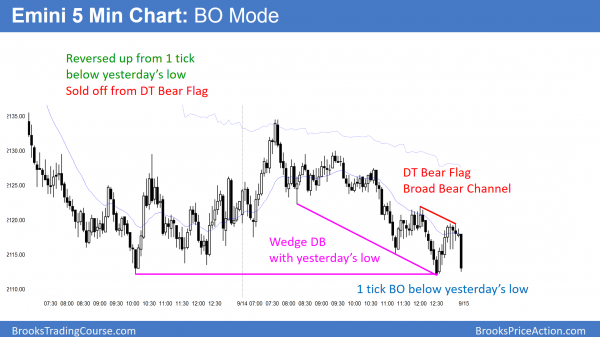

The Emini rallied up in a buy vacuum test of the August 2 trading range low. The rally was a parabolic wedge. It sold off for several hours, and reversed up from 1 tick below yesterday’s low. Hence, this almost created an ii pattern on the daily chart.

Today was the 4th consecutive sideways day. Yet, the odds still favor the bears because the Emini has a 70% chance of closing the gap above the 2 year trading range before rallying to a new all-time high. There is also a bull trend line around that price.

Since today is in a tight trading range on the daily chart, the Emini is in breakout mode. Because the most recent strong move was down, and because of the magnets below, the odds favor the bears over the next week or two. Yet, since the momentum is so strongly up on the weekly and monthly charts, the odds favor a new high after the current pullback ends.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.